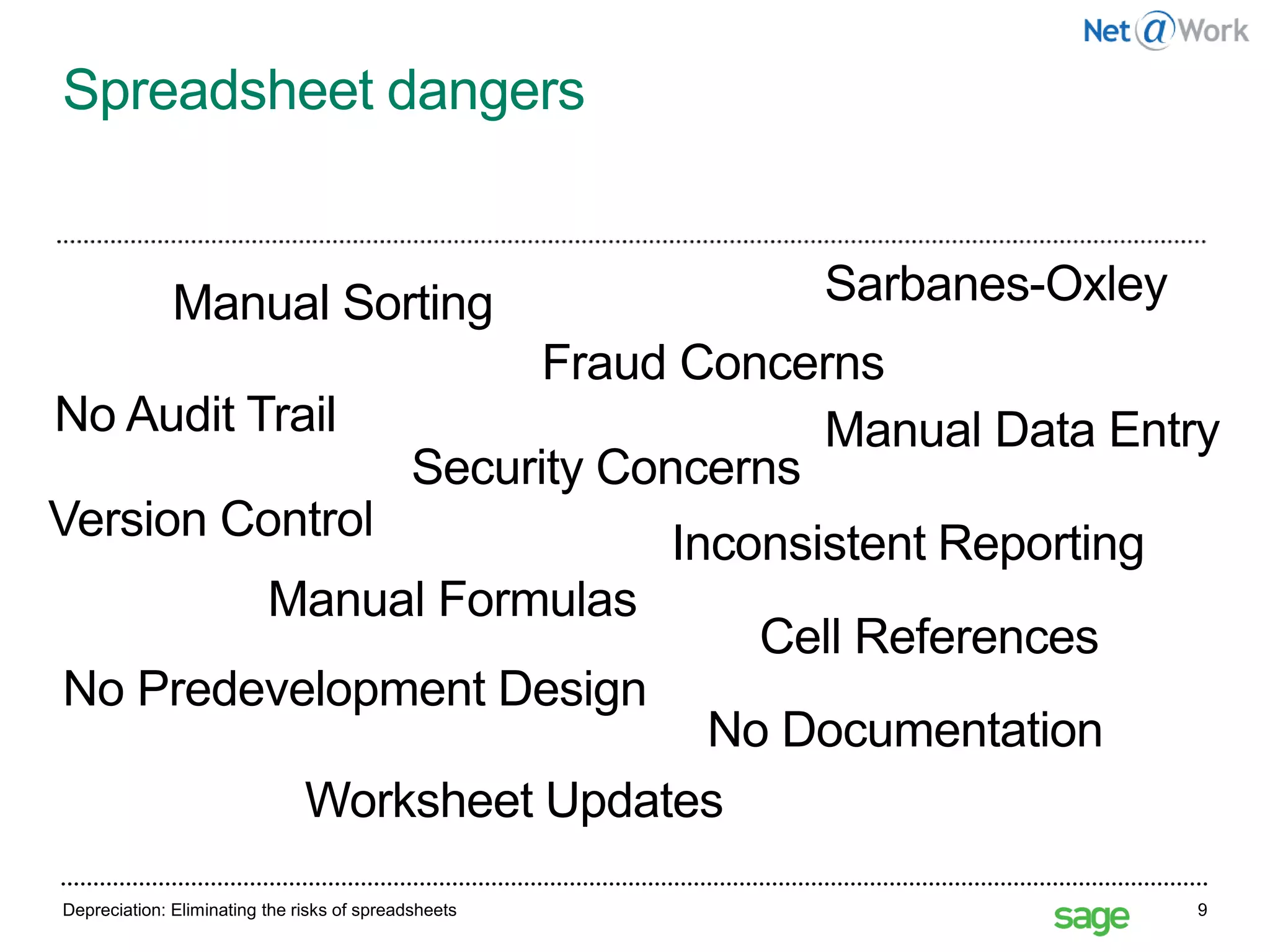

