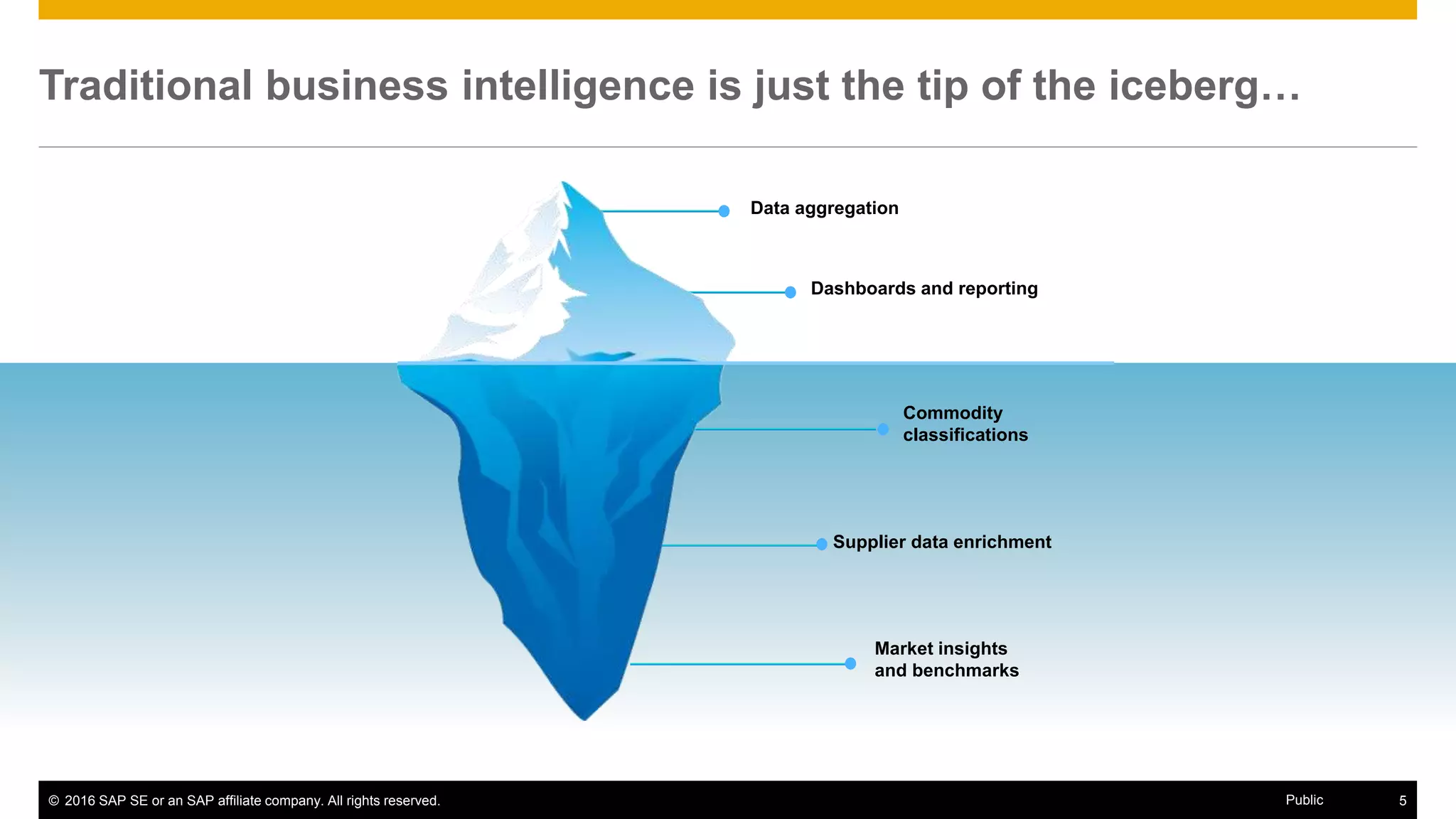

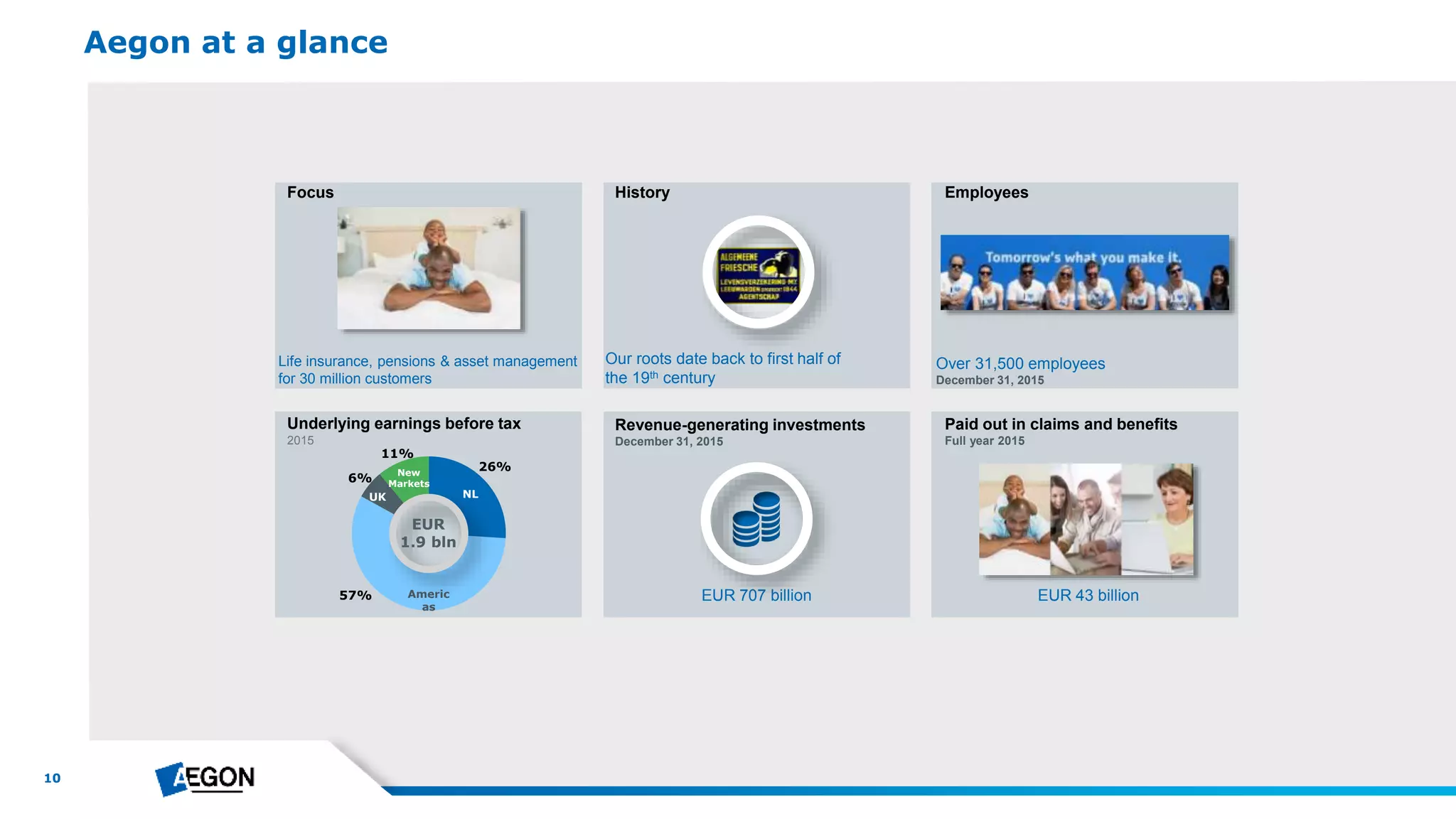

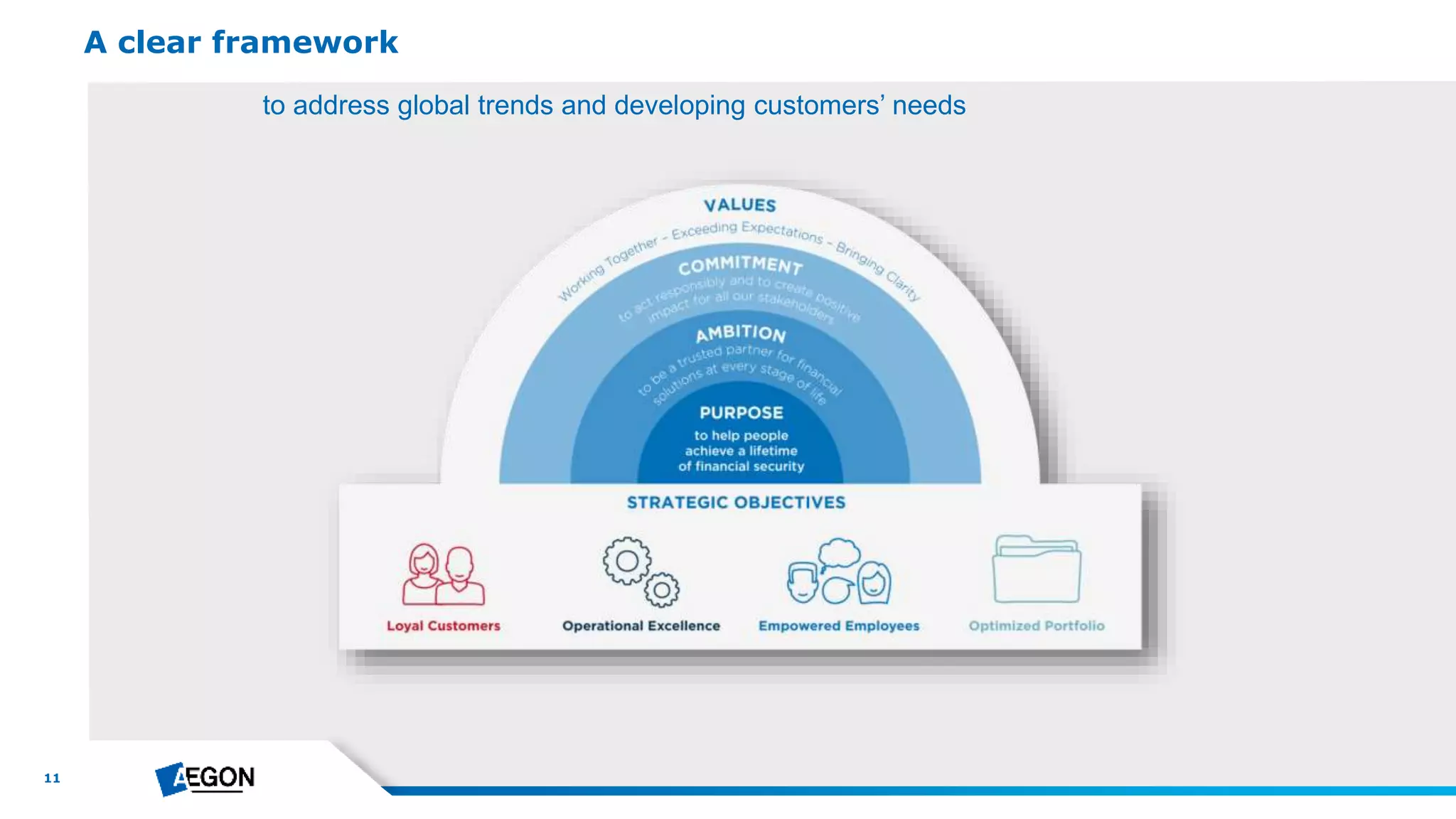

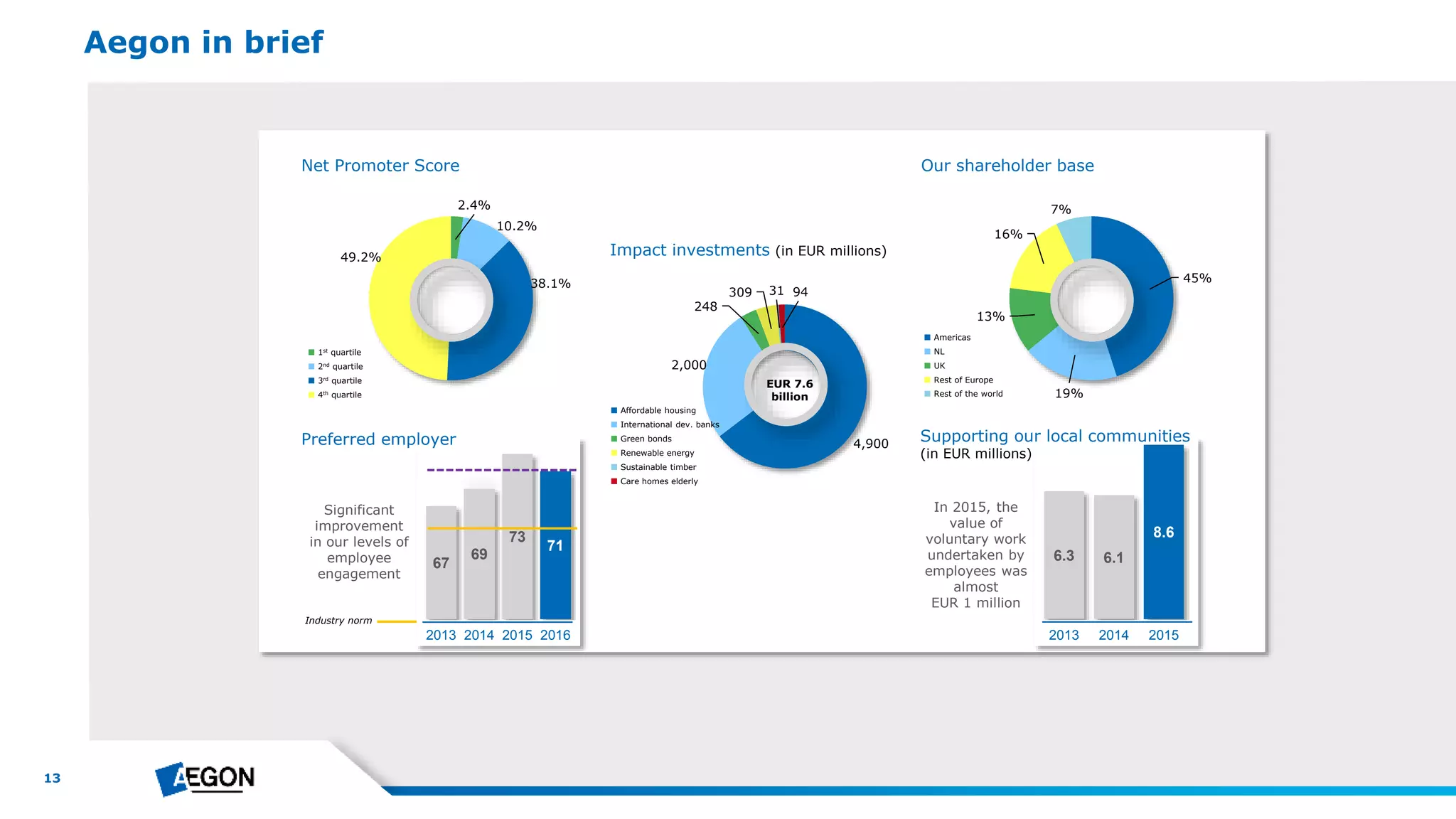

