Advanced taxation (cfap5) by fawad hassan [lecture3]

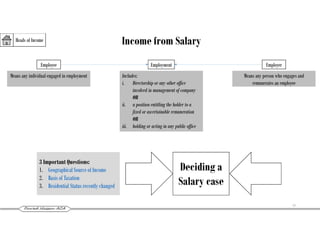

- 1. Income from Salary Employee Employment Employer Means any individual engaged in employment Means any person who engages and remunerates an employee Includes: i. Directorship or any other office involved in management of company OR ii. a position entitling the holder to a fixed or ascertainable remuneration OR iii. holding or acting in any public office 3 Important Questions: 1. Geographical Source of Income 2. Basis of Taxation 3. Residential Status recently changed Heads of Income 61 Deciding a Salary case

- 2. Income from Salary 1. Geographical Source of Income [S-101(1), (11) & (16)] Heads of Income Employment Exercised In Pakistan Outside Pakistan Payment of Salary made In Pakistan PSI FSI Outside Pakistan PSI FSI By or on behalf of FG/PG/LG in Pakistan PSI wherever employment is exercised Salary 62 Pension/Annuity Resident FSI PSI PENRBorn by Paid by

- 3. Income from Salary 2. Basis of Taxation Heads of Income Salary 63 Cash BasisAccrual [S-110] Salary received in current tax year in respect of services rendered in previous Tax Year is taxable on accrual basis. Conditions: (i) Salary is received from a private company (ii) Commissioner of Income Tax is satisfied that the payment of salary was deferred [S-12(7)] Arrears of salary received in tax year caused higher taxation, then tax payer by notice in writing to commissioner tax salary on accrual basis All Other Cases Amount OR Perquisite treated as received [S-12(5)]: as and when it is paid or provided; By (i) Employer (ii) Associate of employer (iii) Any 3rd party under agreement with employer or its associate By (i) Past employer (ii) Perspective employer To (i) Employee (ii) Associate of employee (iii) Any 3rd party under agreement with employee or its associate Receipt of Income [S-69]: Amount/benefit/perquisite treated as received when: (i) Actually received (ii) Applied on behalf/instruction of person OR under any law (iii) Made available to person

- 4. Income from Salary 3. Residential Status Recently Changed Heads of Income Salary 64 Non Resident Resident Geographical Source of Income PSI FSI Residential Status FSI of Resident Foreign Source Salary of Resident [S-102]: Exempt if; - Foreign tax on salary is paid by individual OR - withheld by employer and paid to revenue authority of foreign country Citizen of Pakistan leaves Pakistan [S-51(2)]: If a citizen of Pakistan leaves Pakistan in a Tax Year and remains abroad during that tax year then Salary earned outside Pakistan shall be exempt Returning Expatriate [S- 51(1)]: If resident in a Tax Year but was Non-Resident in preceding 4 Tax Years Then all foreign source income will be exempt in tax year in which tax payer becomes resident and the following tax year Short term Resident [S-50]: FSI will be exempt Conditions: (i) Resident solely by reason of employment (ii) Present in Pakistan for 3 years or less Exceptions: (i) Income from business established in Pakistan (ii) Foreign Source Income brought into or received in Pakistan

- 5. Income from SalaryHeads of Income Salary 65 Deciding a Salary case: 1. Salary Definition 2. Deductions 3. Perquisites/Facilities/Benefits 4. Exemptions

- 6. Income from SalaryHeads of Income Salary 66 Salary [S-12(2)] Means: any amount received by employee from employment whether capital or revenue nature Includes: Perquisites [Section-13] means -items provided by employer in kind OR -cash reimbursed for expenses other than office purpose includes -Services of house keeper, driver, gardener, domestic assistant -Utilities -Any obligation of employee to employer, waived off by employer -Any obligation of employee to another person paid by employer -FMV of property transferred to employee reduced by any payment made by employee Allowances -Cost of Living Allowance -Subsistance Allowance -Rent -Utilities -Education -Entertainment -Travel Allowance; except for official tours -Pay -Wages -Other remuneration -Leave pay -Overtime -Bonus -Commission -Fee -Gratuity -Work condition Supplements Expenditure incurred by employee but paid by employer, other than official purposes Others -Pension, Annuity - Leave encashment -Vehicle wholly or partly for private use -Accommodation -Medical Facility -Interest free loan - Medical Allowance -Profits in lieu of salary -Employee Share Scheme

- 7. Income from SalaryHeads of Income Salary 67 Leave Encashment [2nd Schedule, Part-I, Clause-19]: Encashment of Leave Preparatory to Retirement Of (i) Government Employee (ii) Member of Armed Forces Exempt from Tax Definition