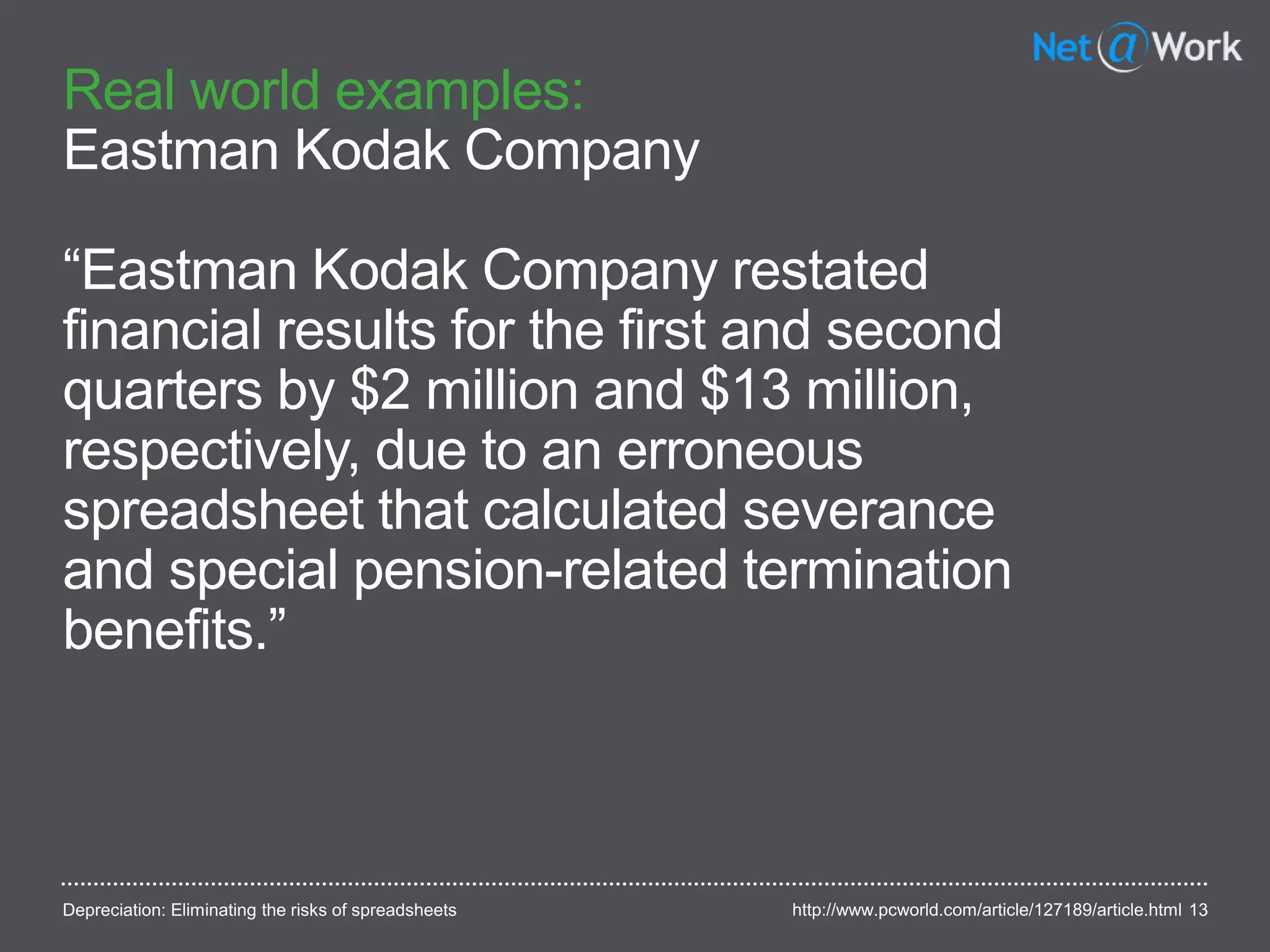

