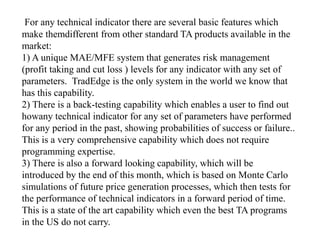

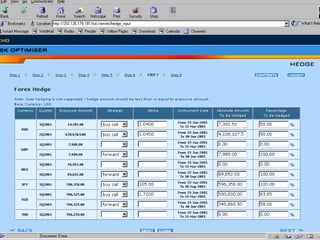

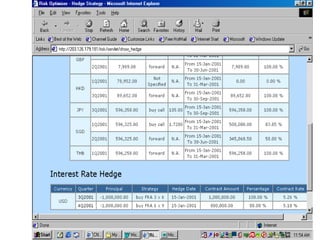

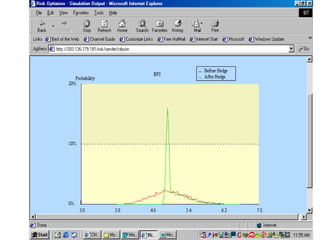

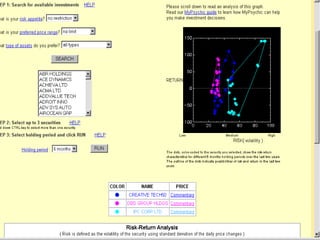

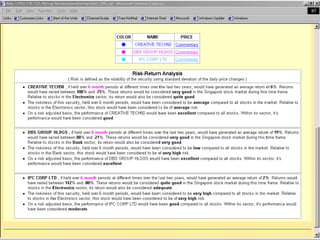

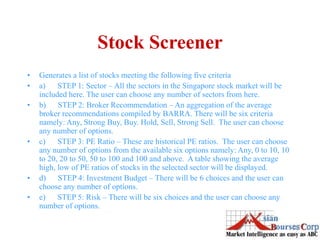

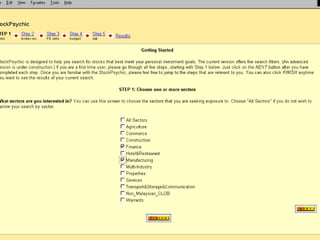

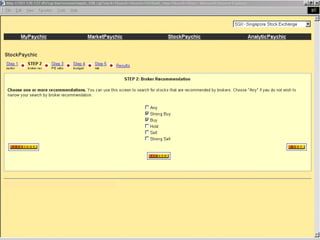

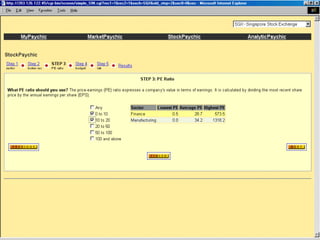

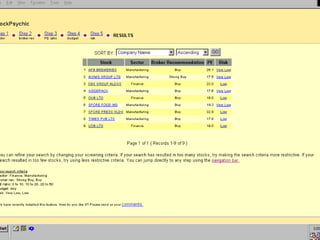

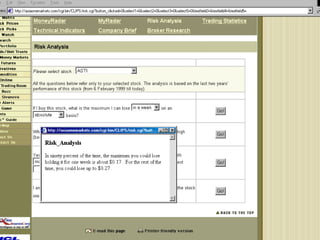

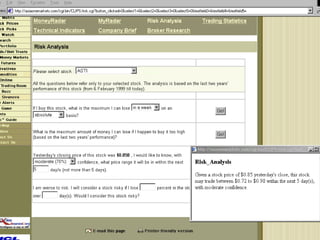

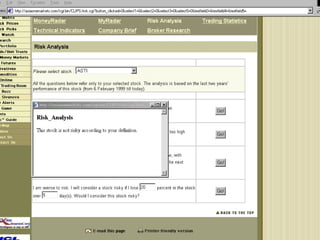

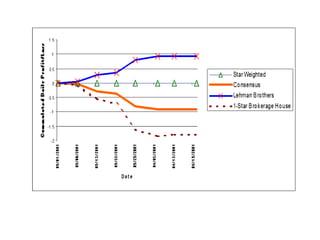

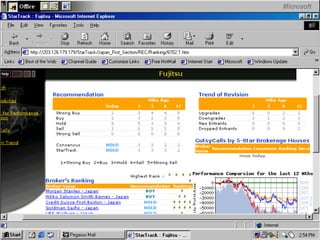

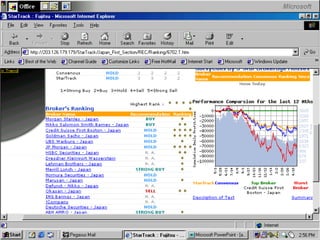

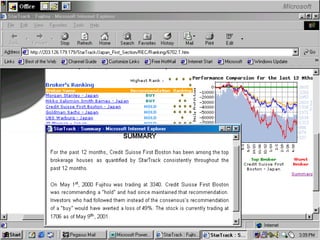

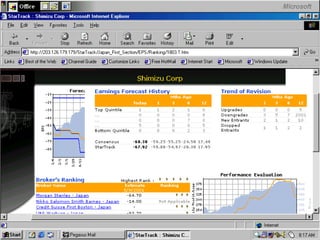

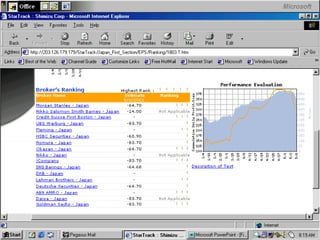

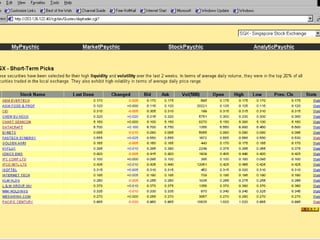

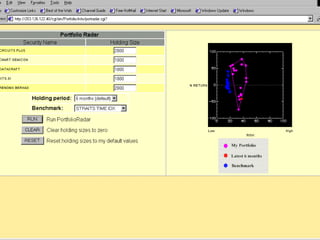

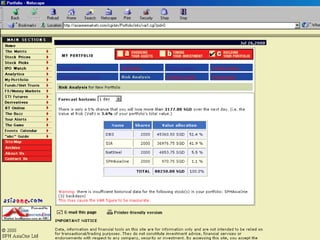

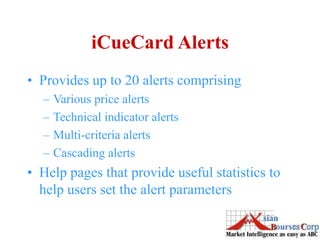

