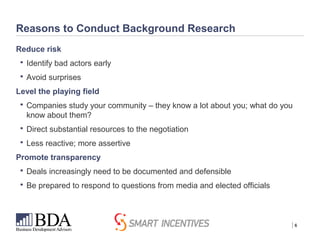

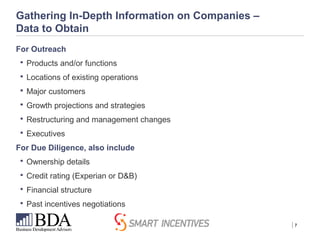

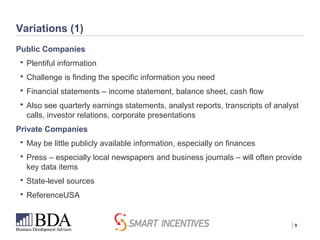

Ellen Harpel presented on using research tools and methods to assess incentive applicants. She discussed how conducting background research on companies can help economic developers 1) reduce risk by identifying problematic companies early, 2) level the playing field by obtaining comparable information to what companies know about the location, and 3) promote transparency. Some key data sources discussed included company websites, SEC filings, press reports, and business directories. The type of company - public, private, small, or international - impacts the level and types of information available.