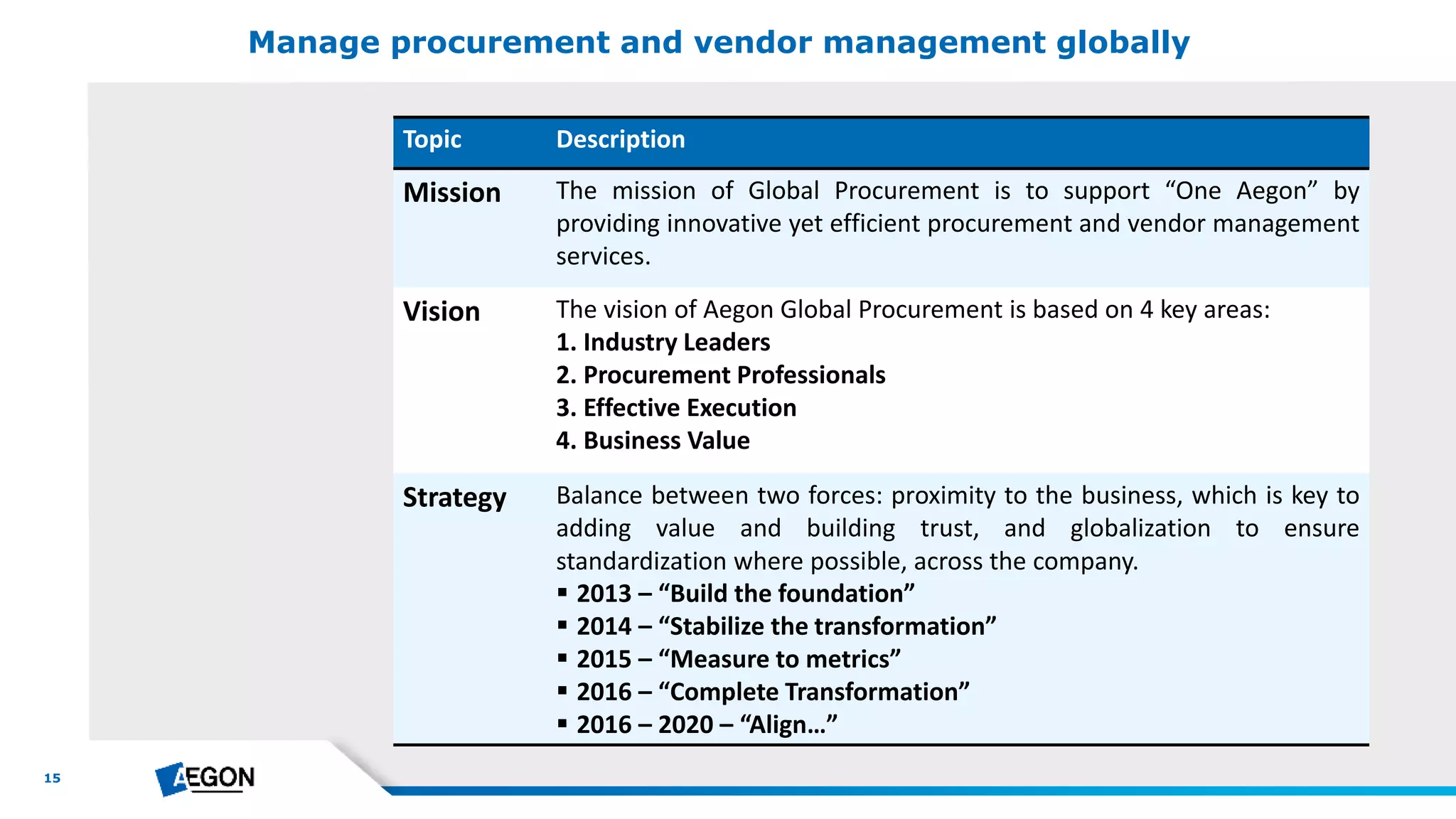

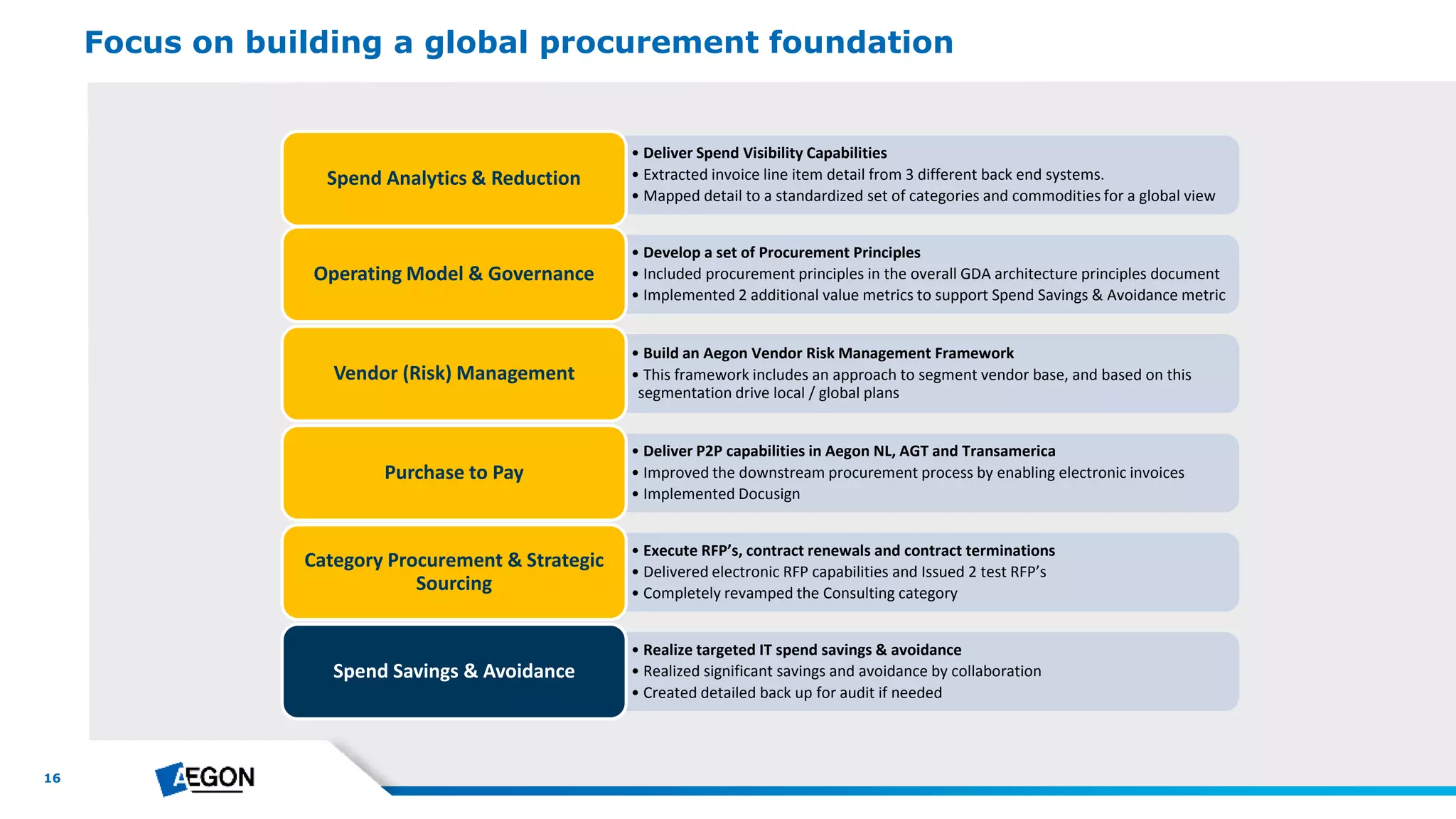

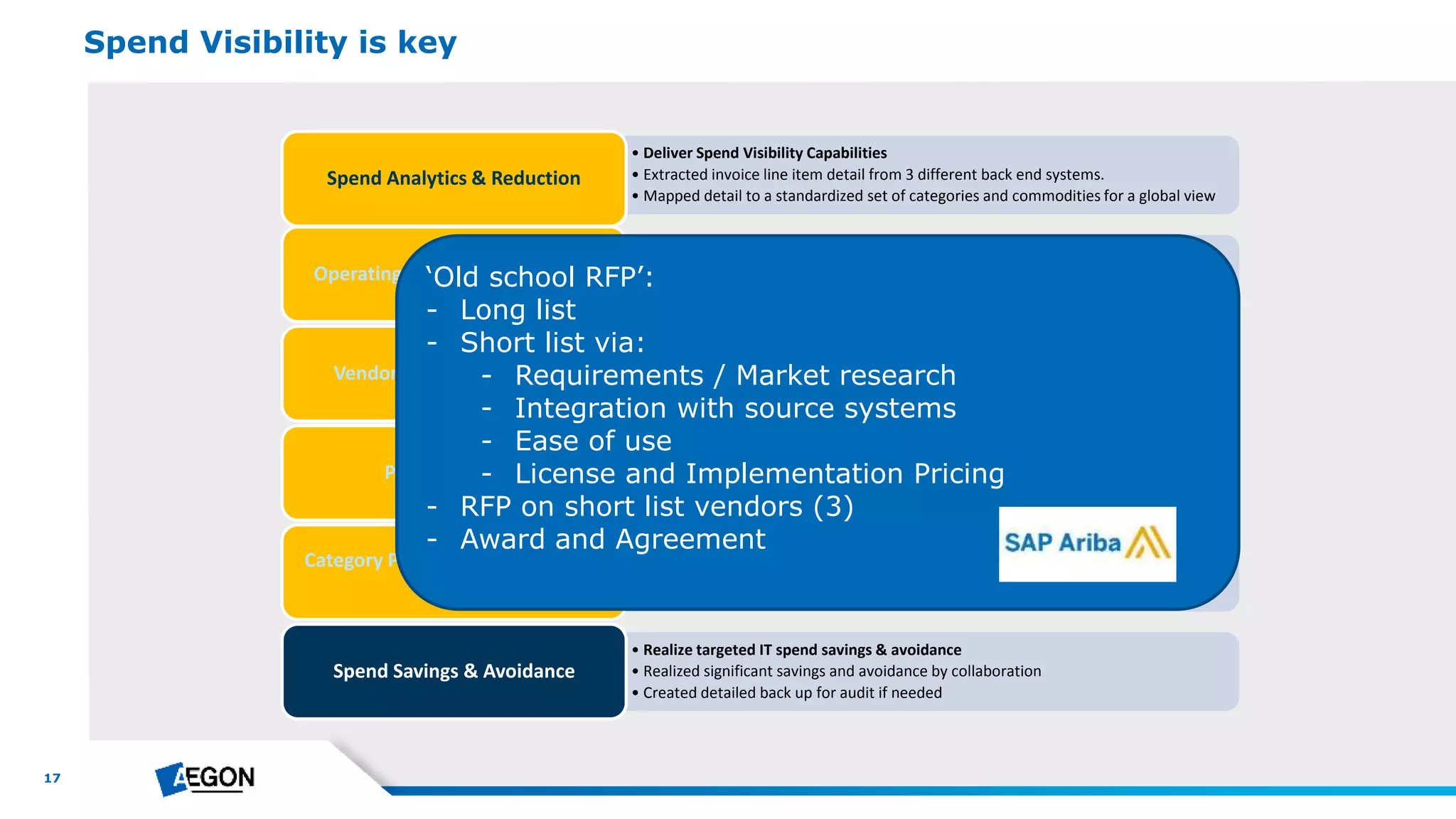

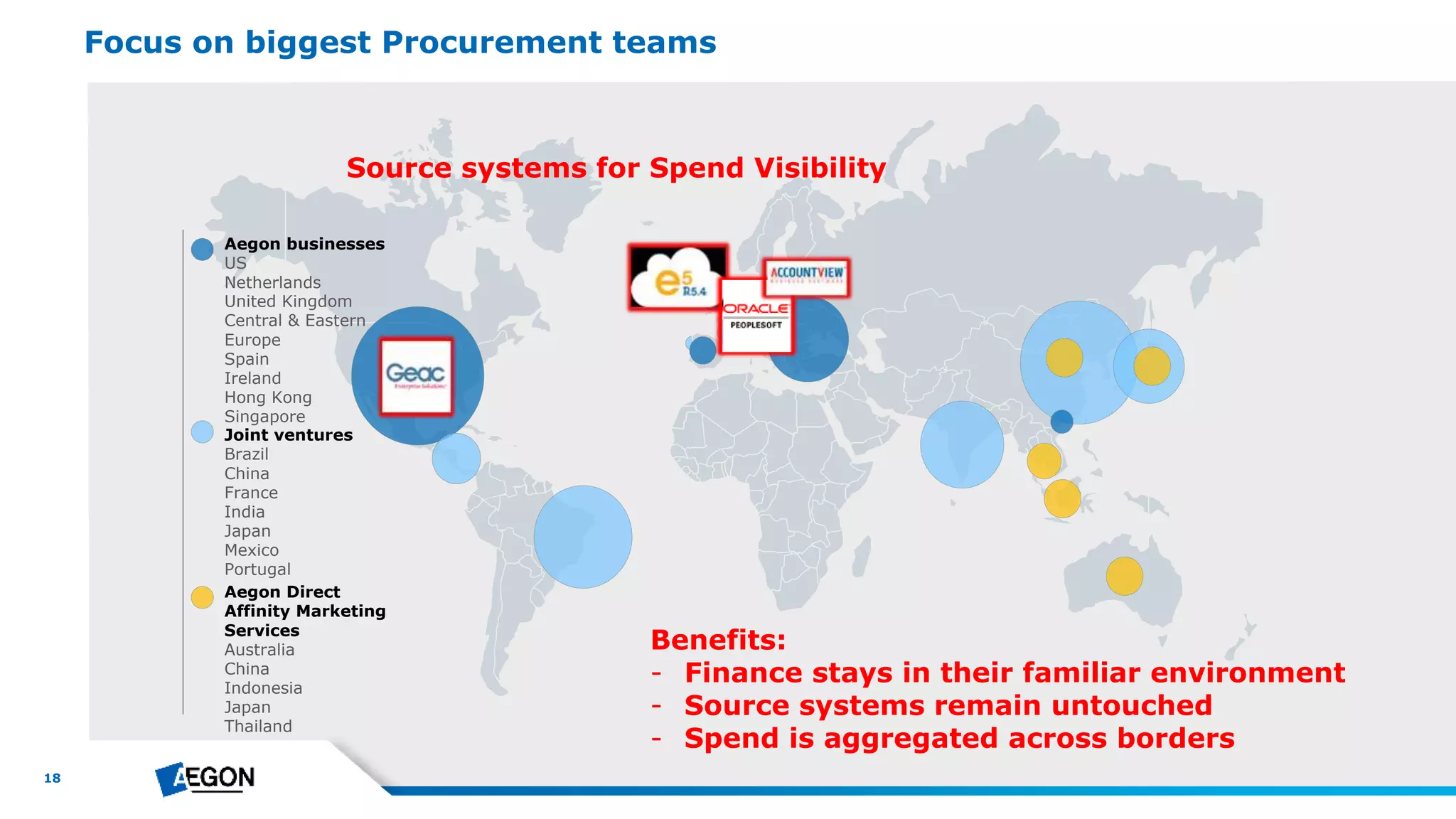

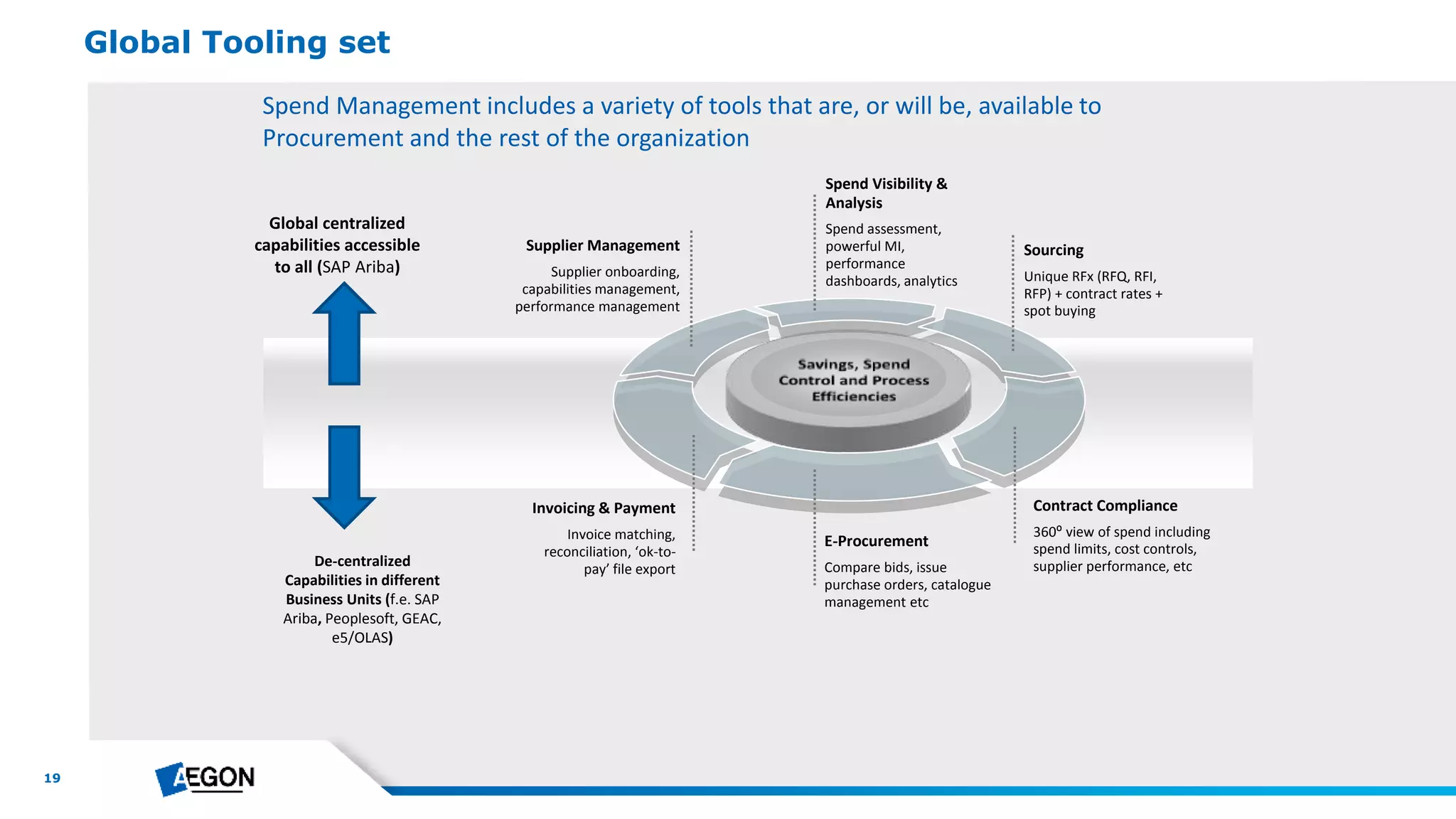