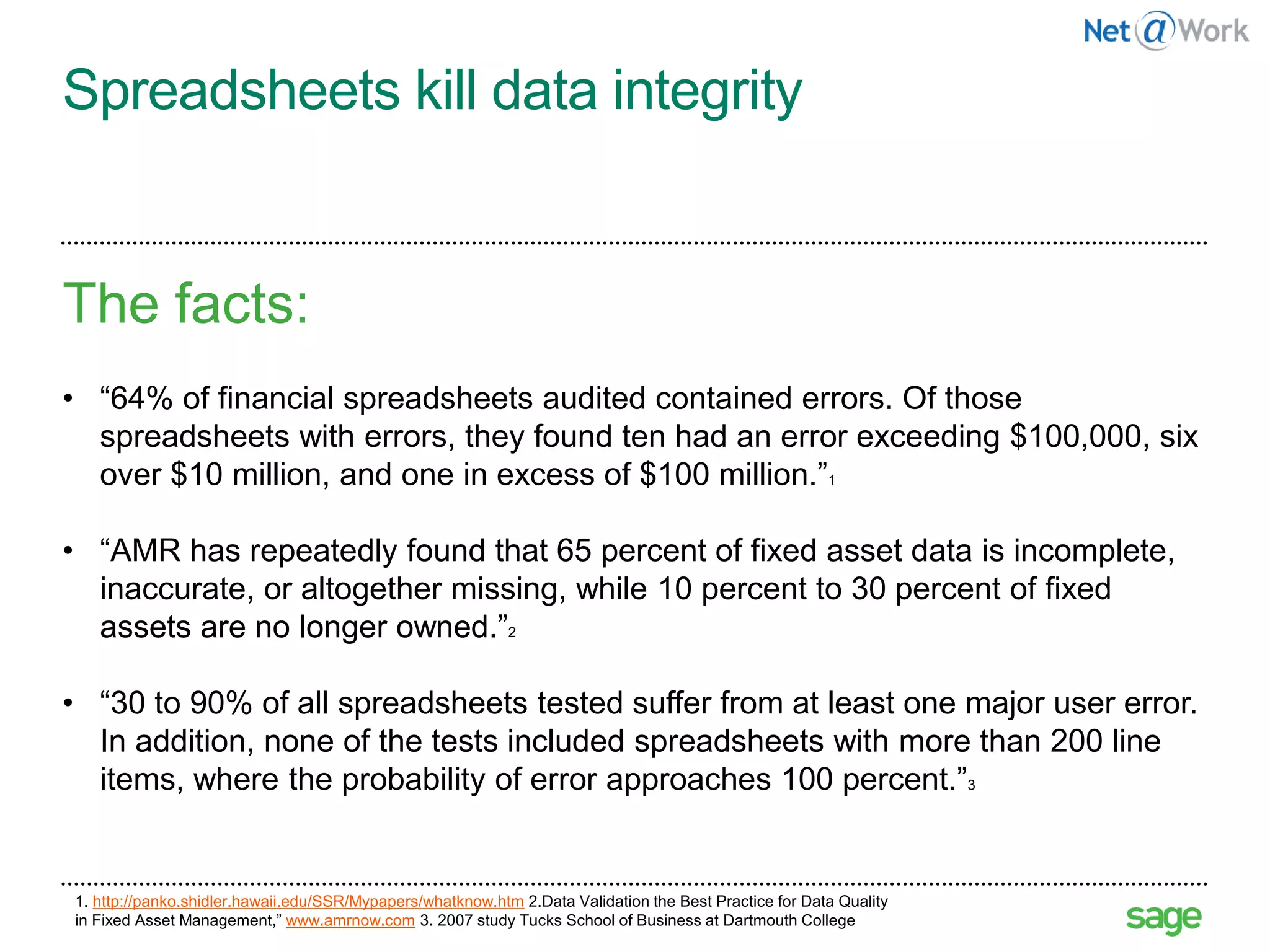

