This document provides an overview and introduction to the SME Banking Knowledge Guide. It discusses how SMEs rely heavily on banks as their primary source of financial services and how banks are increasingly targeting the previously underserved SME market. The guide aims to share lessons from banks that have successfully engaged with SMEs, overcoming challenges like high credit risk. It focuses on the experience of commercial banks, which offer a broad range of financial products and services to formal sector SMEs. The introduction sets up an exploration of the current state of SME banking and approaches that banks are using to profitably serve small and medium enterprises.

![THE SME BANKING KNOWLEDGE GUIDE22

banking have been relatively minimal. They have been limited

by a lack of financial and human capital, and by organizational

missions which remain targeted on poorer individuals.30

In addition to commercial banks that have moved downstream

and MFIs that have moved upstream, the SME banking

industry also includes banks that have been founded specifically

to target the SME sector. Examples of these include a number

of banks founded in Russia and Eastern Europe/Central Asia

shortly after the fall of communism. Some banks, such as

Hamkorbank in Uzbekistan (profiled in Chapter 4), have built

upon successful SME operations to expand into the retail

segment.

The Role of the Operating Environment

While the SME banking industry appears to be growing

rapidly in emerging markets, access to finance is generally still

easier for a small firm in a developed country than a firm of any

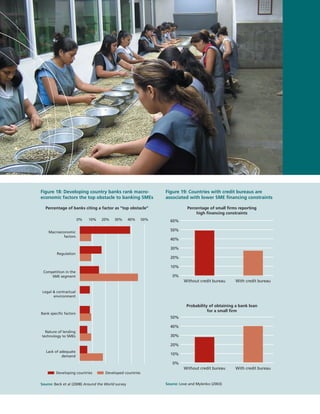

size in a developing country. Developing country banks

surveyed in Bank Financing for SMEs around the World, report

Box 2.2: SME banking during a global economic crisis

SME banking has not been immune to the effects of the current global financial crisis. Yet while momentum may

have slowed, and the full impact of the crisis is not yet known, early signs suggest that the overall trend is toward

continued growth and value in the SME market segment.

The current (2009) crisis was triggered in 2007 in high-income countries and has resulted in a contraction of credit

around the world. Unlike banks in OECD countries, many banks in emerging markets have generally avoided bad

loans and other “toxic” assets, and therefore, did not feel the immediate effects of the crisis. However, these banks

are still affected by the liquidity crunch and by the impact of the crisis on the real economy. Some emerging market

banks have reported a drop in demand, and some have had to pull back on many types of lending out of concern

for rising defaults.

In March 2009, the OECD Turin Round Table on the Impact of the Global Crisis on SME and Entrepreneurship

Financing and Policy Responses cited working capital as a critical need of SMEs during the crisis. This is illustrated by

reports that, for example, many manufacturing SMEs in China have been unable to withstand even a few months

of slowdown in orders from the West. In response to this need, many governments have worked to support lending

to SMEs, mostly through credit guarantees. While the Round Table cautioned that government policies must not

impair fair competition, it noted the importance of providing credit guarantees to the SME market. The head of

a leading international bank’s global small business operations welcomes this support, “This crisis is completely

different from those in the past as far as SMEs are concerned…SMEs used to be the first ones to be hit…now

governments have provided a credit backstop.”

While the financial crisis continues, and a complete picture of its impact on SME banking is yet to be seen, the

orientation of many emerging market banks toward SME banking does not seem to have changed significantly. This

is despite the fact that some banks are scaling back aggressive SME loan growth targets, citing a lack of demand

from SMEs. Says one executive regarding operations in Asia, Africa, and the Middle East, “Our loans have withstood

the current stress. Profitability will get impacted but I don’t think the default rates will go up like [in past crises].”

Banks interviewed in Ghana and India, even in the midst of the crisis, report seeing SMEs as the economic future

of their countries and express their desire to be positioned accordingly. In Latin America, even though 50 percent

of banks in a 2008 study believe the SME situation in their country will be the same or worse in two years, only 23

percent plan to reduce their exposure to SMEs in response to the crisis. The sentiment expressed by an executive at

one pan-African bank is not uncommon, “Our SMEs often sell to the developed world. Now people are not buying

their products. This has definitely affected us. But the impact is not a threat to our profitability at the moment.”

Sources: Bank and expert interviews; Summaries and reports from the Turin Round Table, OECD (2009); Latin America study: IIC/MIF, IDB and

FELEBAN with D’Alessio (2008)](https://image.slidesharecdn.com/cb1bedbe-e944-489c-be41-2c6a229a0912-150420043605-conversion-gate01/85/1414071625IFCTheSMEBankingKnowledgeGuide-24-320.jpg)