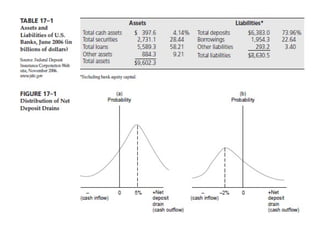

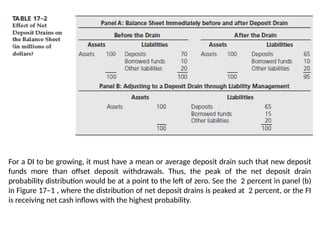

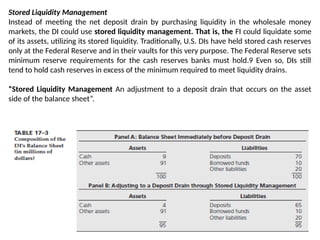

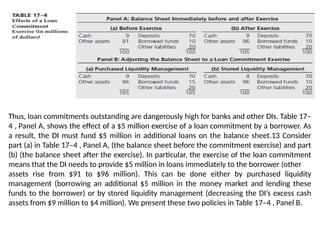

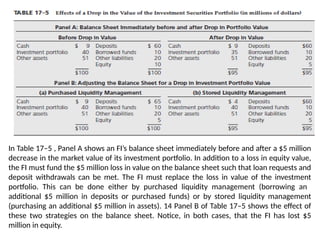

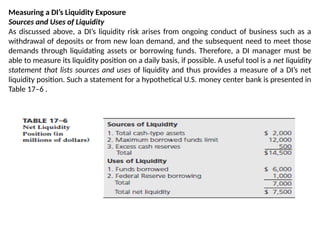

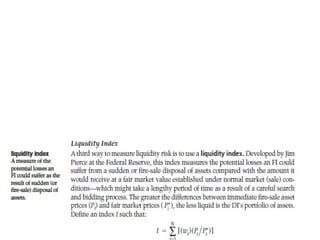

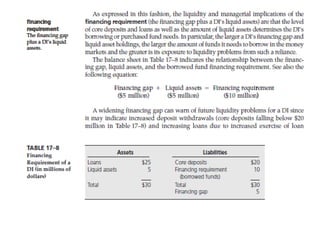

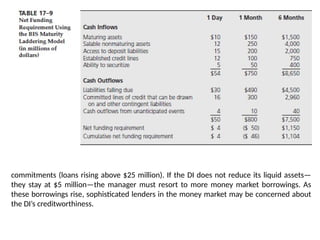

Liquidity risk in financial institutions arises from liability-side issues when depositors demand immediate cash, requiring the institution to liquidate assets or borrow funds, often at unfavorable prices. This risk is managed through purchased and stored liquidity management strategies, which address cash shortfalls either by accessing market funds or utilizing existing cash reserves. Additionally, fluctuations in loan requests can also pose liquidity challenges, necessitating consistent monitoring of liquidity positions and potential adjustment measures.