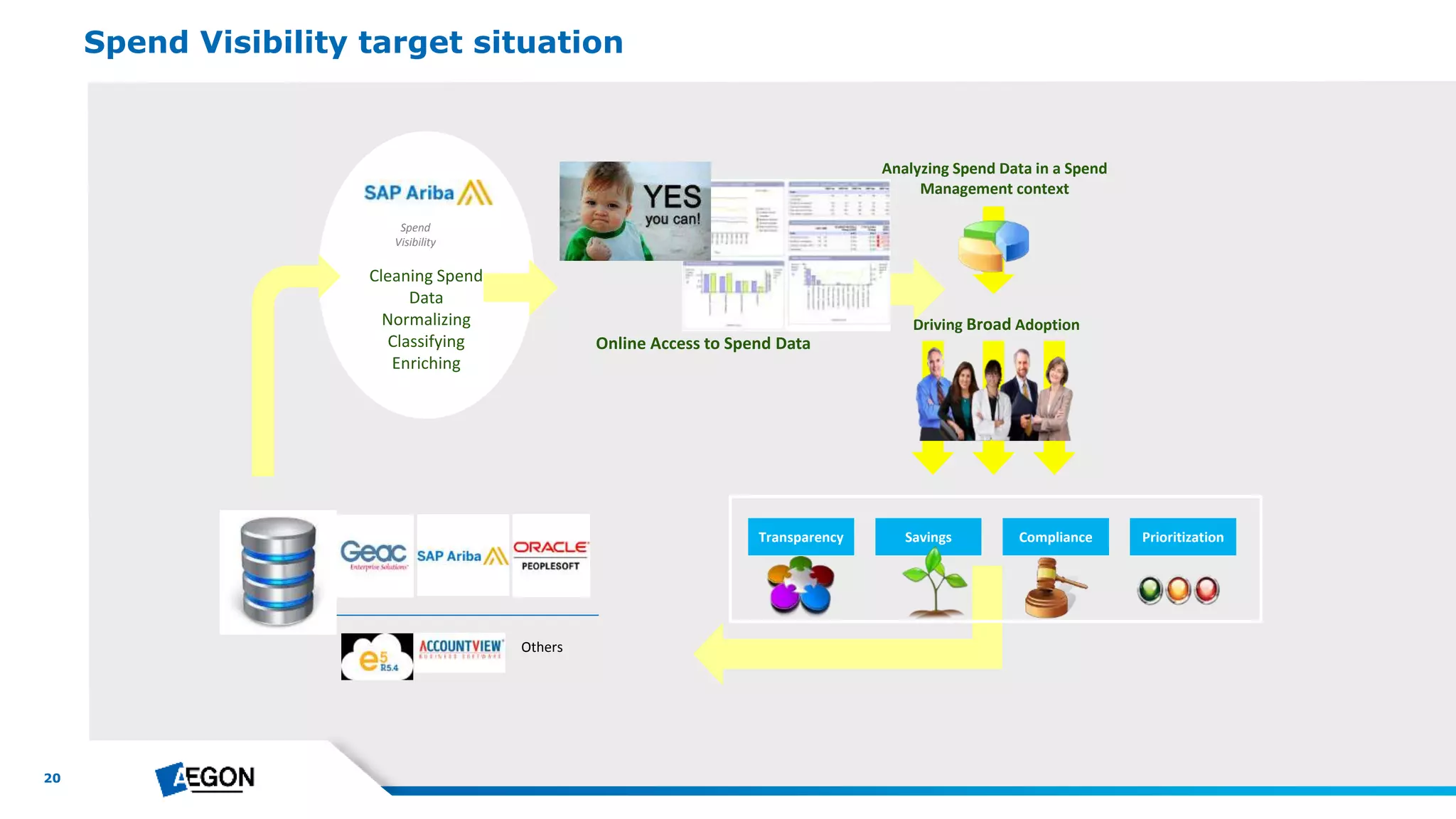

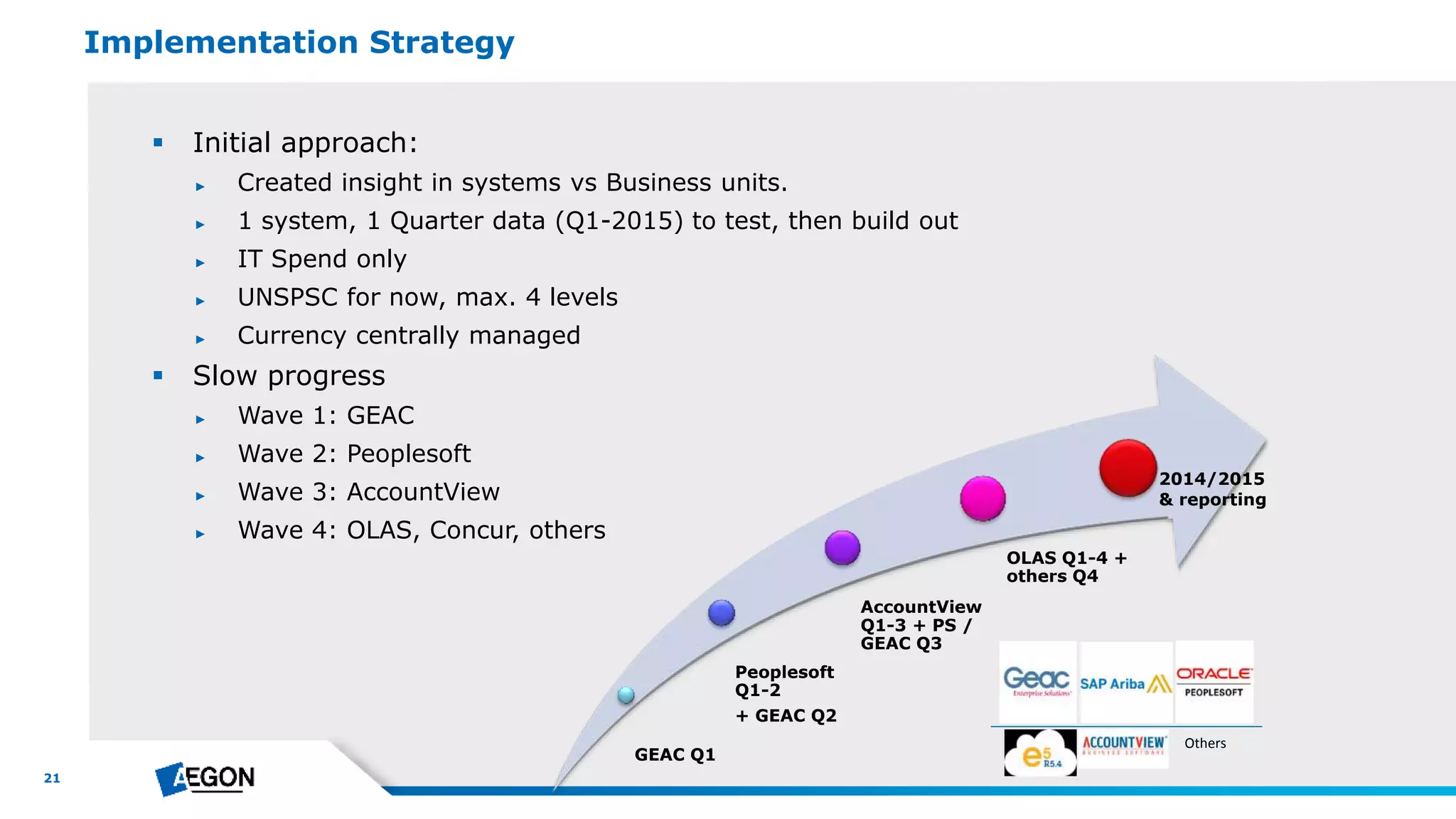

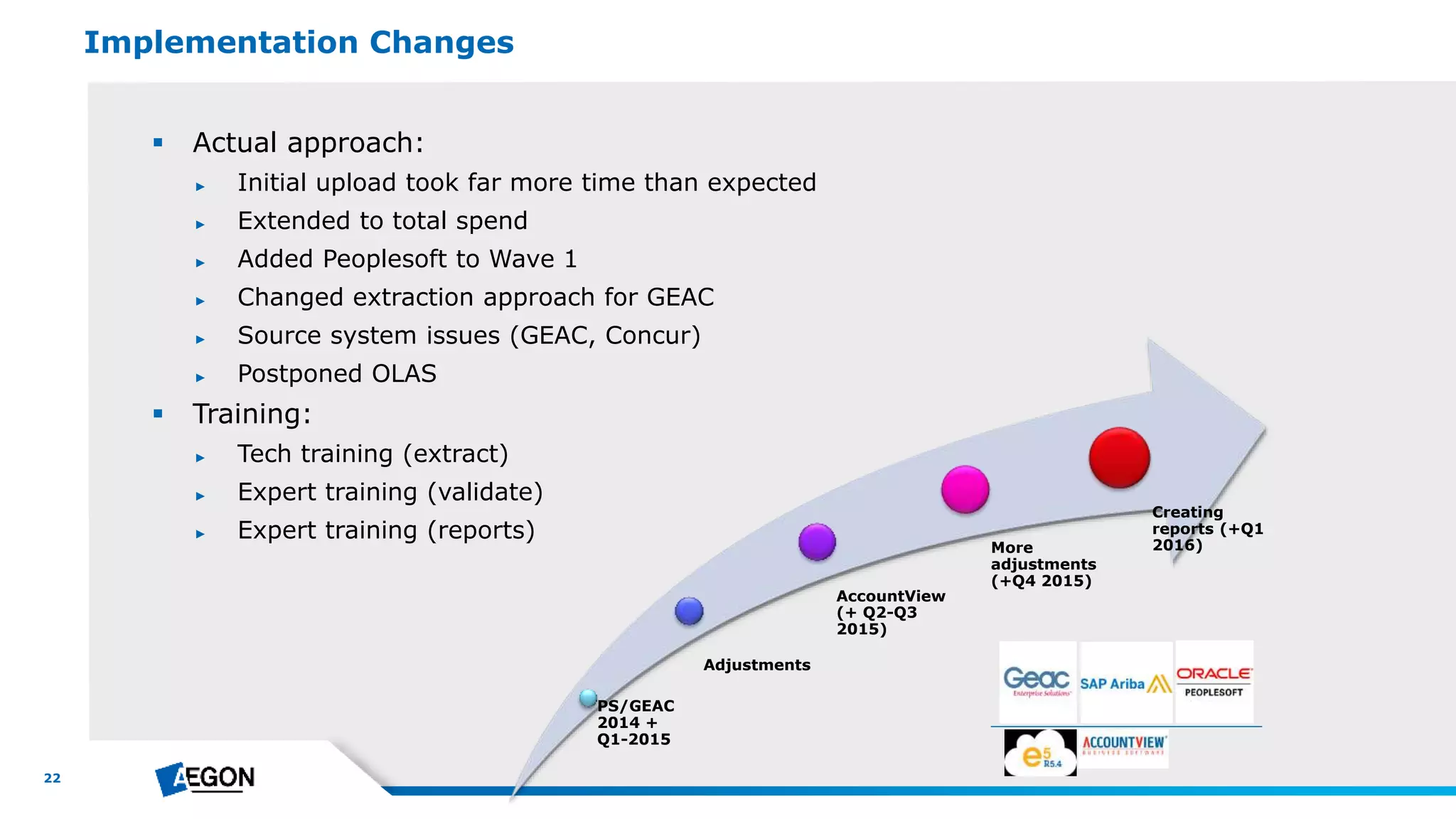

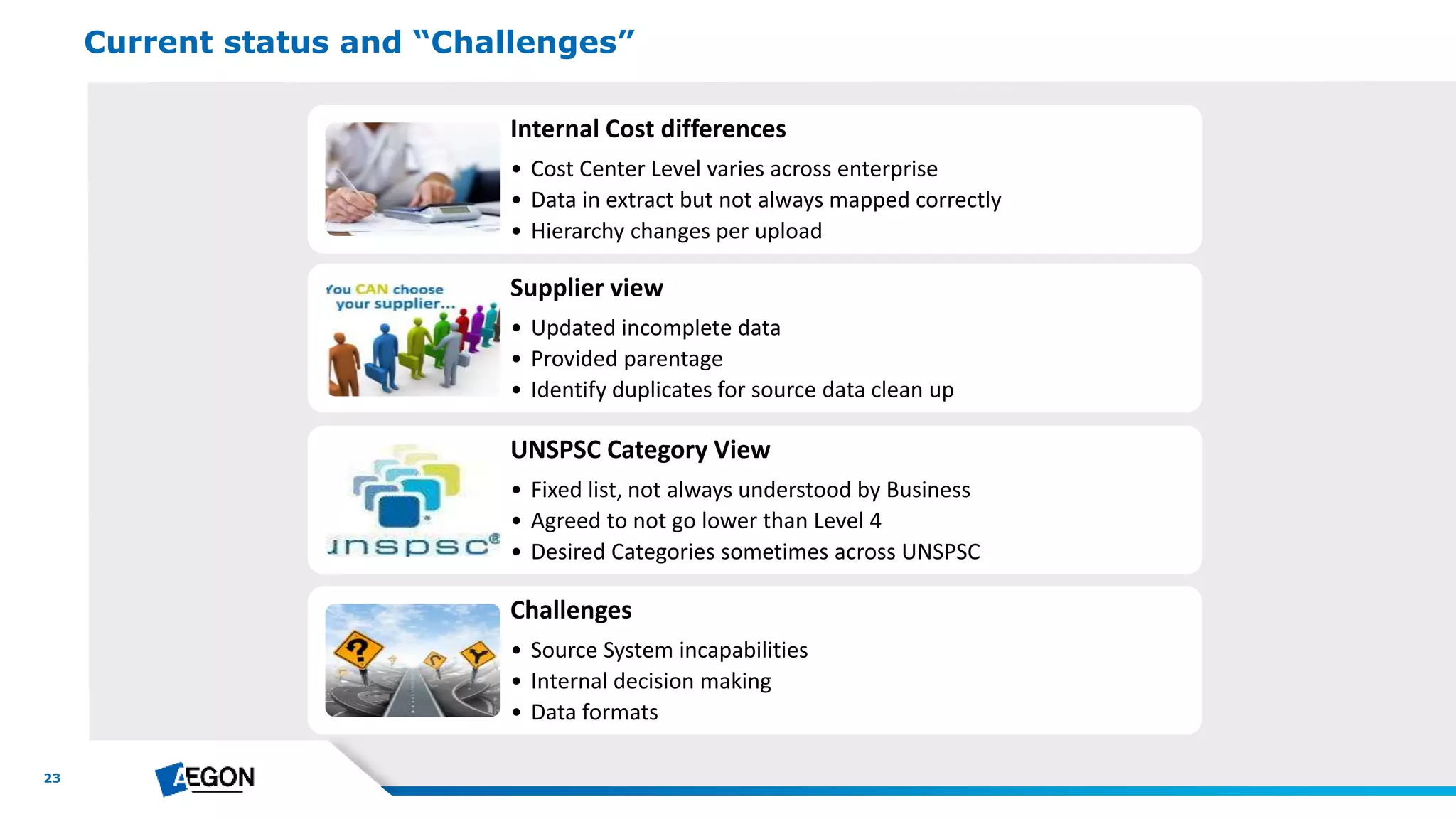

