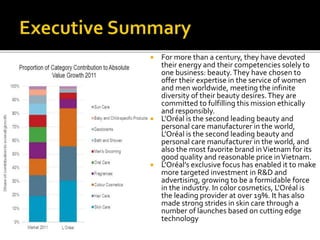

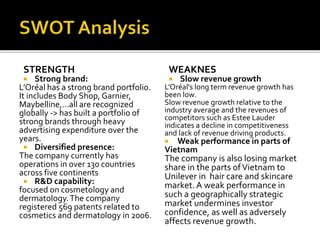

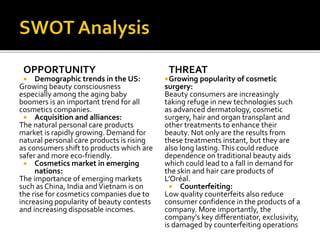

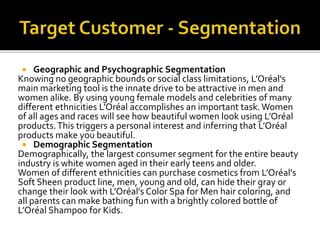

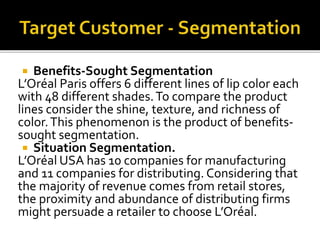

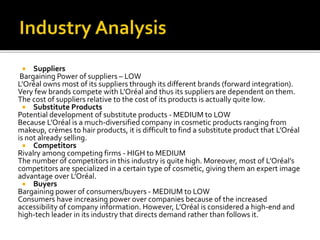

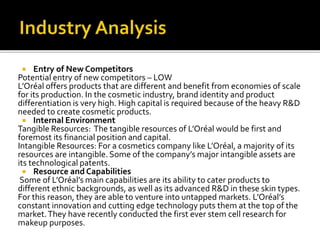

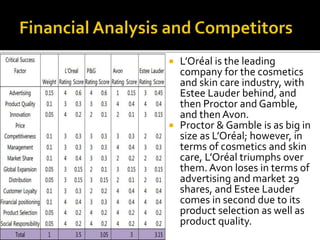

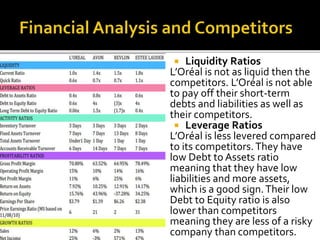

The document outlines L'Oréal's sales plan. It discusses L'Oréal's mission of offering beauty to all through ethical and responsible means. It analyzes L'Oréal's strengths in strong brands, diversified presence, and R&D capabilities, as well as weaknesses like slow revenue growth. The plan examines opportunities in demographic trends, acquisitions, and emerging markets, alongside threats such as cosmetic surgery and counterfeiting. Finally, it focuses on the Asian market, specifically China, India, and Vietnam, as key growth drivers over the next two decades.