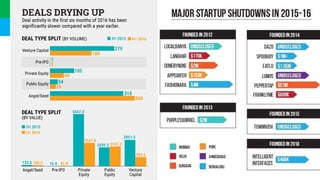

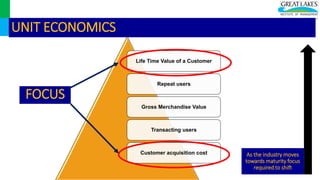

Internet businesses are shifting their focus from cash burn to profitability as the market has become saturated with copycat models. Venture capital activity has slowed and investors are now looking for sustainable business models with a path to profitability. The honeymoon period of raising funding rounds without regard for profits is over, as unit economics and positive cash flow have become priorities in an increasingly competitive market.