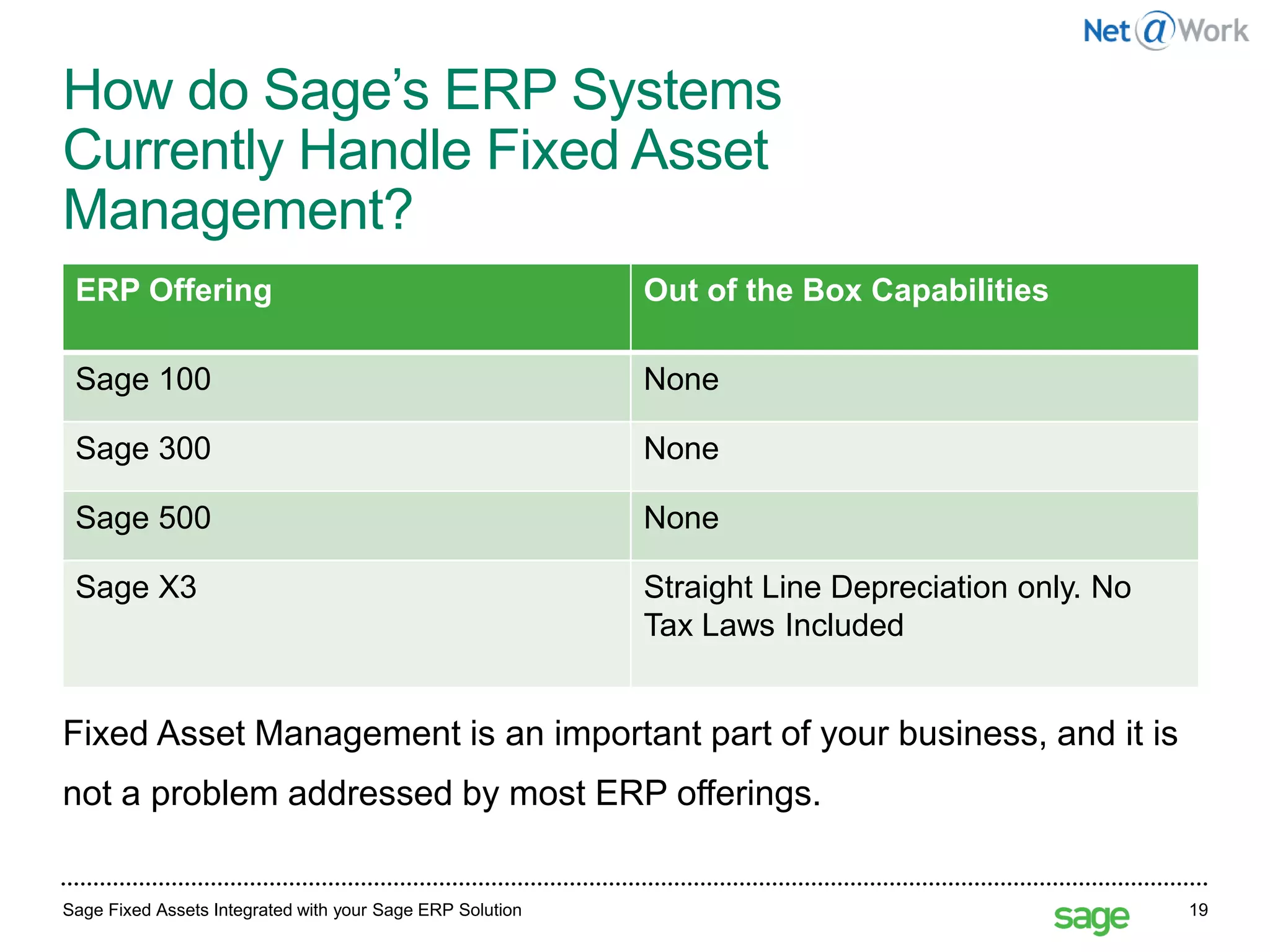