- 8. Income from SalaryHeads of Income Salary 68 Valuation of Conveyance [Rule-5]: Taxable Vehicle leased by employerVehicle owned by employer Official Use only Official & Personal use Personal Use only Usage Not Taxable 5% of FMV at commencement of lease5% of cost of vehicle 10% of FMV at commencement of lease10% of cost of vehicle Definition

- 9. Income from SalaryHeads of Income Salary 69 Valuation of Accommodation [Rule-4]: Amount that would have been paid if accommodation was not provided 45% of MTS/Basic Salary Higher TaxableTaxable Accommodation provided in mufasal areas shall be taxable at 30% of MTS/Basic Salary Definition

- 10. Income from SalaryHeads of Income Salary 70 Medical Allowance [2nd Sched, P-I, Clause 139]: BothMedical Facility/Reimbursement Not in accordance with terms of employment In accordance with terms of employment Medical Allowance Medical Allowance >>>>exempt upto 10% of Basic Salary Medical Facility>>>>>>totally taxable Taxable Medical Allowance >>>>Totally Taxable Medical Facility>>>>>>totally exempt if following conditions are met (i) Provide NTN of medical practitioner (ii) Attestation of expense by employer Totally exempt if following conditions are met: (i) Provide NTN of medical practitioner (ii) Attestation of expense by employer Exempt upto 10% of Basic Salary Definition

- 11. Income from SalaryHeads of Income Salary 71 Interest Free Loan [S-13(7) (8) & (14)]: Loan from employer @ benchmark rate or more Markup charged? Markup @ benchmark rate Included in Taxable Income Markup @ benchmark rate – Markup charged by employer Included in Taxable Income Nothing Taxable NoYes Yes Above is not applicable on loan upto Rs 500,000/- OR Where such benefit is extended by the employer due to waiver of interest by such employee on his accounts maintained with the employer. No X (X) X If loan is utilized by employee to acquire any asset Then employee shall be treated as having been paid markup @ benchmark rate or actual markup paid, which ever is higher. Definition

- 12. Income from SalaryHeads of Income Salary 72 Profits in lieu of salary [S-12(2)(e)] (i) Payment of Employer's Contribution from provident fund (ii) Amount on termination of employment, whether voluntary basis or under an agreement (iii) Compensation for redundancy or loss of employment (e.g., Golden Hand Shake) (iv) Consideration for employee's agreement to : • enter into employment agreement • accept changes to conditions of employment • a restrictive covenant to any past, present or future employment Includes: [S-12(6)] Tax payer has option to get it taxed @ last 3 years average rate of tax Last 3 year’s taxable income Last 3 year’s tax liability =Average rate of tax Definition

- 13. Income from SalaryHeads of Income Salary 73 Employee Share Scheme [S-14] Option/Right Acquired Shares disposed off Shares acquired without any restriction on transfer OR restriction removed afterwards Shares acquired with restriction on transfer Exercised Option/Right & Shares received Taxable under salary Consideration - Cost Paid Option/Right Disposed Off Nothing Taxable X (X) X FMV - Consideration paid to acquire shares X (X) X Taxable under salary Taxable under Capital Gains Disposal value - Consideration paid to acquire option & share - Amount previously included in Taxable income X (X) (X) X Nothing Taxable Definition

- 14. Income from SalaryHeads of Income Salary 74 Deductions: Section 12(4): No deduction shall be allowed for any expense incurred by employee in deriving salary income.

- 15. Income from SalaryHeads of Income Salary 75 Perquisites/Facilities/Benefits: 1. Pension 2. Commutation of Pension 3. Gratuity & Commutation of Pension 4. Provident Fund 5. Tax on Salary Born by Employer 6. Services provided by employer to employee 7. Utilities 8. Obligation of employee waived by employer 9. Obligation of employee to 3rd party, paid by employer 10. Property or service provided to employee 11. Any other perquisite 12. Self Hiring of Property 13. Superannuation Fund 14. Benevolent Fund

- 16. Income from SalaryHeads of Income Salary 76 Perquisites/Facilities/Benefits: 1. Pension [2nd Sched, Pt-I, Cl (8)&(9)] Member of Armed Force Employee of FG/PG Totally Exempt Others Age>60 Totally Exempt Works for same employer or its associate Taxable More than 1 pension Totally Exempt Higher amount is exemptYes No YesNo YesNo Perks

- 17. Income from SalaryHeads of Income Salary 77 Perquisites/Facilities/Benefits: 2. Commutation of Pension [2nd Sched, Pt-I, Cl (12)] Received from Government OR Received from Scheme approved by FBR Totally Exempt Perks

