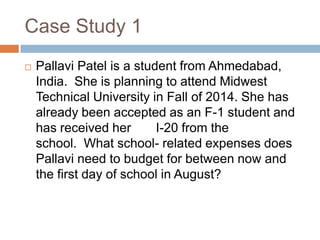

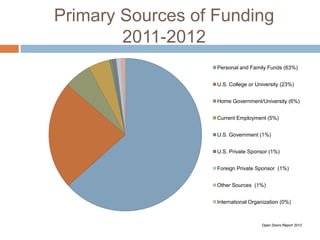

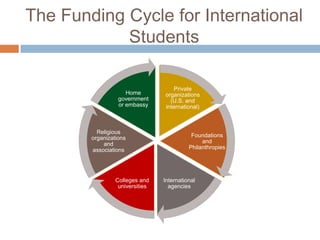

The document provides an overview of financial resources available for international students, including budgeting advice and case studies focusing on various financial challenges they may face. It discusses primary sources of funding, the rising cost of tuition, and recommended strategies for managing finances effectively. Additionally, it highlights the importance of institutional support, scholarships, and external resources for assisting international students in financial distress.