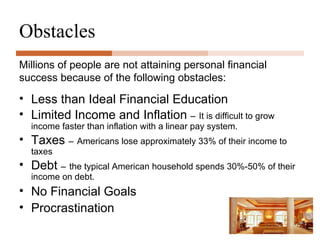

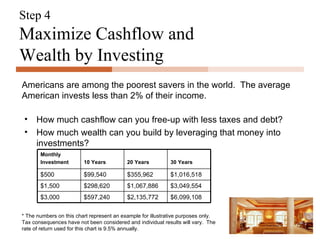

This document discusses personal financial success and provides steps to achieve it. It defines financial success as having enough cash flow to support one's lifestyle through work income and retirement investments. It identifies obstacles like lack of education, debt, and taxes. It then provides four steps: 1) maximize cash flow by correcting tax withholding, 2) maximize deductions to minimize taxes, 3) eliminate debt to free up cash flow, and 4) invest freed-up cash flow for long-term wealth building and retirement. The key is leveraging extra cash flow from the first three steps into investments over decades to attain significant wealth.