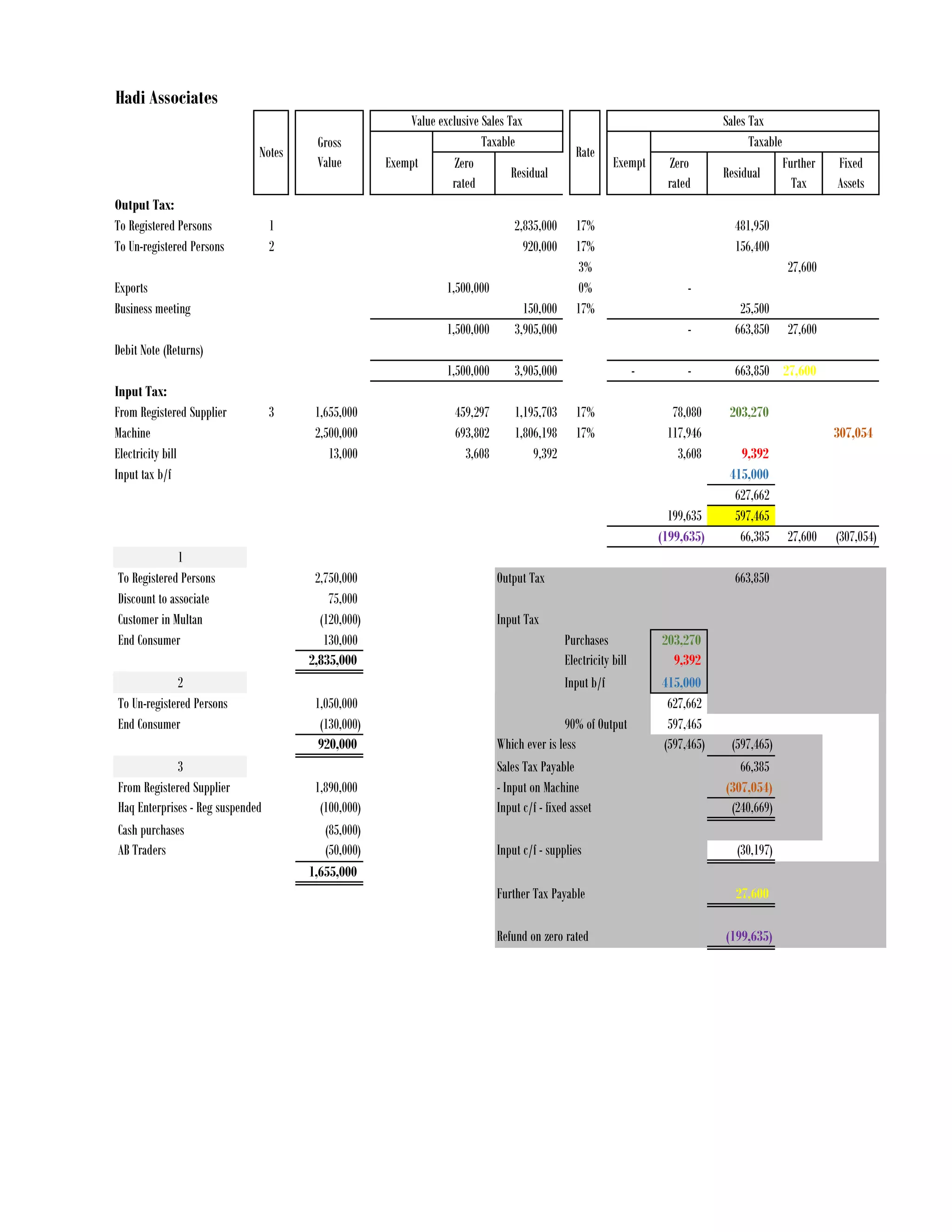

Hadi Associates recorded output tax of PKR 663,850 and input tax of PKR 627,662 for the tax period. After deducting input tax from output tax, the sales tax payable is PKR 66,385. Hadi Associates is also liable to pay further tax of PKR 27,600 for the period.