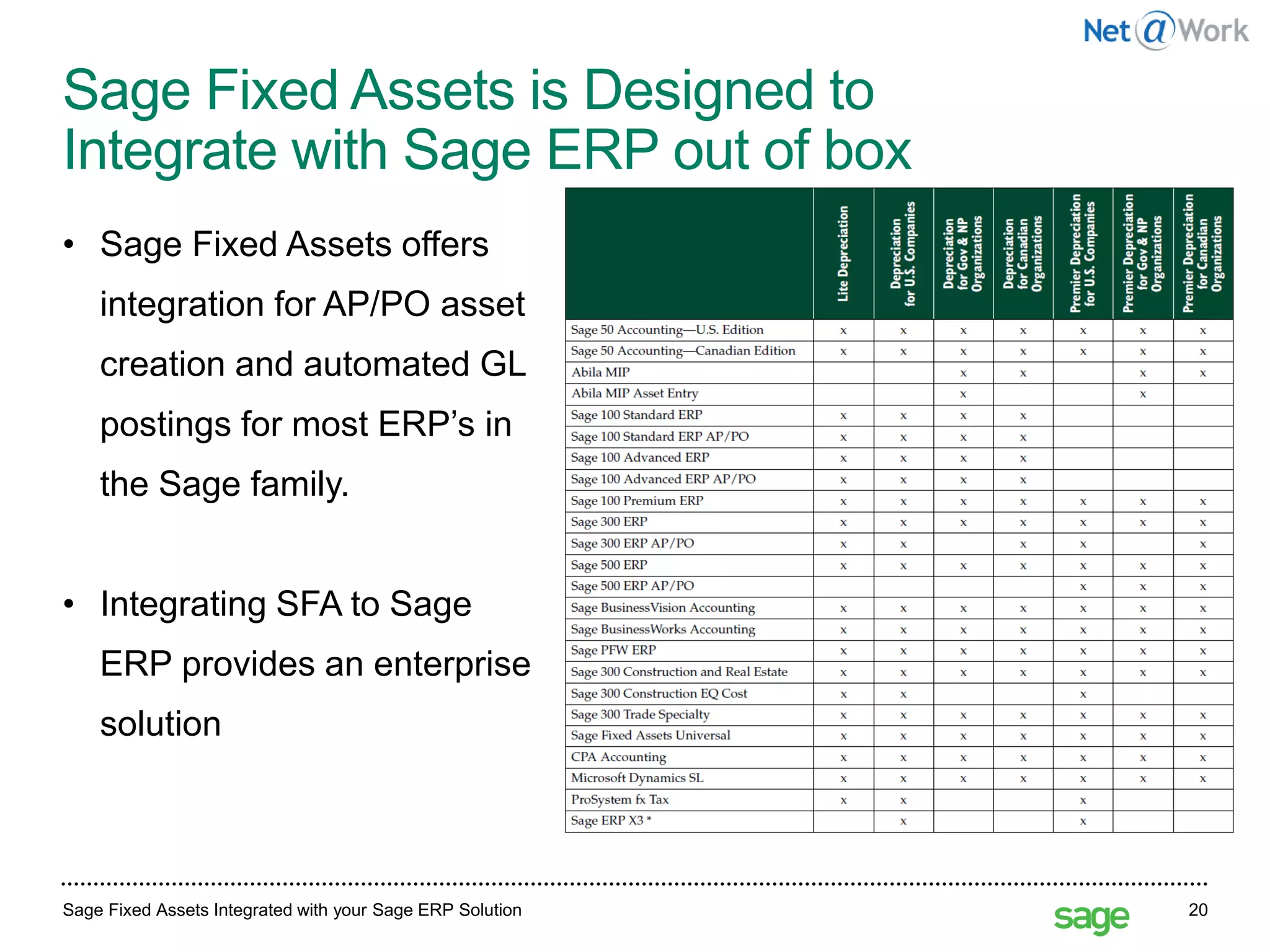

