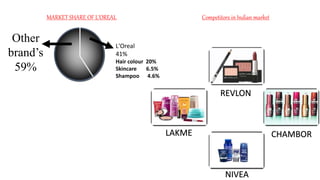

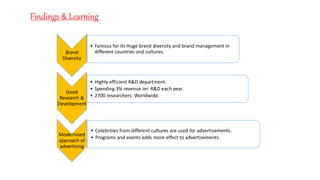

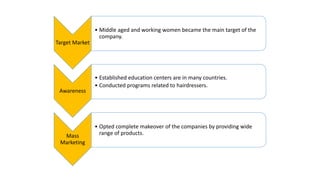

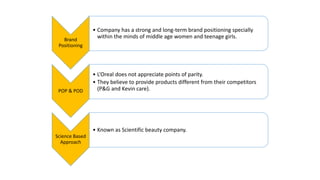

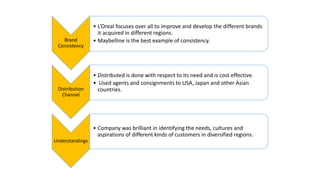

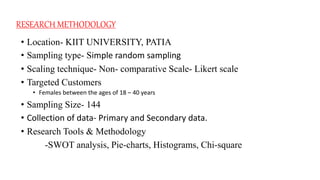

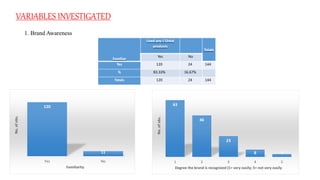

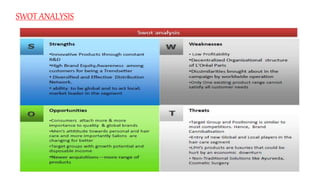

The history of L'Oreal began in 1907 when a French chemist developed a colour formula and registered his own company. Over time, L'Oreal grew significantly and became a global leader in cosmetics. Today, L'Oreal has a 41% market share in India, competing against brands like Lakme, Revlon, and Nivea. L'Oreal targets various consumer segments in India like women seeking hair solutions and employs celebrities in its advertisements. The research analyzed L'Oreal's brand awareness, attitudes, and value among Indian women to understand how to strengthen emotional connections and better target older age groups.