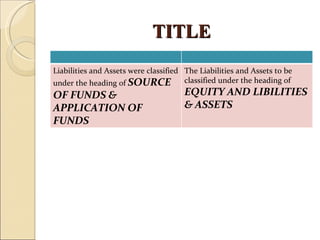

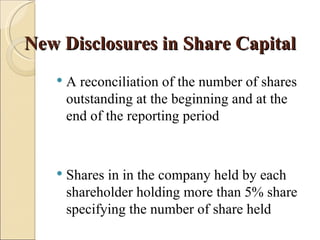

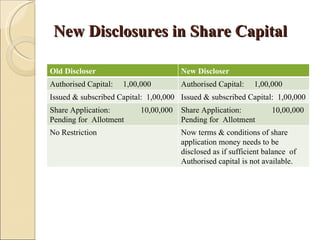

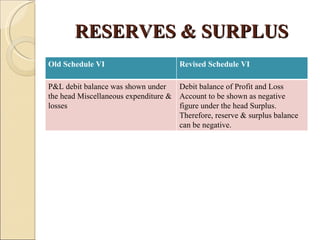

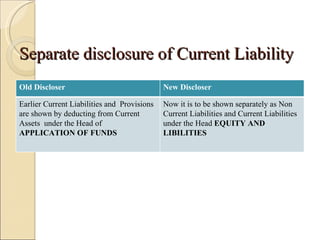

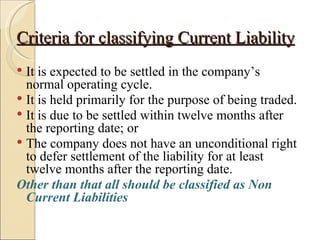

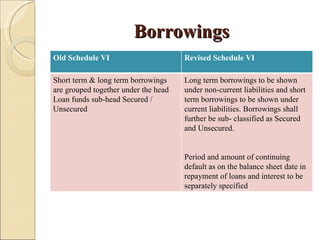

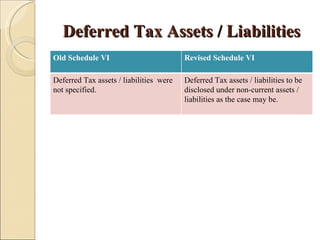

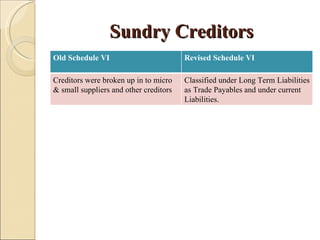

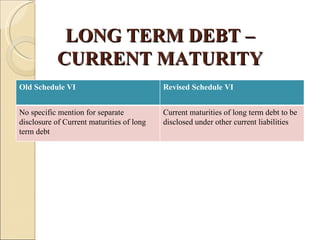

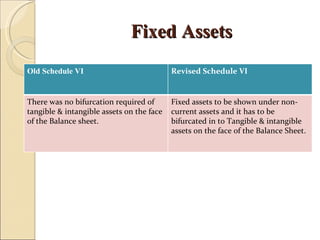

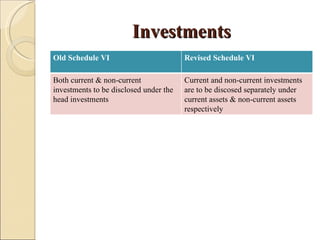

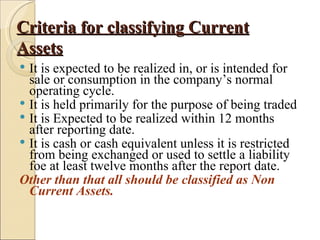

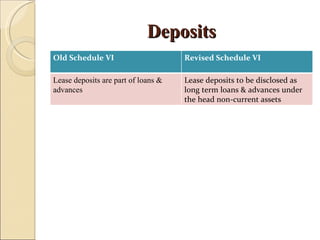

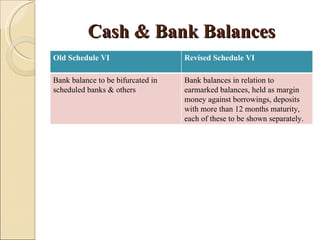

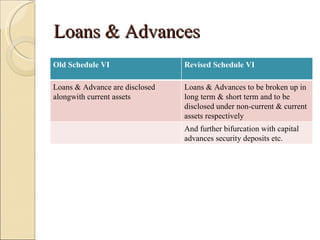

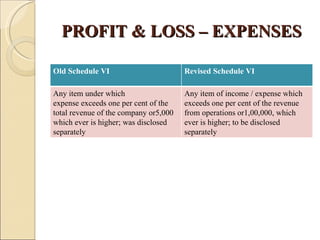

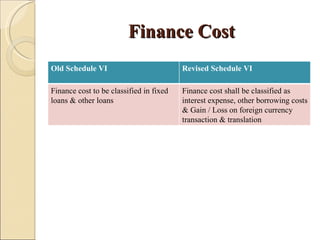

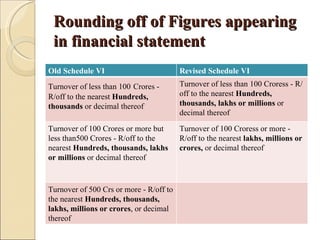

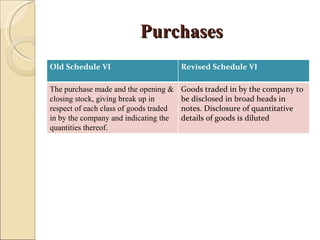

The document outlines key changes made in Schedule VI of the Companies Act regarding the classification and disclosure of items in the balance sheet and profit and loss statement. Some of the major changes include separate disclosure of current and non-current assets/liabilities, further classification of certain items like borrowings, investments, loans and advances, and changes in the rounding off of figures based on company turnover. Specific line items like reserves and surplus, deferred tax, fixed assets are also required to be disclosed differently in the revised Schedule VI.