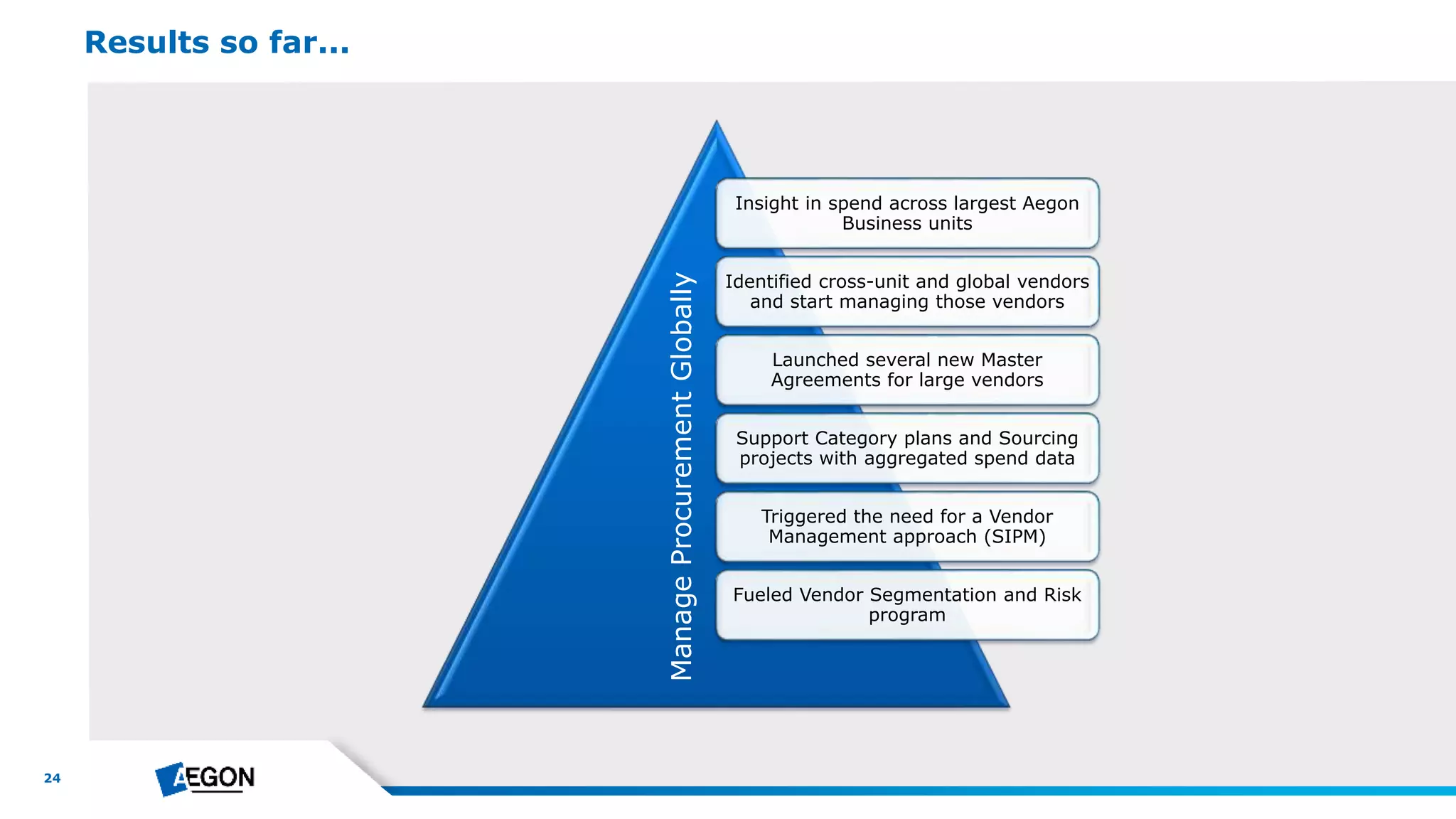

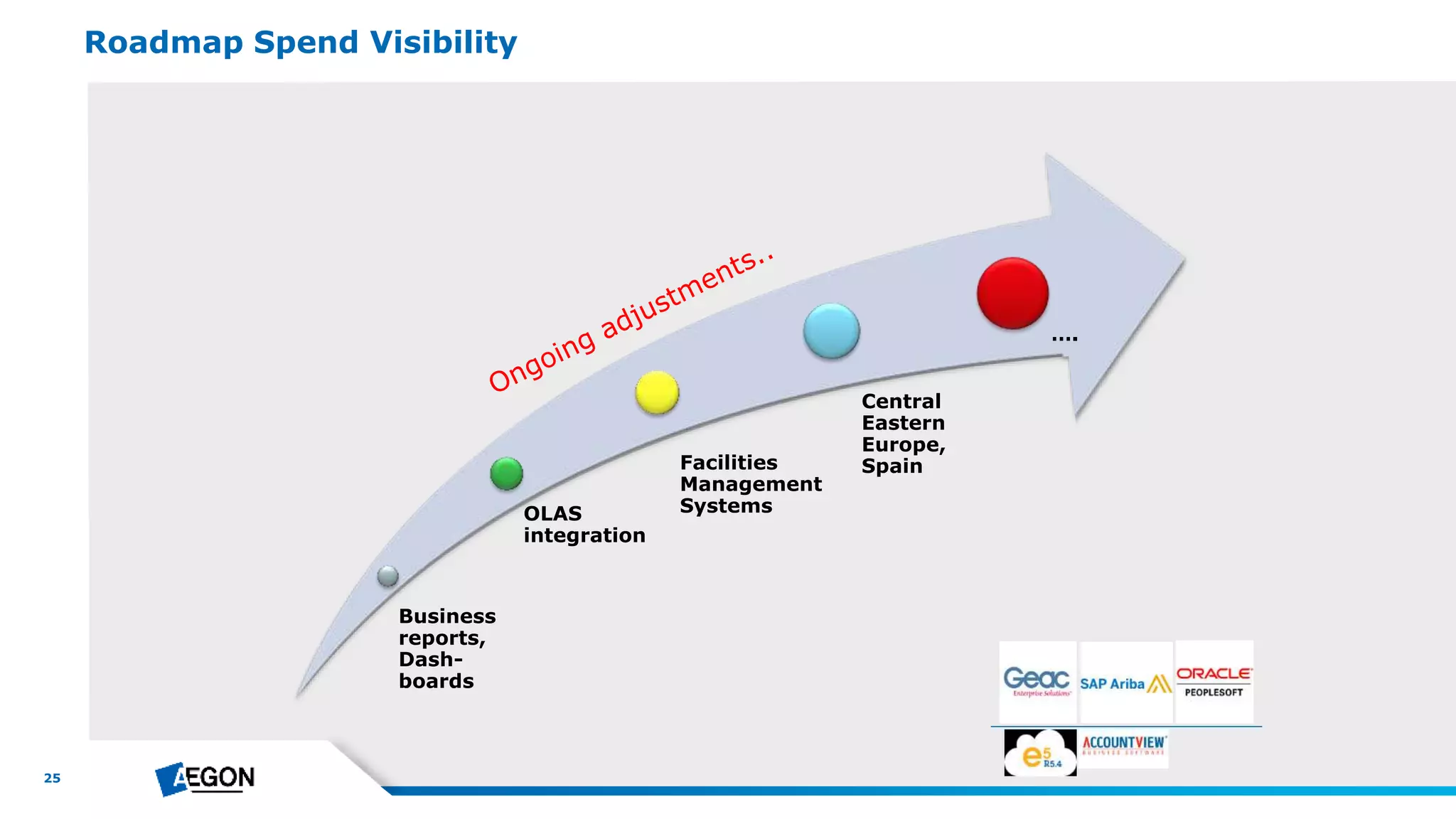

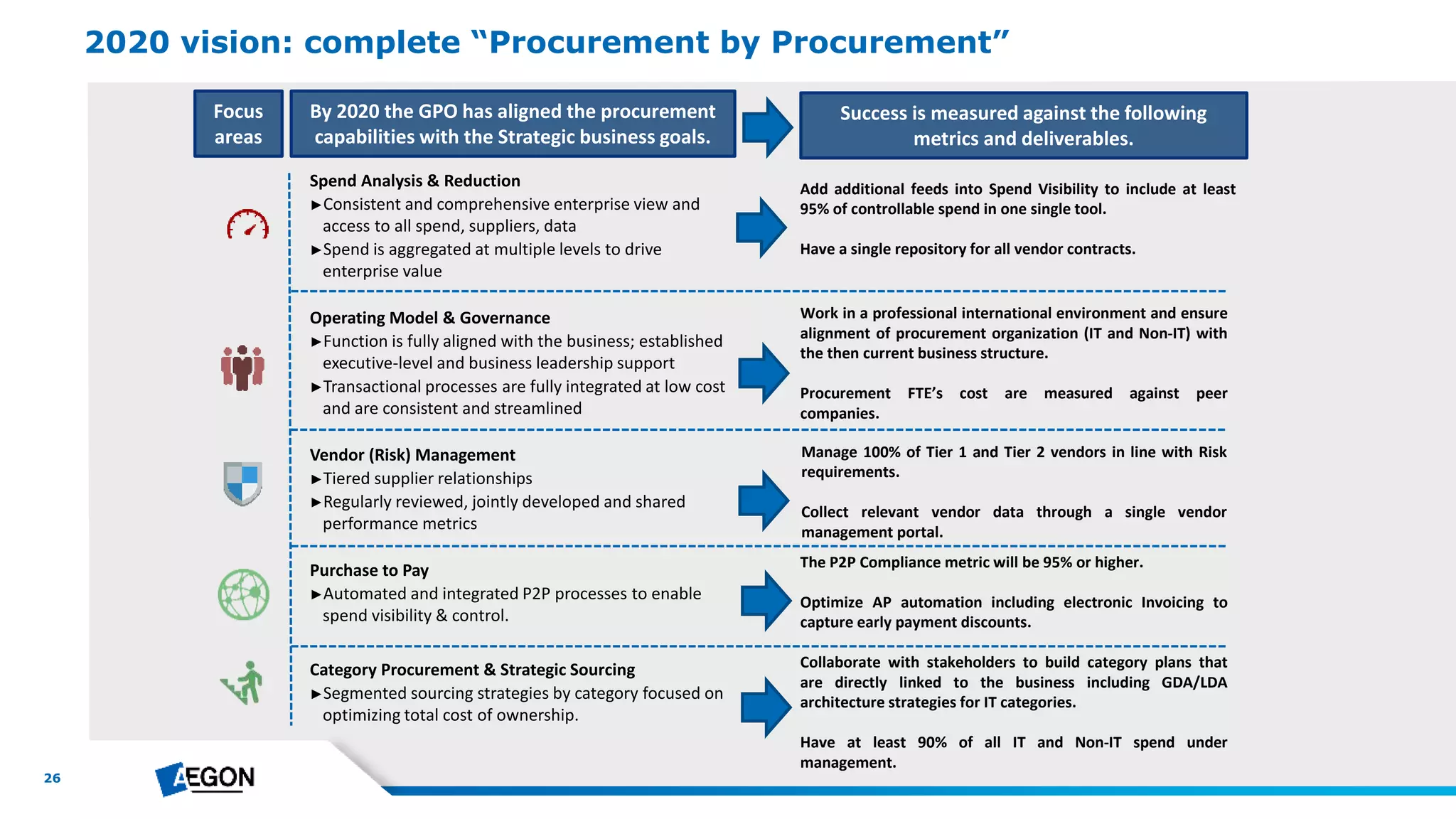

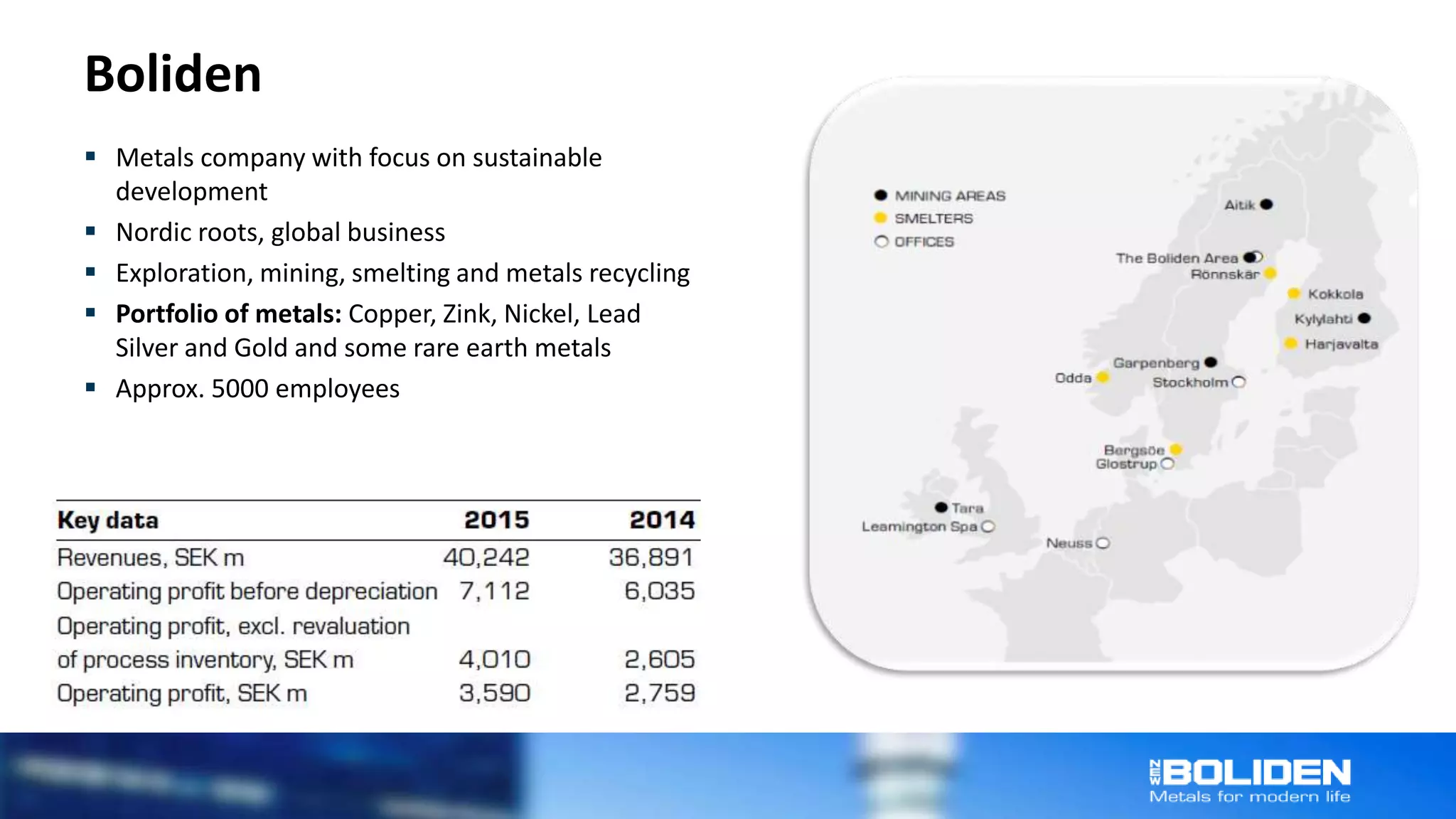

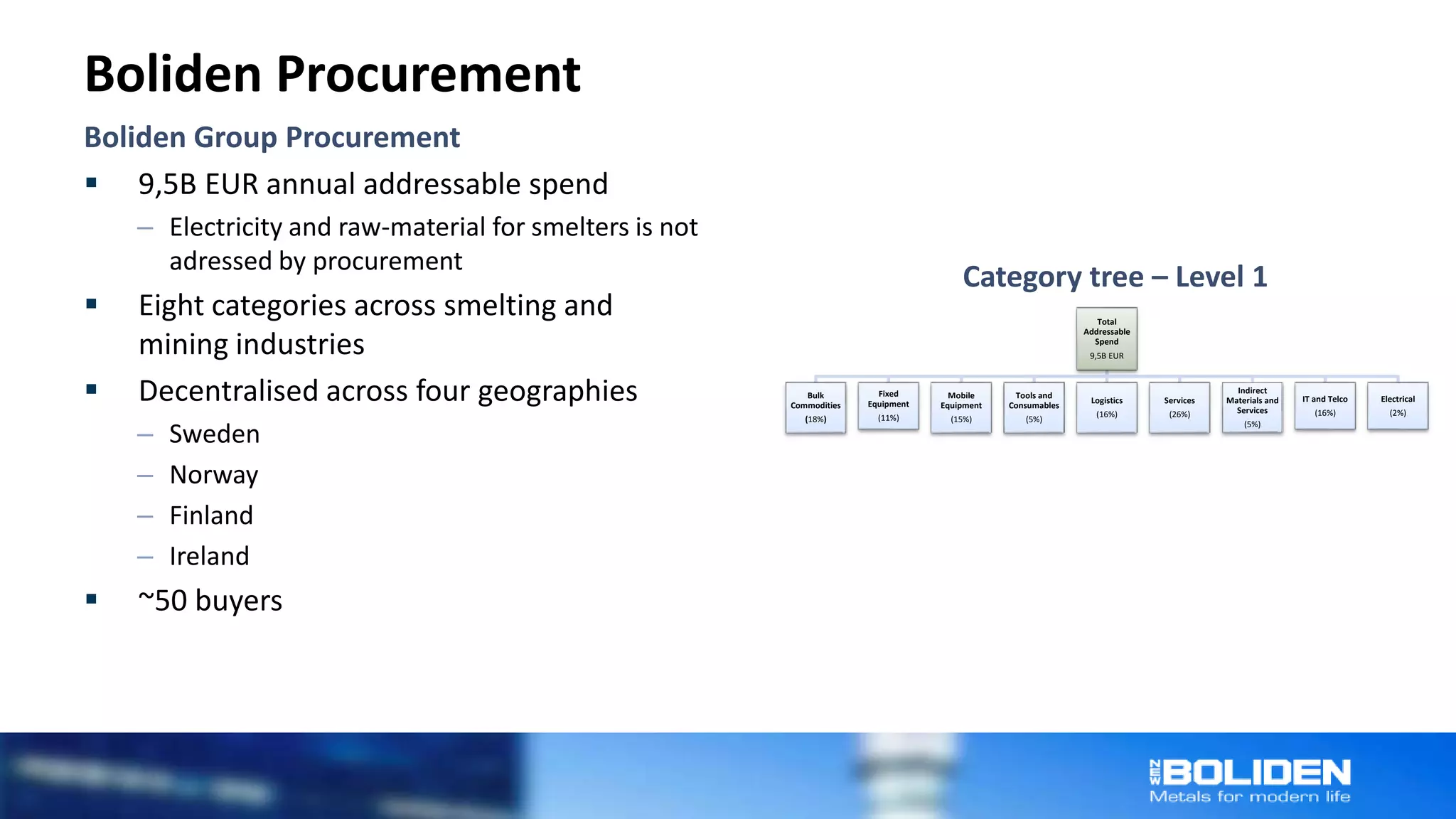