- 18. Income from SalaryHeads of Income Salary 78 Perquisites/Facilities/Benefits: 3. Gratuity and Commutation of Pension [2nd Sched, Pt-I, Cl (13)] Rs 75,000/- OR 50% of amount (Which ever is less is exempt) Exempt upto Rs 300,000/-Totally Exempt Un-approved Gratuity OR Un-approved Commutation Gratuity & Commutation Scheme Approved by FBR Government Employee OR Approved Gratuity Fund by CIT under 6th Schedule Exemption not available to following: (i) Payment not received in Pakistan (ii) Payment received by Director of Company who is not employee of company (iii) Payment received by Non Resident (iv) Gratuity received by employee who has already received gratuity from same or another employer Perks

- 19. Income from SalaryHeads of Income Salary 79 Perquisites/Facilities/Benefits: 4. Provident Fund [2nd Sched, Pt-I, Cl (23)] & [6th Sched, Pt-I, Cl (3), (4) & (5)] Already taxed in salary, therefore no treatment Employee Contribution Govt. PF Already taxed in salary, therefore no treatment Already taxed in salary, therefore no treatment Un-recognized PFRecognized PF ExemptEmployer Contribution No treatment when contribution is made Rs 150,000 OR 10% of (Basic Salary + Dearness Allowance) (Lesser is exempt) Exempt Returns credited during year Return @ 16% OR 1/3rd of (Basic Salary + Dearness Allowance) (Higher is exempt) ExemptAccumulated Balance Paid No treatment when returns are credited Exempt Only employee’s contribution is exempt All other sums are taxable Note: Dearness Allowance is a type of Cost of Living Allowance Perks

- 20. Income from SalaryHeads of Income Salary 80 Perquisites/Facilities/Benefits: 5. Tax on Salary Born by Employer [S-12(3)] Amount of salary income shall be grossed up by amount of tax payable by employer. Q. Mr. A has received taxable salary and allowances amounting to Rs 1,810,000 during tax year 2017. You are required to calculate his taxable income and tax payable under each of following situations: (i) 100% tax is to be borne by employer (ii) 40% of tax is to be borne by employer and balance to be borne by Mr. A (iii) Rs 50,000 is to be borne by employer and balance to be borne by Mr. A (iv) Mr. A shall pay only Rs 50,000 as tax and balance tax to be borne by employer Perks

- 21. Income from SalaryHeads of Income Salary 81 Perquisites/Facilities/Benefits: 6. Services provided by employer to employee [S-13(5)] House keeper Gardner Driver Other domestic assistant Less: payment by employee to employer for these services Salary paid to them by employer X (X) X Taxable Perks

- 22. Income from SalaryHeads of Income Salary 82 Perquisites/Facilities/Benefits: 7. Utilities [S-13(6)] Electricity Gas Water Telephone Less: payment by employee to employer for these utilities Fair Market Value of utilities X (X) X Taxable Perks

- 23. Income from SalaryHeads of Income Salary 83 Perquisites/Facilities/Benefits: 8. Obligation of employee waived by employer [S-13(9)] Waived Amount Taxable 9. Obligation of employee payable to 3rd party paid by employer [S-13(10)] Paid Amount Taxable 10. Property or service provided to employee [S-13(11)] Less: payment by employee to employer Fair Market Value X (X) X Taxable Perks

- 24. Income from SalaryHeads of Income Salary 84 Perquisites/Facilities/Benefits: 11. Any other perquisite [S-13(13)] Less: payment by employee to employer for perquisite Fair MV of perquisite X (X) X Taxable Perks

- 25. Income from SalaryHeads of Income Salary 85 Perquisites/Facilities/Benefits: 12. Self Hiring of Property [S-15(5)] "Income from Salary" shall include value of accommodation in accordance with Rule-4 "Income from Property" shall include rent income in accordance with Section-15(4)&(5) Perks

- 26. Income from SalaryHeads of Income Salary 86 Perquisites/Facilities/Benefits: 13. Superannuation Fund approved by Commissioner in accordance with Part-II of 6th Schedule [Cl-4-6] & 2nd Sched, P-I, Cl-25 : Employer’s Contribution During life time other than above In lieu of annuity On deathPayment out of fund: Taxable Exempt Interest Credited Perks

- 27. Income from SalaryHeads of Income Salary 87 Perquisites/Facilities/Benefits: 14. Benevolent Fund [2nd Sched, P-I, Cl-24] Any payment in accordance with "Central Employee Benevolent Fund & Group Insurance Act 1969" Exempt Perks

