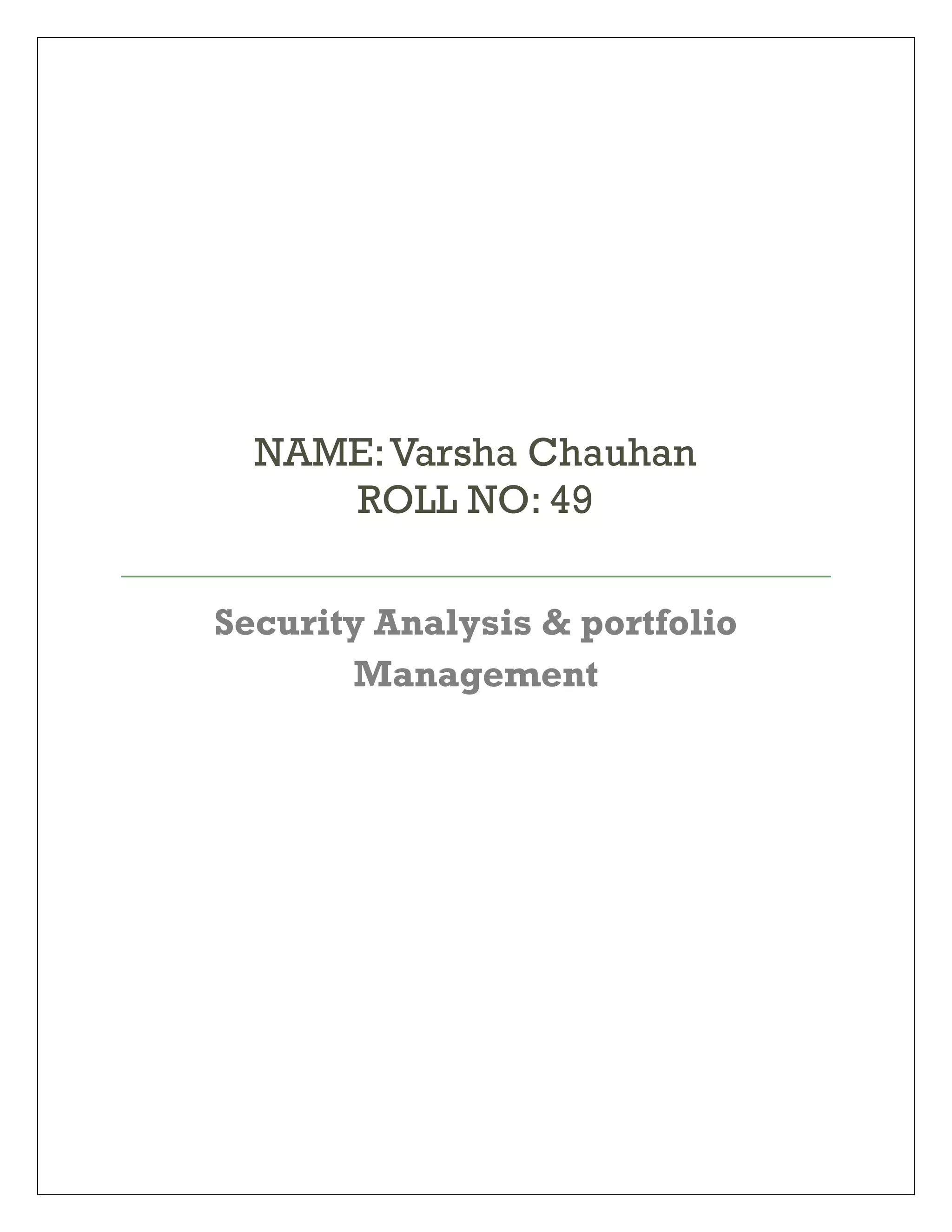

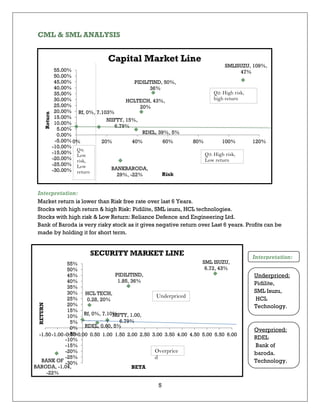

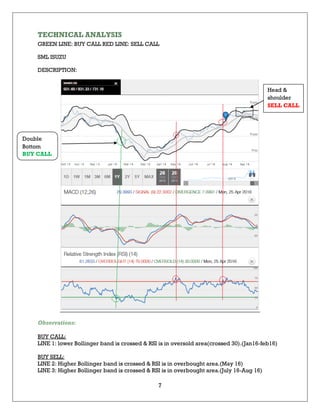

The document analyzes a stock portfolio consisting of five companies, evaluating their risk, return, and overall performance. Specific companies discussed include Bank of Baroda, HCL Technologies, Pidilite, Reliance Defence and Engineering Limited, and SML Isuzu, each showing distinct performance metrics and market conditions. The analysis includes various financial models such as CAPM and Fama & French, ultimately recommending the portfolio due to its positive alpha of 10.30%.