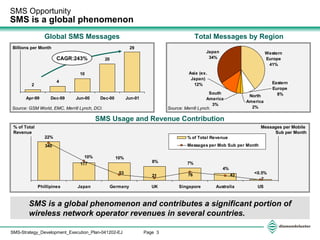

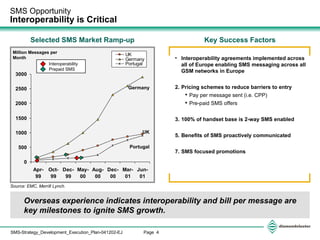

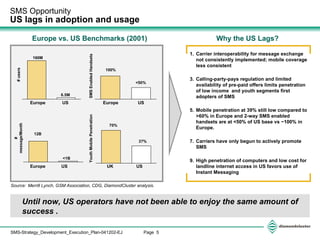

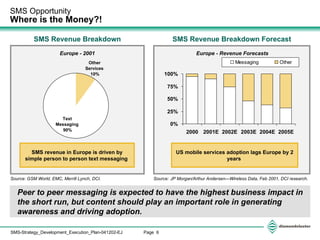

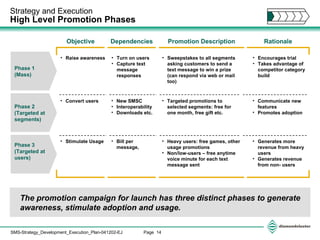

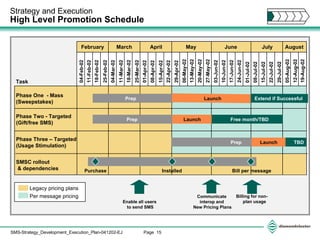

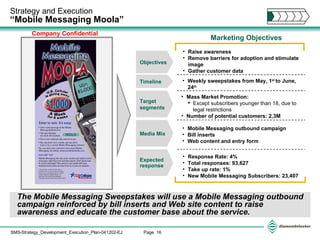

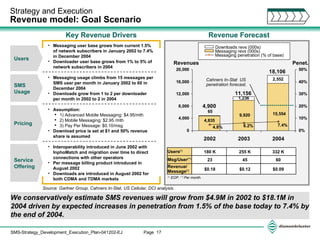

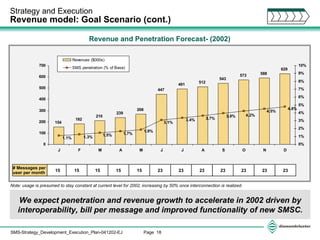

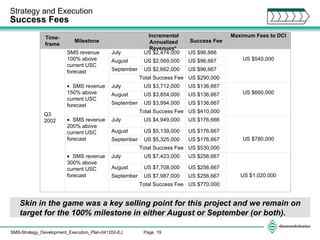

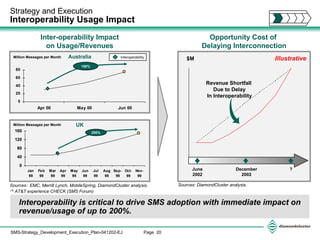

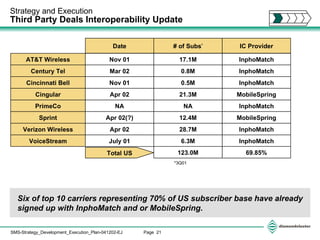

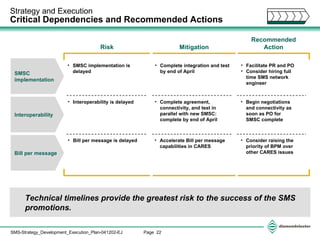

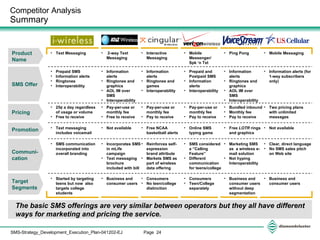

The document outlines a strategy and execution plan for SMS services at a wireless carrier. It identifies five early adopter customer segments and recommends prioritizing text messaging, alerts, and ringtones. A three-phase promotion strategy is proposed to generate awareness, stimulate adoption, and increase usage. Interoperability is identified as critical for growth. The plan forecasts growing SMS revenues from $4.9M in 2002 to $18.1M in 2004 through increased penetration and usage. Success fees are tied to revenue milestones.

![I-wireless started as a teen brand but has started to expand its base by targeting college students as well. Teens Teens Teens TEXT MESSAGE #1: Party 10:00. Matt TEXT MESSAGE #2: Meet at 6:30 our spot. Jen GIRL: Hey. How was your day? [also said in sign language] GUY signs a response. END TEXT: Send and receive text messages with your phone. Two way Text Messaging now available. Competitor Analysis I-Wireless Marketing Case Study: Teen Commercials TEEN: Hey wait man. You can’t forget this. I like your shoes. Those are shiny shoes. Later, man. May I help you cross the street? ELDERLY LADY: Let go of me. Let me go! TEEN: People say I’m a good person and you know what, I believe them. Have a nice day. Elderly lady : Wha- Chippy, where are you dear? TEEN: I’ve been good. I deserve I-wireless. TEEN: Oh I’m popular now. It all changed pretty quickly. People just need to get to know the real me…. So, Saturday night then. You just gotta know how to present yourself. Script/ Text “ SMS” “ I’ve been good” “ Popular” Ad Target](https://image.slidesharecdn.com/smstelecomdaysmsej-12875724825492-phpapp02/85/Sms-Telecom-Day-Sms-Ej-27-320.jpg)

![College College/Teens College/Teens BOY: Hey guys, guess who’s finally going out with me? Gretchen! [Tarzan-esque Cheers] FRIEND CALLING: Hey big stud. Did you get lucky yet? GRETCHEN:That depends on how fast you can get here…. I am not to be underestimated. Competitor Analysis I-Wireless Marketing Case Study: College/Teen Commercials TEXT: I have free caller I.D. Your ex-boyfriend will hate this. I have digital prepaid. His complaints will come in clear. I have free text messaging. He’ll even put it in writing. I have 10 ¢ minutes evenings and weekends. In case it takes awhile…to get him to stop…crying. I live by my terms. GIRL: I live by my terms. IVR: Welcome to the I-wireless telemessaging service. To identify yourself as a subscriber, please press #. Please enter your password. Dana Raven, you have new messages. First new message GUY: Hey it’s Chad. Call me. Message deleted. Hey Dana, it’s Chad, the captain of the football team?! Last night was fantastic. Why don’t you give me a— Message deleted. Hey Dana, me again. Uh, maybe, uh, you lost my number or something. It’s 555-653— Message deleted. H ey— Message deleted. Look if you’re not— Message deleted. NARRATOR: I-wireless comes with free voicemail and caller I.D. for those calls you’d rather not pick-up. GUY: I thought you said I was special. Message deleted. NARRATOR I-wireless affordable prepaid digital service. Ad Script/ Text Target “ The Date” “ Ex-boyfriend” “ Quarterback” Radio Ad](https://image.slidesharecdn.com/smstelecomdaysmsej-12875724825492-phpapp02/85/Sms-Telecom-Day-Sms-Ej-28-320.jpg)