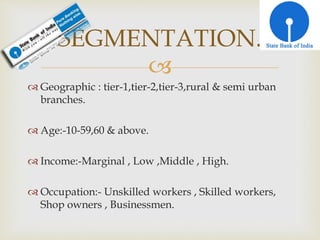

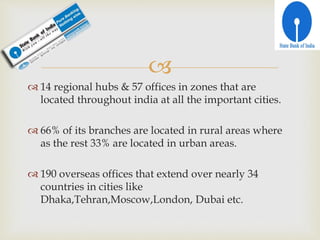

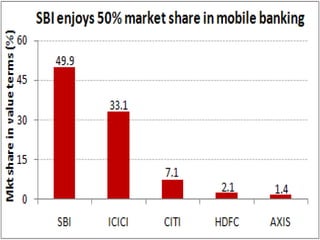

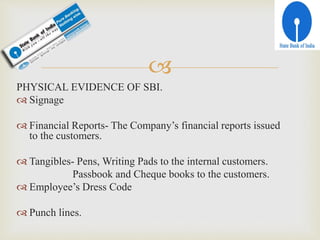

State Bank of India (SBI) is the largest bank in India in terms of assets, deposits, profits, capital, and number of branches. It has over 17,000 branches across India and has a long history dating back to 1806. SBI offers a wide range of banking products and services to both retail and corporate customers through multiple channels including branches, ATMs, internet banking, and mobile banking. It focuses on customer centricity, high service quality, and product innovation in its marketing strategy and positioning in the highly competitive Indian banking sector.