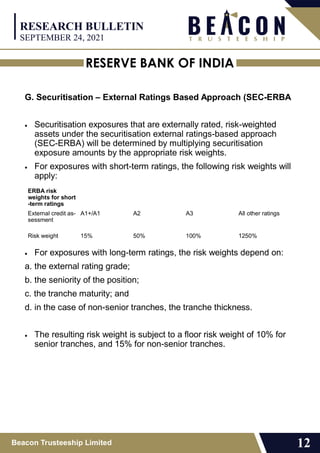

The Reserve Bank of India issued detailed master directions for the securitization of standard assets, covering eligibility criteria, minimum holding periods, minimum retention requirements, and origination standards. Key provisions include the prohibition of certain securitization activities, requirements for special purpose entities, and the need for rigorous due diligence by lenders. The regulations also highlight capital requirements and disclosure obligations for participants involved in securitization transactions.