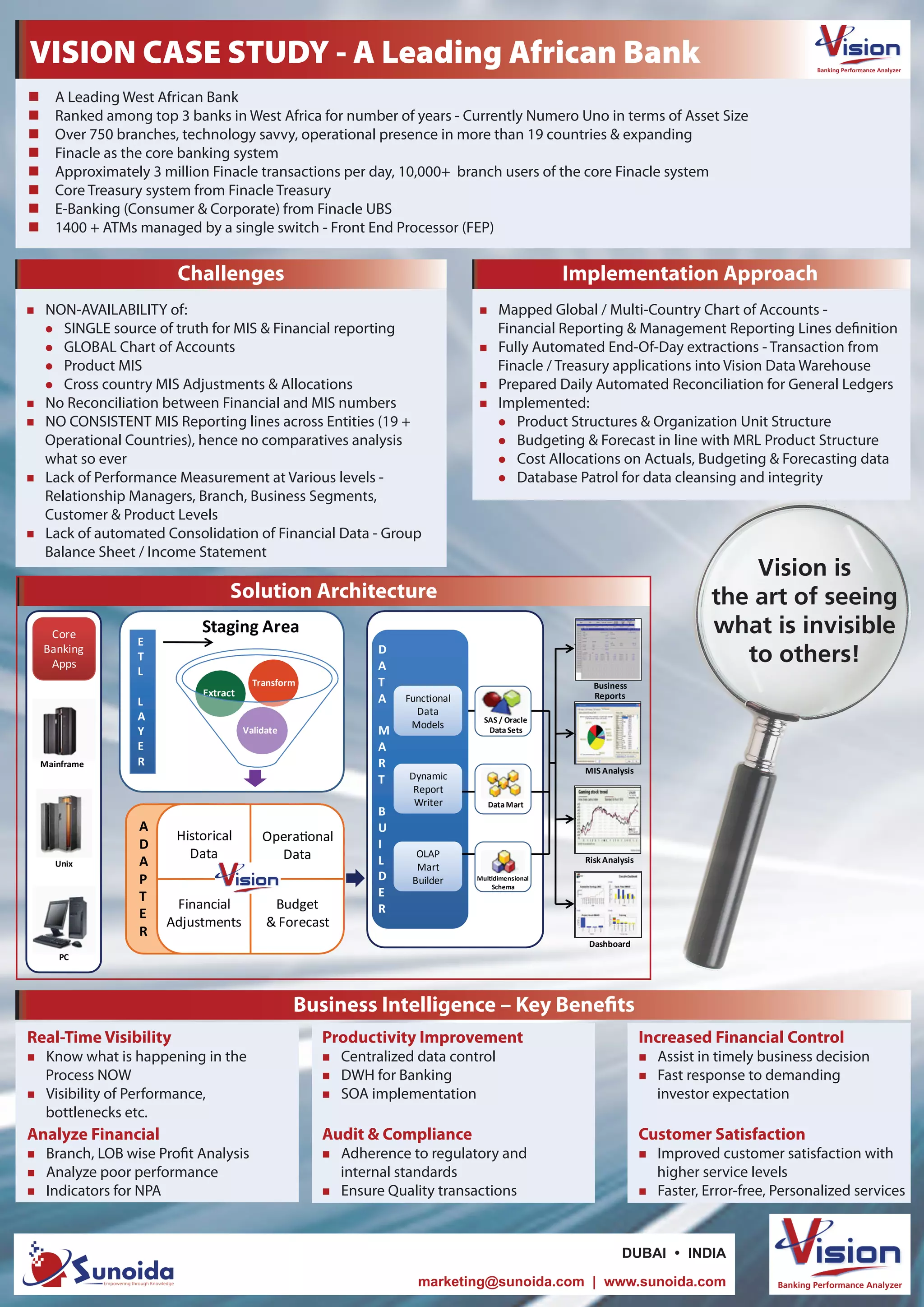

This document describes a case study of a leading West African bank that implemented a business intelligence solution from Vision to address several challenges. The bank has over 750 branches across 19 countries and processes around 3 million transactions per day. Vision was used to create a single source of truth for management information and financial reporting across countries, enable automated data extraction and reconciliation, and provide consistent management reporting lines and performance measurement. The solution architecture extracts transaction data from the bank's core systems into a data warehouse for reporting, analytics, and dashboards to provide real-time visibility, improve productivity, increase financial control, and enhance customer satisfaction.