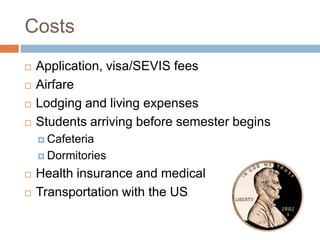

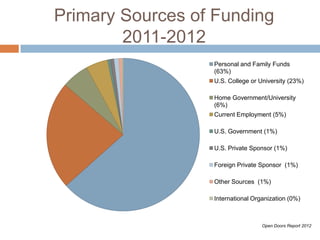

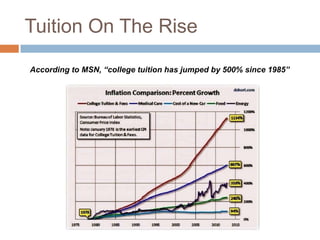

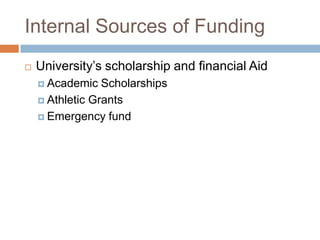

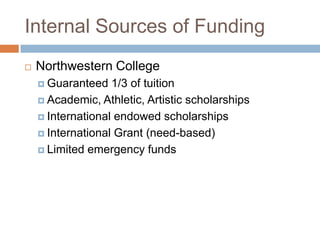

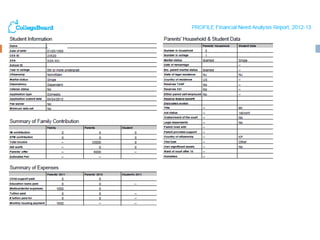

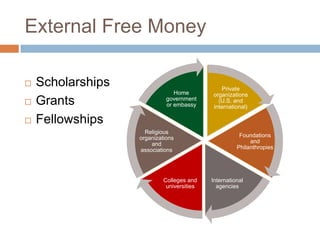

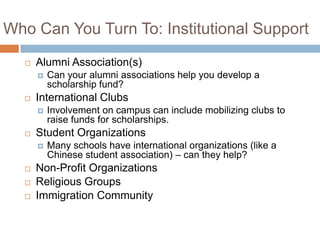

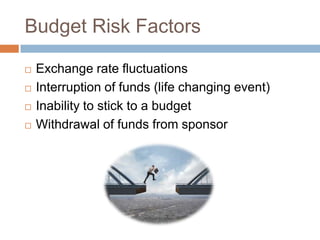

The document discusses budgeting and affordability for international students, highlighting case studies of financial hardship and potential solutions. It evaluates costs associated with tuition, living expenses, and funding sources, and emphasizes the importance of transparent financial processes for student recruitment and retention. Additionally, it covers various forms of financial aid and scholarships available to international students, and the challenges they may face regarding budgeting and expenses.

![Evaluating costs

Tuition

Room and Board

Other

$10,500

$ 7,686

$ 3,670 [books, health

insurance, fees]

TOTAL COST

$21,856](https://image.slidesharecdn.com/financialaidpresentationregionivfinal-131111092440-phpapp01/85/Can-I-Afford-It-8-320.jpg)