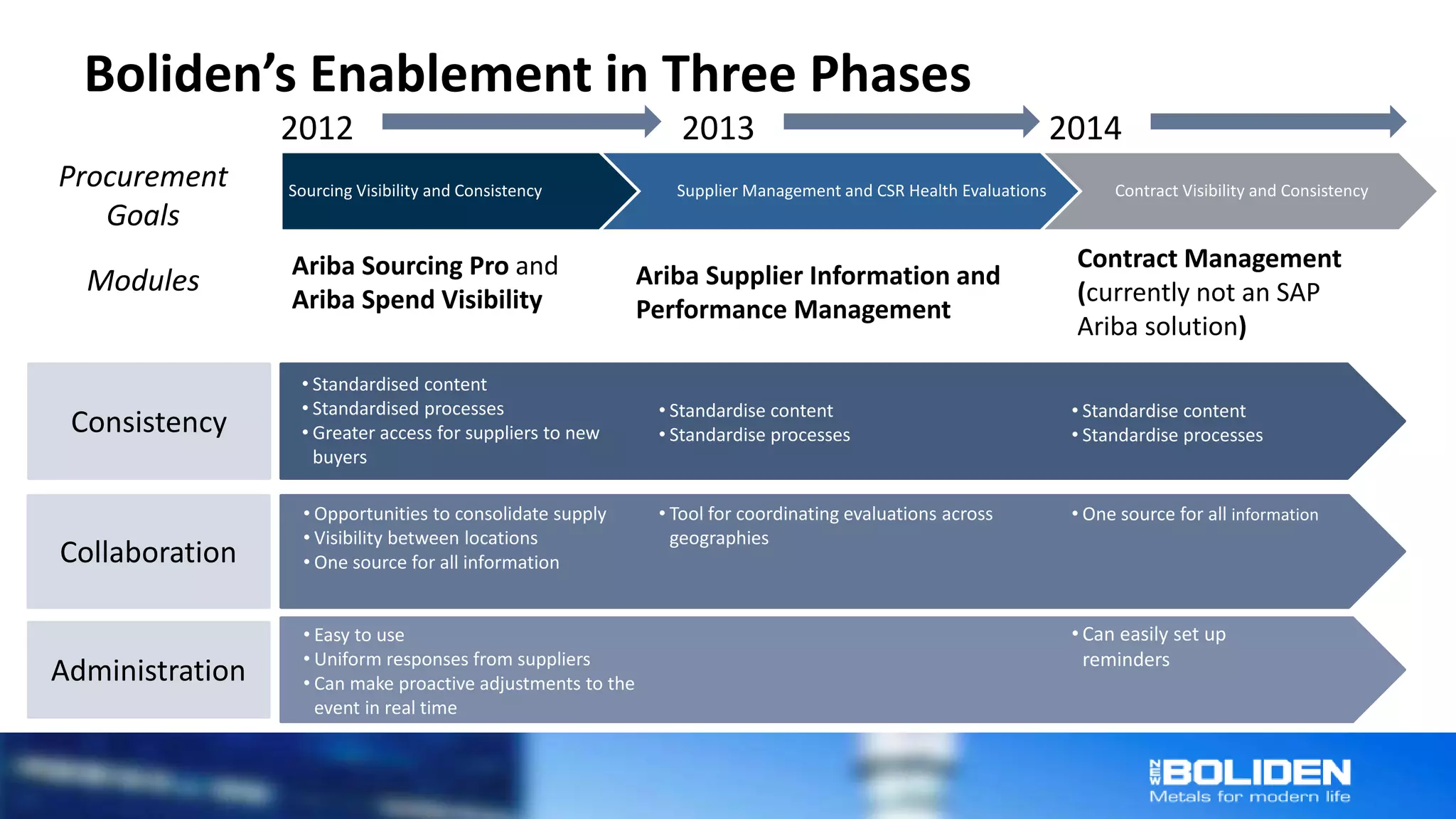

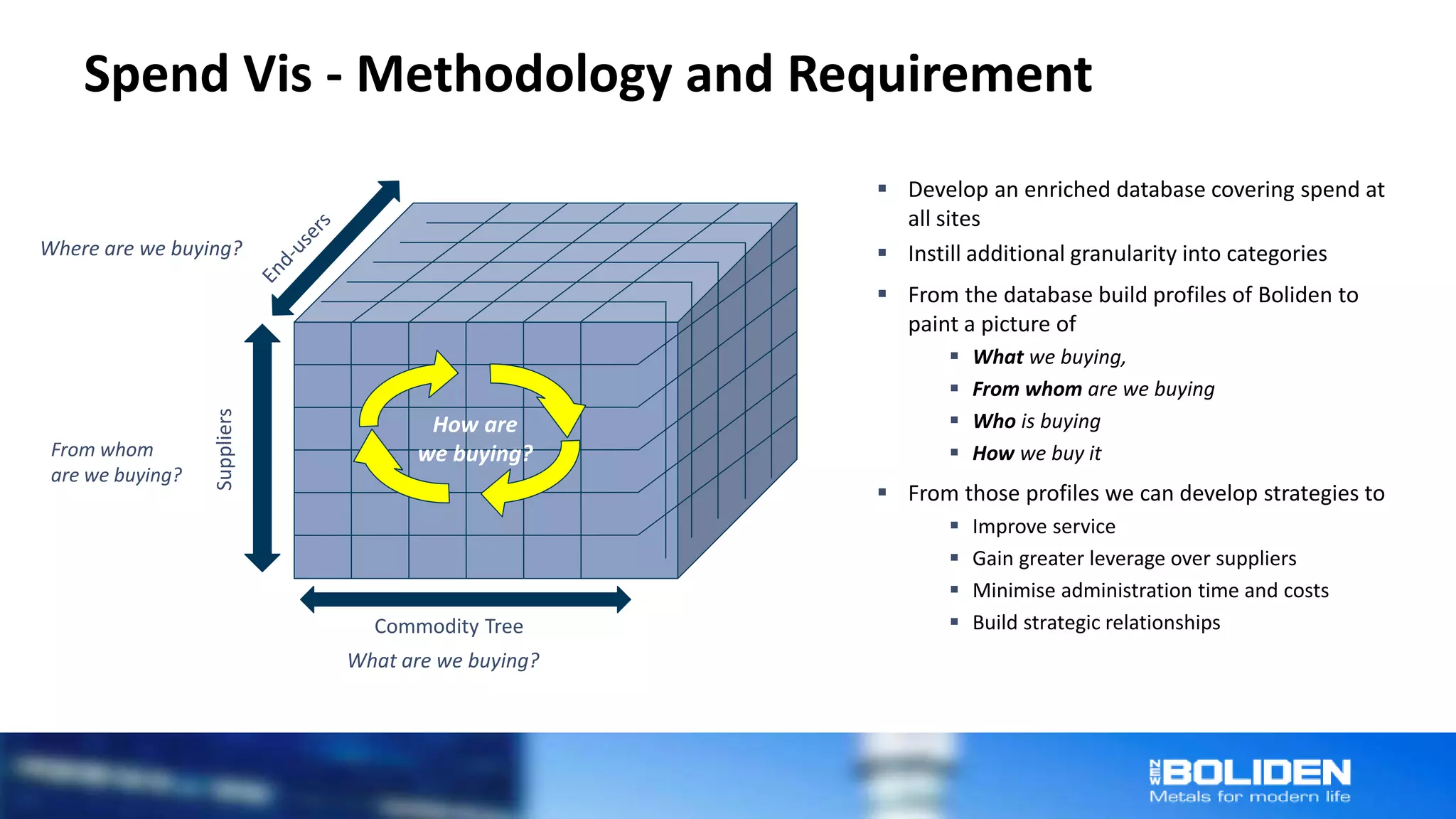

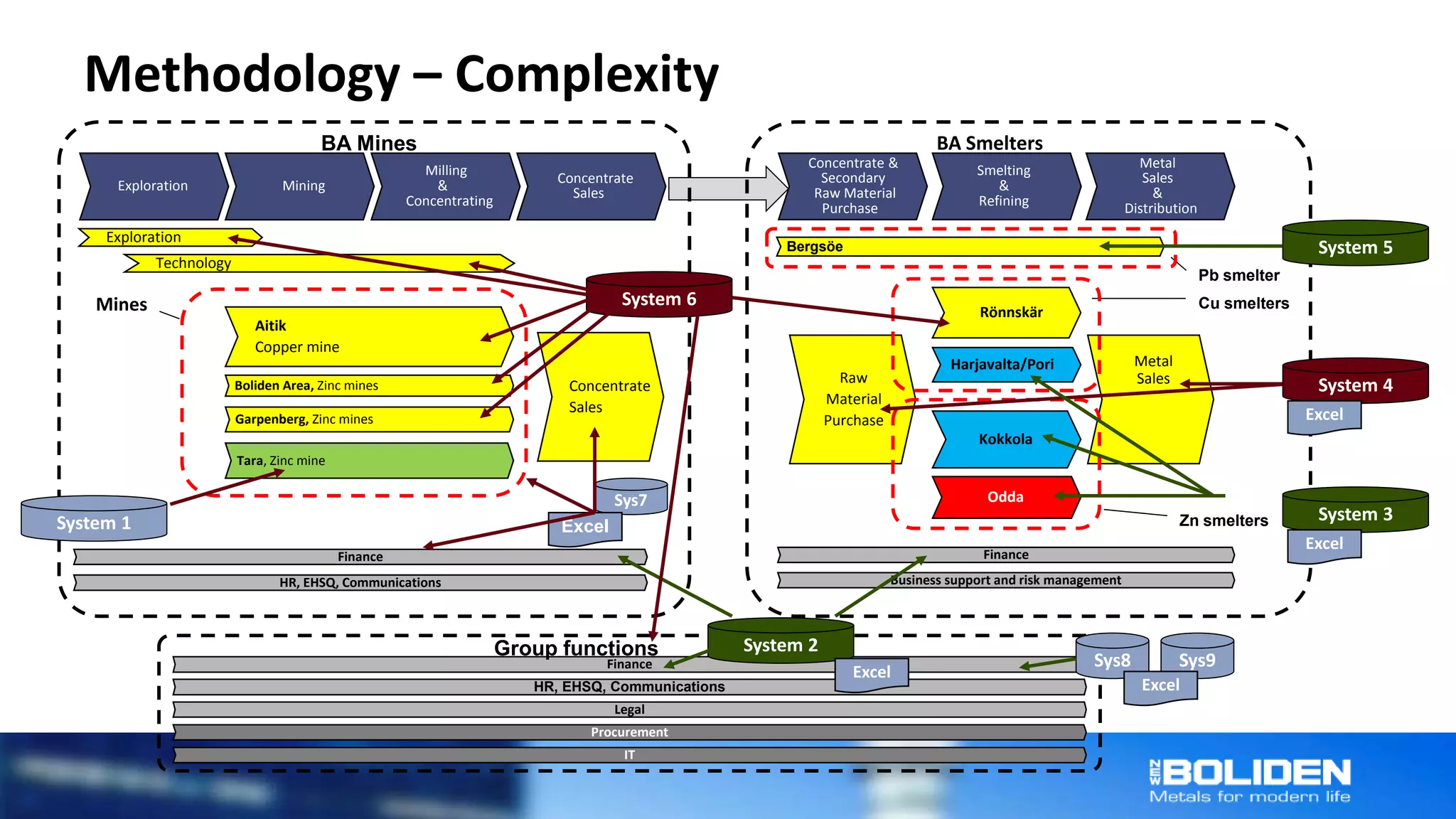

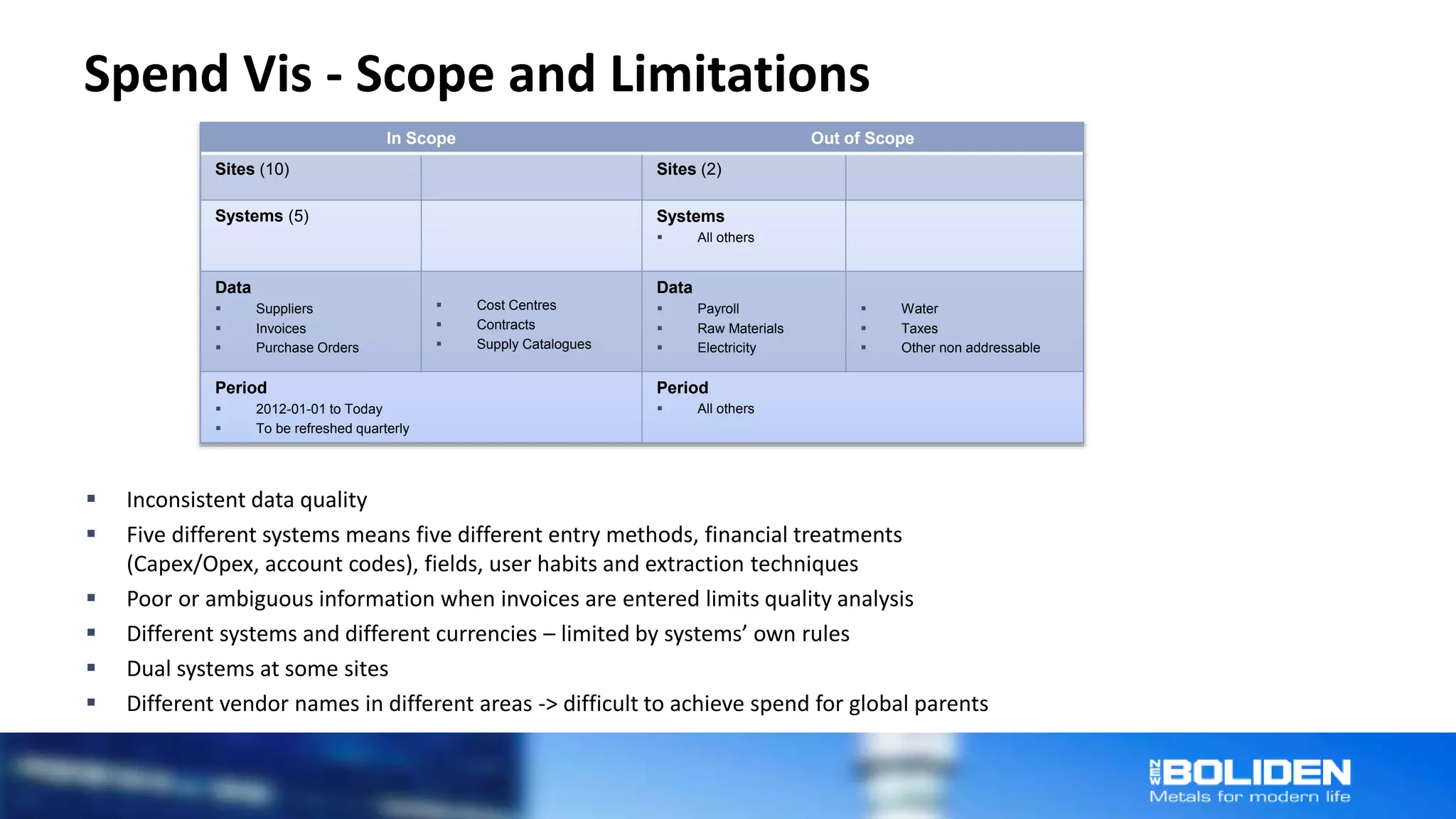

