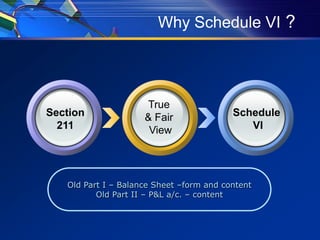

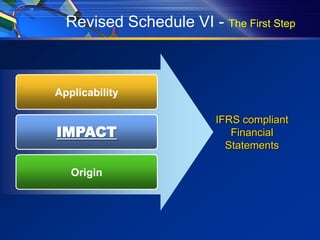

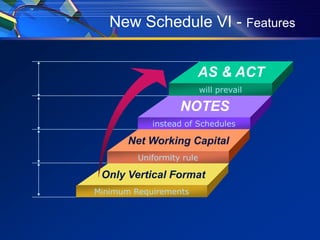

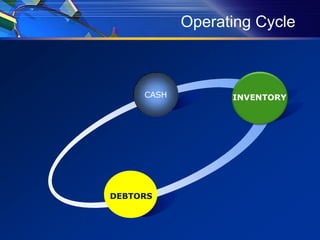

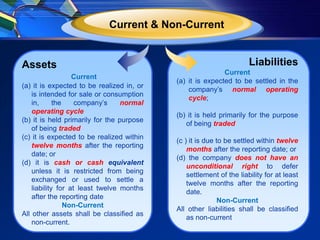

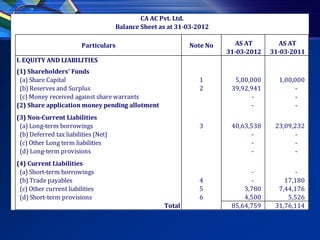

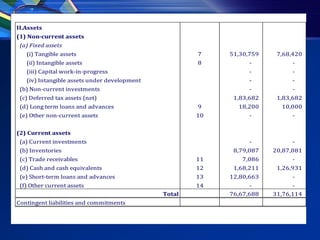

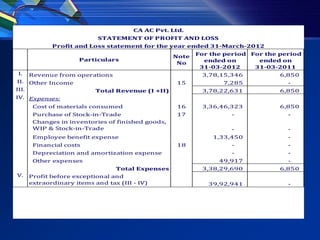

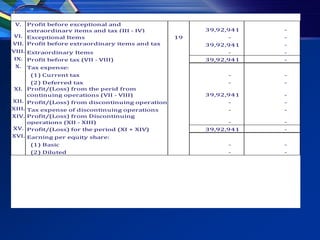

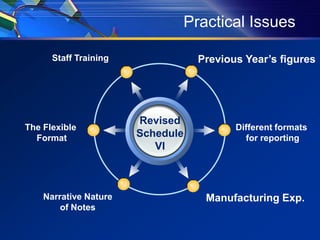

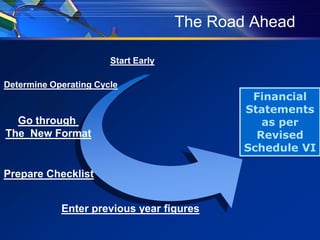

The document discusses the revised Schedule VI under the Companies Act of 1956, highlighting its features and the need for updates due to outdated information and inflexible formats. It presents changes in classifications of assets and liabilities, disclosures, and provides a sample balance sheet and profit & loss statement as per the new requirements. The new schedule aims for greater uniformity and compliance with IFRS standards, along with specific guidance on reporting financial statements.