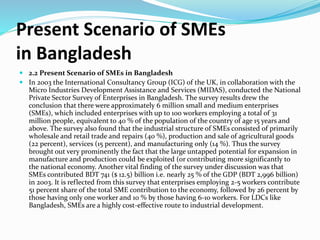

Small and medium enterprises (SMEs) in Bangladesh are crucial for economic development and poverty alleviation but face numerous challenges such as inadequate credit, complex loan procedures, and lack of skilled workforce. The study assesses these issues and proposes recommendations for enhancing SME growth, emphasizing the need for better financing options and support systems. Despite these hurdles, SMEs have demonstrated significant potential for contributing to GDP and creating employment opportunities.