- 28. Income from SalaryHeads of Income Salary 88 Exemptions: 1. Foreign Government Officials 2. Diplomatic & United Nations Exemptions 3. International Agreements 4. Perquisites without Marginal Cost to Employer 5. Special Allowance 6. Workers’ Participation Fund 7. Salary income of seafarer 8. Allowances to persons working outside Pakistan 9. Full Time teacher/researcher

- 29. Income from SalaryHeads of Income Salary 89 Exemptions: 1. Foreign Government Officials [S-43] Salary of foreign government employee shall be exempt from tax if: (i) employee is citizen of foreign country and not citizen of Pakistan (ii) services performed are similar to those performed by employees of Federal Government in foreign countries (iii) foreign government grants similar exemption to employees of the Federal Government performing similar services in such foreign country

- 30. Income from SalaryHeads of Income Salary 90 Exemptions: 2. Diplomatic & United Nations Exemptions [S-42] Following shall be exempt from tax: (i) Individuals entitled to privileges under the Diplomatic and Consular Privileges Act, 1972 (ii) Individuals entitled to privileges under the United Nations (Privileges and Immunities) Act, 1948 (iii) Pension received by citizen of Pakistan due to former employment in the United Nations or its specialized agencies, if the person’s salary from such employment was exempt under this Ordinance

- 31. Income from SalaryHeads of Income Salary 91 Exemptions: 3. Exemption under International Agreements [S-44] If Pakistan is not permitted to tax an income under TAX TREATY, it will be exempt from tax Salary received under an AID AGREEMENT is exempt from tax subject to following conditions: (i) Salary received by individual, who is not citizen of Pakistan (ii) Exemption will be to the extent provided in AID AGREEMENT (iii) AID AGREEMENT is between FG≈Fr.G FG ≈PIO (iv) Individual is not resident OR Is resident solely for performance of service under AID AGREEMENT (v) In case AID AGREEMENT is with Foreign Govt. then individual should be citizen of that country (vi) Salary is paid out of funds released to Pakistan under AID AGREEMENT Any income under a bilateral or multilateral technical assistance AGREEMENT is exempt from tax subject to following conditions:: (i) Income is received by person, who is not citizen of Pakistan (ii) Person is engaged as a contractor, consultant, or expert on a project in Pakistan (iii) Exemption will be to the extent provided in AGREEMENT (iv) AGREEMENT is between FG≈Fr.G FG ≈PIO (v) Project is financed out of funds released in accordance with AGREEMENT (vi) Person is not resident OR Is resident solely for performance of service under AGREEMENT (vii) Income is paid out of funds under AGREEMENT

- 32. Income from SalaryHeads of Income Salary 92 Exemptions: 4. Perquisites without Marginal Cost to Employer [2nd Sched, P-I, Cl-53A] Hospital/ClinicEducational InstitutionHotel/Restaurant Any other notified by FBR Free/subsidized Medical Treatment Free/subsidized education Free/subsidized food during duty hours Totally Exempt

- 33. Income from SalaryHeads of Income Salary 93 Exemptions: 5. Special Allowance [2nd Sched, P-I, Cl-39] Any allowance, other than Conveyance and Entertainment Allowance, specially granted to meet expenses wholly and necessarily incurred in performance of office duties Exempt

- 34. Income from SalaryHeads of Income Salary 94 Exemptions: 6. Workers’ Participation Fund [2nd Sched, P-I, Cl-26] Amount received as worker, out of Workers' Participation Fund Exempt

- 35. Income from SalaryHeads of Income Salary 95 Exemptions: 7. Salary Income of Seafarer [2nd Sched, P-I, Cl-4] Salary income shall be exempt if Pakistani seafarer is on Pakistan flag vessel for 183 days or more on vessel Foreign vessel No limit of number of days Following conditions required for exemption: (i) Income remitted to Pakistan (ii) through normal banking channel (iii) within 2 months of relevant tax year

- 36. Income from SalaryHeads of Income Salary 96 Exemptions: 8. Allowance to person working outside Pakistan [2nd Sched, P-I, Cl-5] Allowance from Govt of Pakistan to a citizen of Pakistan for rendering services outside Pakistan Exempt

- 37. Income from SalaryHeads of Income Salary 97 Exemptions: 9. Full Time teacher/researcher [2nd Sched, P-III, Cl-1(2)] Tax payable in salary shall be reduced by 40% if following conditions are fulfilled: (i) The individual is Full time teacher/researcher (ii) in non-profit education/research institution, duly recognized by a. Higher Education Commission (HEC) b. Board of Education c. University recognized by HEC (iii) including in any Government training/research institute

