This internship project report focuses on investment perception and selection behavior towards the stock market, conducted at Patel Wealth Advisor Pvt Ltd, and supervised by Dr. Bilva Desai Singh. It aims to provide insights into market trends, investment factors affecting investor behavior, and basic information for new investors. The report includes various analyses, including a SWOT analysis of the Indian stock market, along with a detailed overview of stock types and exchanges.

![Page 3 of 75

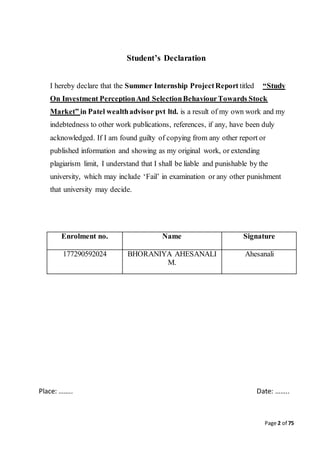

Date:__/__/____

Institute Certificate

“This is to Certify that this Summer Internship ProjectReport Titled “Study On

Investment PerceptionAnd SelectionBehaviourTowards StockMarket” is the

bonafide work of BHORANIYA AHESANALI M. (1777290592024.)who has

carried out his project under my supervision. I also certify further, that to the bestof

my knowledge the work reported herein does not form part of any other project

report or dissertation on the basis of which a degree or award was conferred on an

earlier occasionon this or any other candidate. I have also checkedthe plagiarism

extent of this report which is ……… % and it is below the prescribed limit of

30%. The separate plagiarismreport in the form of pdf file is enclosedwith

this.

Rating of ProjectReport[A/B/C/D/E]: ______

(A=Excellent; B=Good;C=Average; D=Poor;E=Worst)

(By Faculty Guide)

Dr. Bilva Desai Singh

Signature of the Faculty Guide/s

Dr. Siddarth Singh Bist

Signature of Principal/Directorwith Stamp of Institute](https://image.slidesharecdn.com/ahesanalifinal-180812105827/85/Study-on-customer-perception-towards-STOCK-MARKET-3-320.jpg)