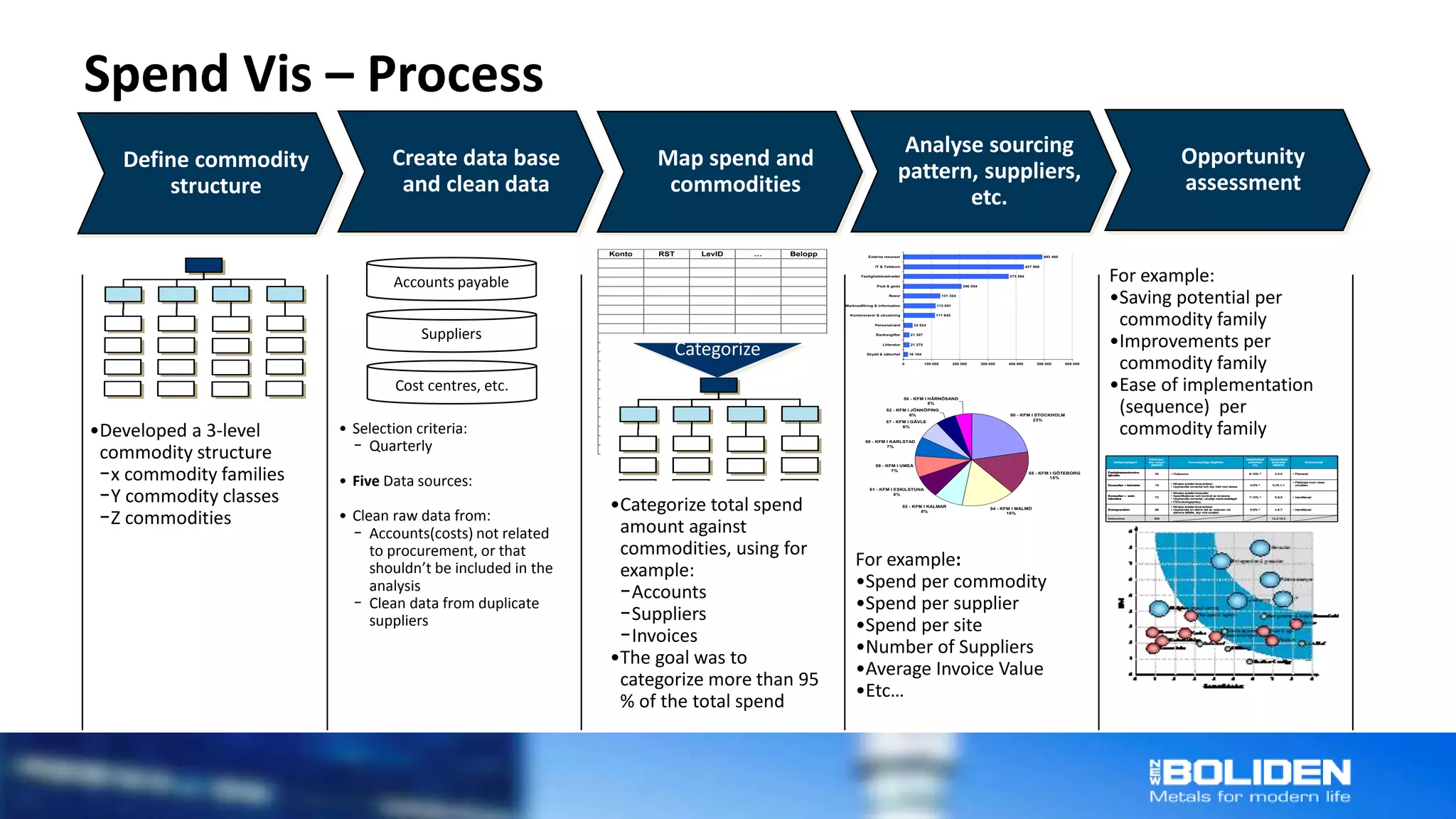

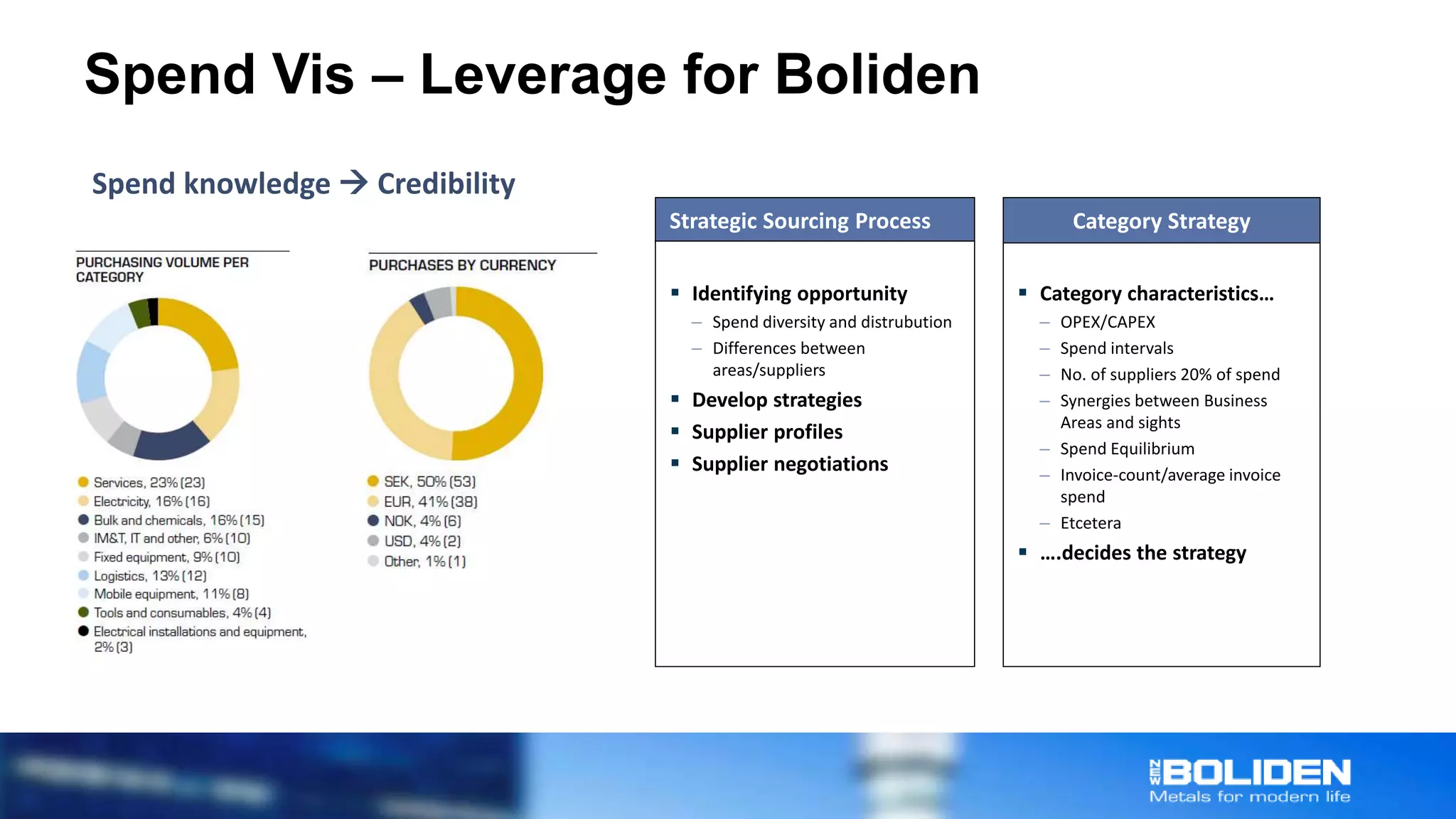

The document discusses the importance of public spend analysis and how organizations like Aegon and Boliden are leveraging procurement and spend visibility tools to improve efficiency and decision-making. It highlights Aegon's strategies for optimizing costs and vendor management through a systematic approach to spend analytics and governance. Additionally, it provides insights into the implementation challenges and evolving methodologies in procurement practices across different business units.