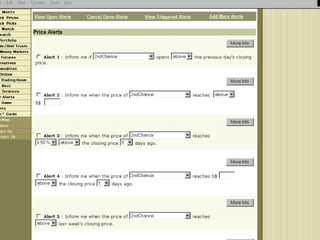

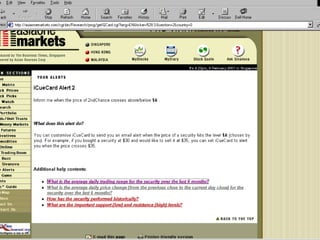

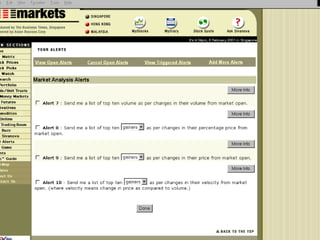

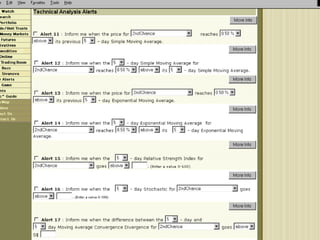

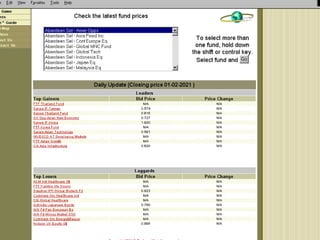

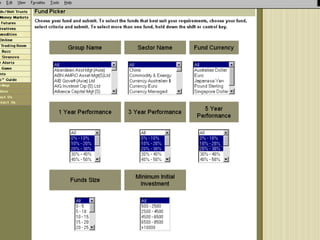

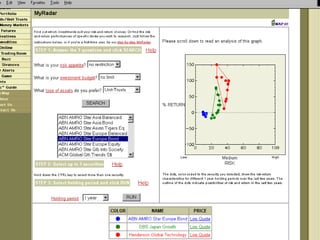

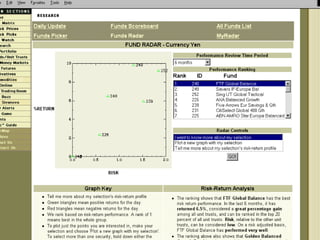

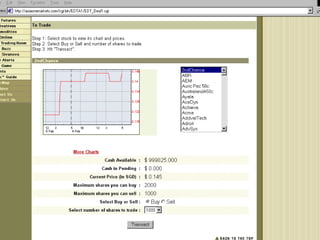

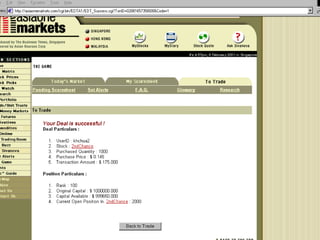

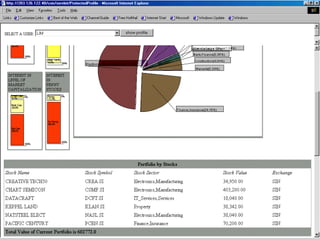

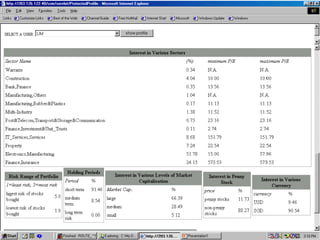

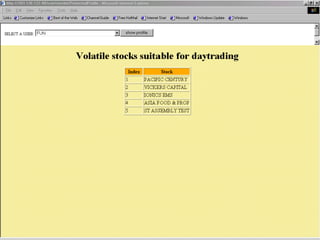

The document outlines a comprehensive suite of online analytics and CRM tools developed by GS Khoo, PhD, for clients involved in trading. Key features include unique risk management systems, back-testing capabilities, automated commentary, and extensive alert systems, aimed at enhancing trading decisions and risk analysis. The tools provide integrated technical and fundamental analysis, historical performance data, and educational resources for users seeking to improve their trading strategies.