- 38. Income from Property Owner/Landlord Property Land/Building Tenant Rent means: Amount received/receivable By owner of land/building As consideration to use/occupy OR right to use/occupy the land/building Rent includes: Forfeited deposit on contract for sale of land/building [S-15(1)&(2)] 2 Important Questions: 1. Geographical Source of Income 2. Basis of Taxation Heads of Income 98 Deciding a Property Income case Accrual Basis

- 39. Income from Property 1. Geographical Source of Income [S-101(9) & (10)] Heads of Income Property 99 Immovable Property situated in Pakistan Right to explore natural resources in Pakistan Rental Income shall be Pakistan Source Income Gain on disposal of above property or right shall also be Pakistan Source Income

- 40. Income from Property Deciding Income from Property Case: Heads of Income Property 100 Individual Company Tax shall be imposed on these persons on Gross Rent Income @ 1st Sched, P-I, Div-VIA Except following: (i) Individual/AOP (ii) having no taxable income under any other head & (iii) Taxable Property Income is upto Rs 200,000/- [S-15(6) & (7)] Income from Property derived by Company shall be taxable under "Normal Tax Regime” Rental income shall be reduced by allowable expenses, detailed in Section-15A, and remaining amount shall by included in taxable income under Normal Tax Regime AOP Rent

- 41. Income from Property Deciding Income from Property Case: Heads of Income Property 101 Rent i. 1/10th of advance will be treated as Rent in • TY of receipt & • 9 subsequent TYs ii. Nothing will be included in taxable income, in the tax year in which such advance is refunded iii. If tenancy is terminated before 10 years and previous advance is returned and new advance is received then: 1/10th of advance will be treated as Rent in • TY of receipt & • 9 subsequent Tys NON-ADJUSTABLE Advance (Building) [S-16] automatically included in taxable income because of accrual basis of taxation Advance ADJUSTABLE against Rent Taxable on accrual basis Rent Amount of new advance - Amount charged to tax earlier X X (X)

- 42. Income from Property Deciding Income from Property Case: Heads of Income Property 102 Rent [S-15], [S-39] & [S-66] Important !! (i) Rent received/receivable OR Fair Market Rent, which ever is higher, is taxable [S-15(4)] (ii) Above is not applicable if Fair Market Rent has already been included in salary income due to self hiring of property [S-15(5)] (iii) Following amounts shall be included in taxable income under the heads of income mentioned thereagainst; • Ground Rent • Rental income from sub-lease of land or building • Rental income from lease of building, together with Plant & Machinery • Amount of amenities, utilities, other services connected with renting • Amount received as consideration for vacating possession of building (iv) When a property is owned by two or more persons & their share is definite and ascertainable then Persons shall not be treated as AOP Share of each person's income from property shall be taxed separately Income from Other sources [S-39(1)(d)] [S-39(1)(e)] [S-39(1)(f)] & [S-15(3)] [S-39(1)(fa)] & [S-15(3A)] [S-39(1)(k)]

- 43. Income from Property Deciding Income from Property Case: Heads of Income Property 103 Allowable Deductions [S-15A] i. Building Repair Allowance ii. Insurance Premium iii. Rates, tax, charge, cess not being Income Tax iv. Ground Rent v. Markup on loan to acquire, construct, renovate, extend, reconstruct property vi. HBFC Loan / Scheduled Bank Loan on scheme based on sharing rent (share in rent+share in appreciation in value) vii. Markup on mortgages/charges 1/5th of rent chargeable to tax Paid/Payable Paid/Payable Paid/Payable Paid/Payable Paid/Payable Paid/Payable

- 44. Income from Property Deciding Income from Property Case: Heads of Income Property 104 Allowable Deductions [S-15A] viii. Expenses wholly & exclusively for deriving rent including administrative and collection charges ix. Legal Charges x. Irrecoverable Rent xi. Inadmissible deductions [S-21] • Paid/Payable • maximum upto 6% of rent chargeable to tax • must be paid within 3 subsequent tax years • otherwise will be included in taxable income in 4th subsequent tax year • if unpaid amount which is included in taxable income, as above, is subsequently paid, then it will be allowed as deduction in tax year in which it is paid Paid/Payable (to defend title of property or defend any suit connected with property in a court) Conditions: i. Tenancy was bonafide ii. defaulting tenant has vacated property OR steps have been taken to compel tenant to vacate property iii. defaulting tenant is not occupying any other property of same person iv. person has taken all legal steps for recovery OR reasonable grounds exist that legal proceedings will be useless v. rent was previously included in taxable income and tax was duly paid (if irrecoverable rent is subsequently recovered, then it will be included in taxable income in tax year of recovery) will be studied in "Income from Business"