Embed presentation

Download to read offline

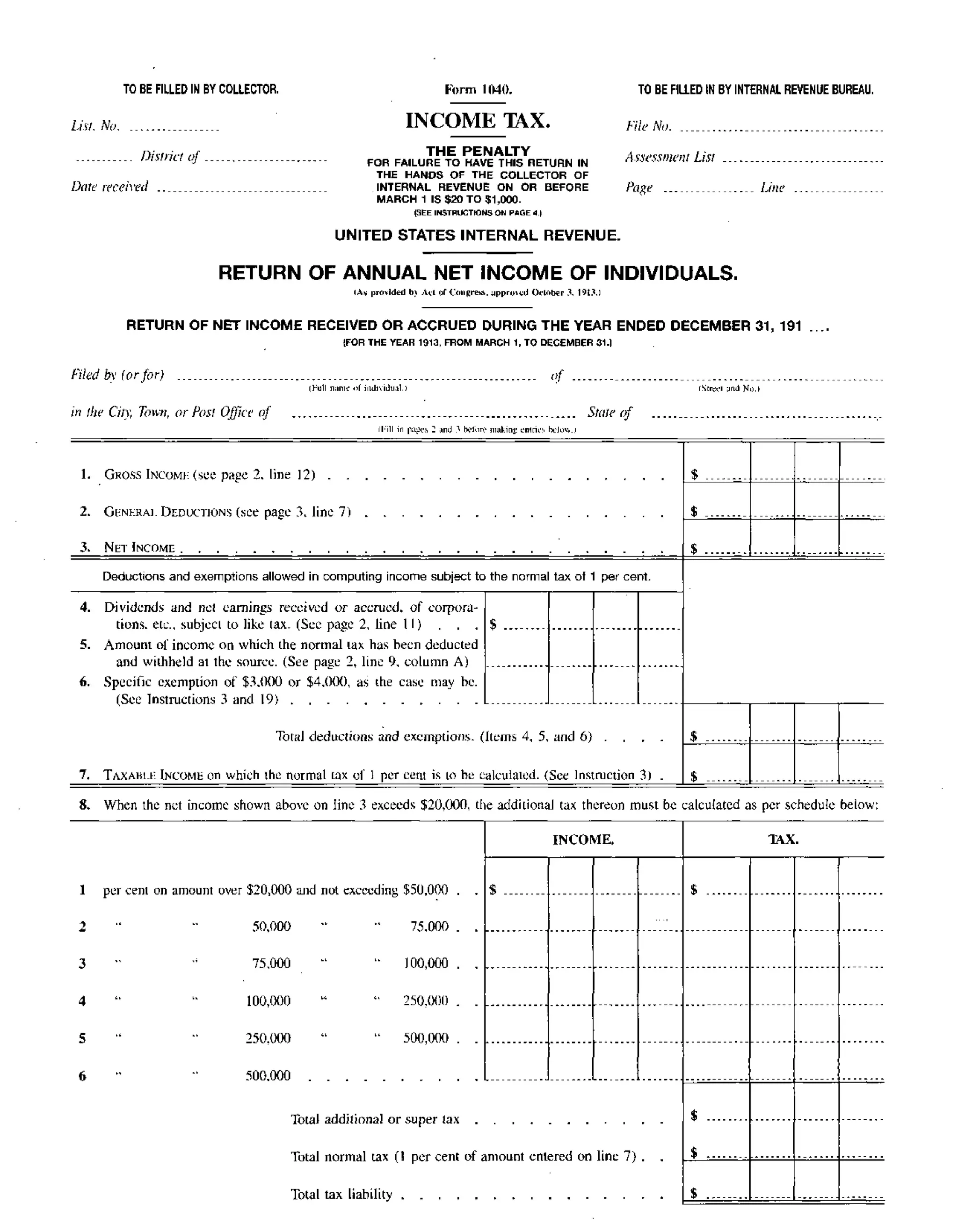

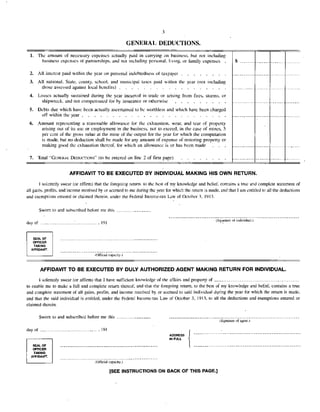

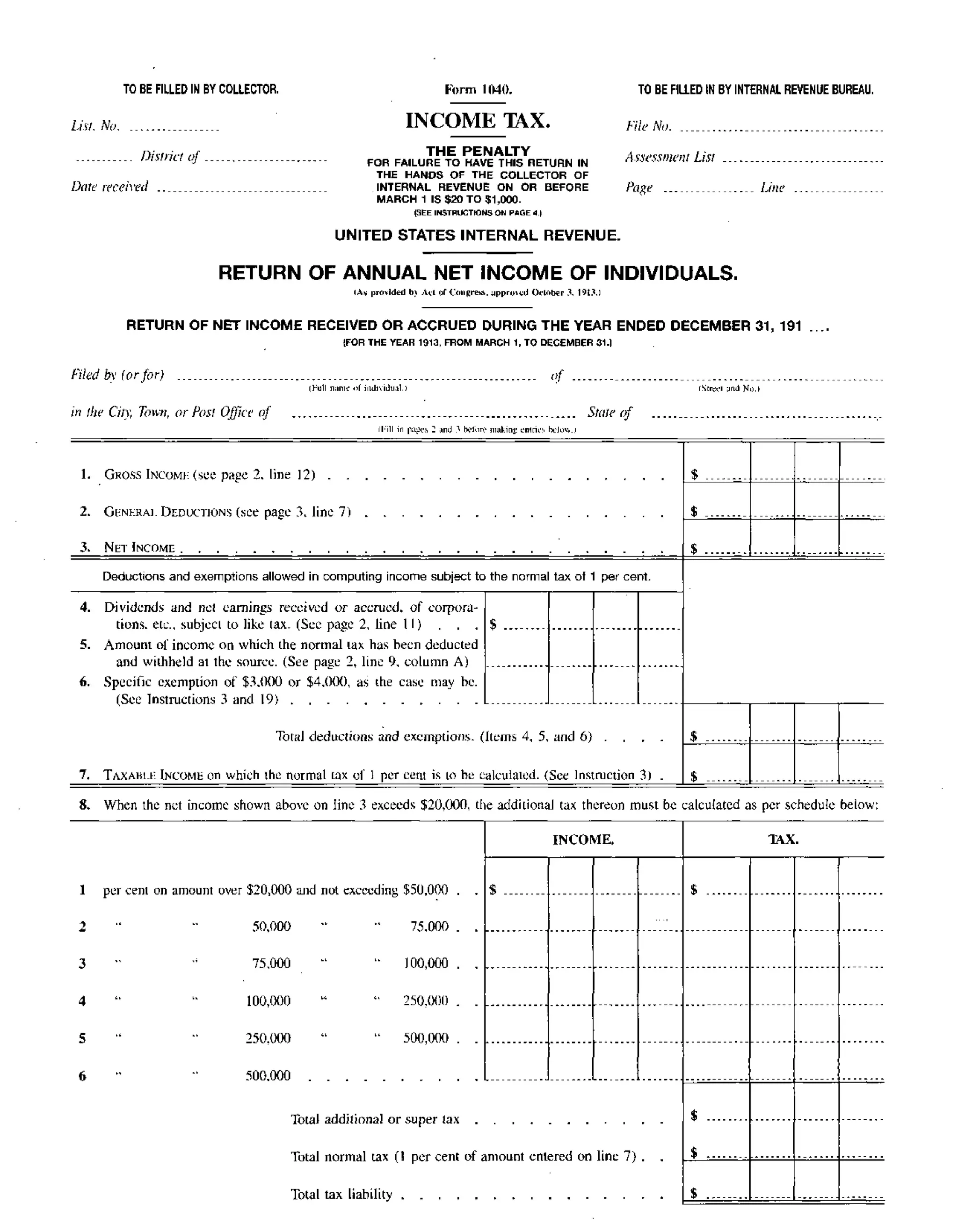

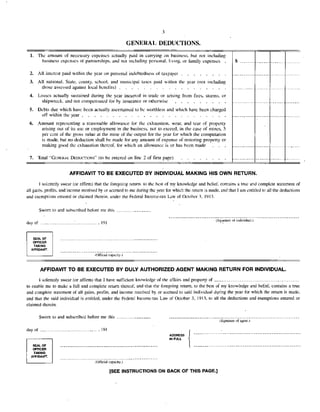

This document is an early 20th century U.S. federal income tax form (Form 1040) from 1913. It contains instructions for reporting various types of individual income, deductions, exemptions, and calculating the tax owed. Key details include reporting gross income, dividends, deductions for expenses, taxes paid, losses, and worthless debts. The form must be filed by March 1st to avoid penalties and includes an affidavit certifying the accuracy of the reported information.