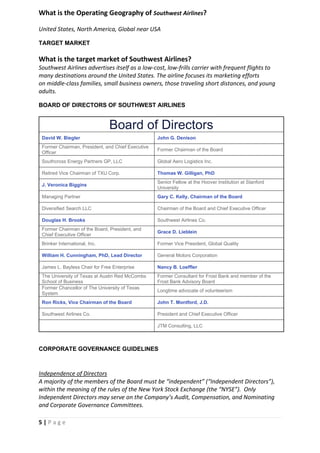

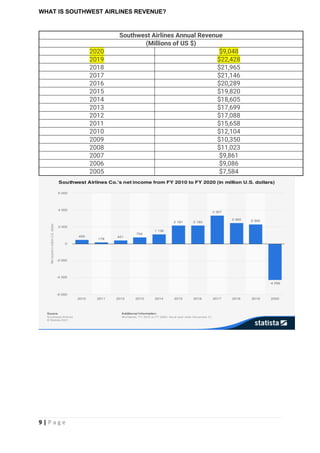

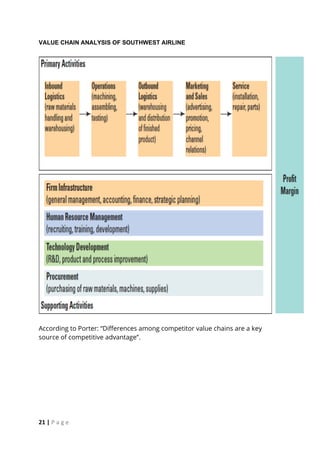

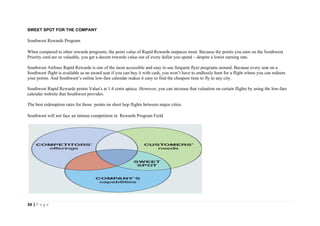

Southwest Airlines is a major US airline founded in 1967 that pioneered low-cost air travel. It operates flights across the US and to nearby international destinations. The document provides an overview of Southwest's mission to provide high quality customer service, vision to become the world's most loved airline, services offered, target markets, leadership, and business strategy. It also analyzes the airline industry and Southwest's position using tools like PESTLE, Porter's Five Forces, and SWOT. The purpose is to evaluate Southwest Airlines' business operations and strategies.