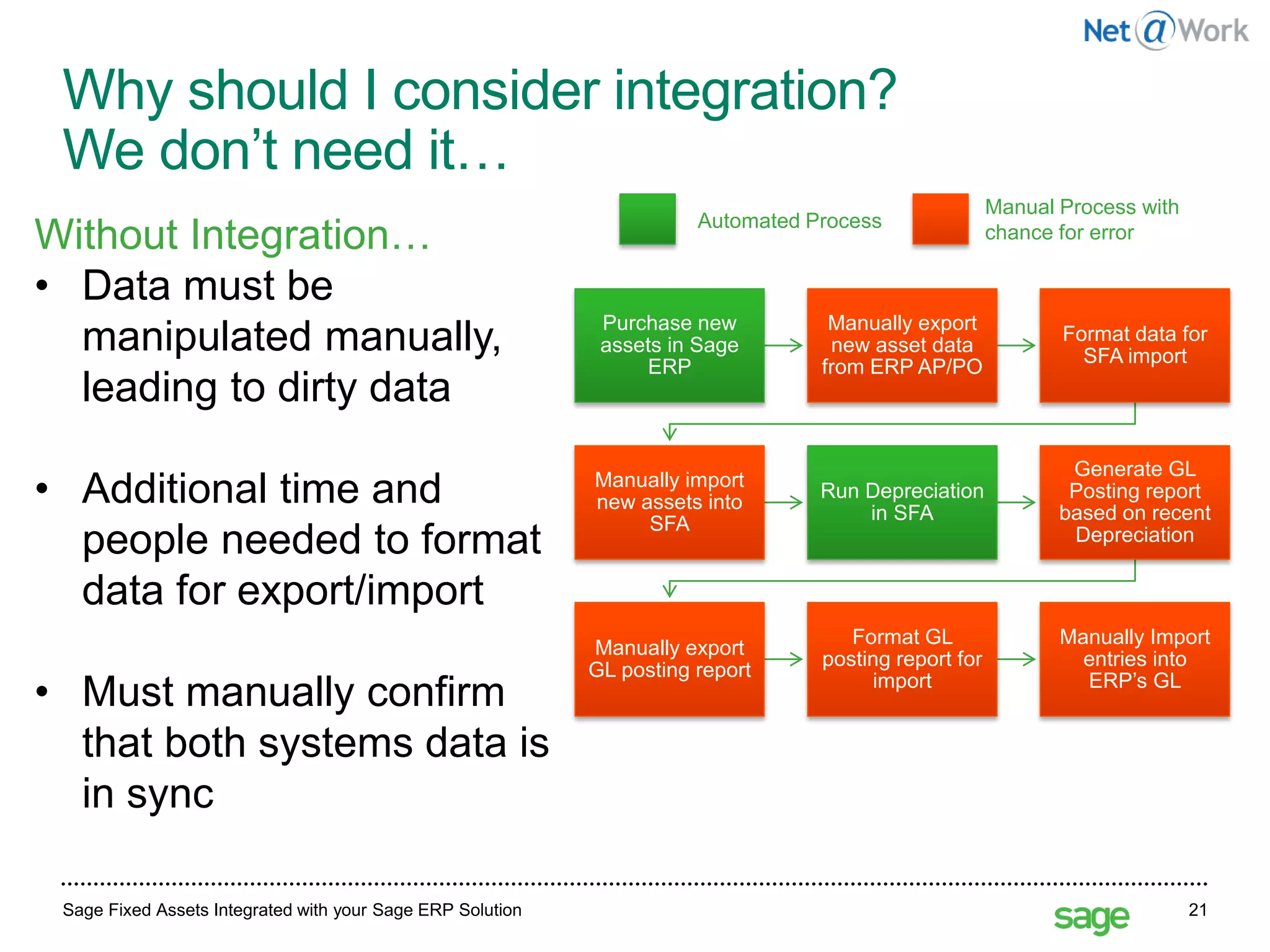

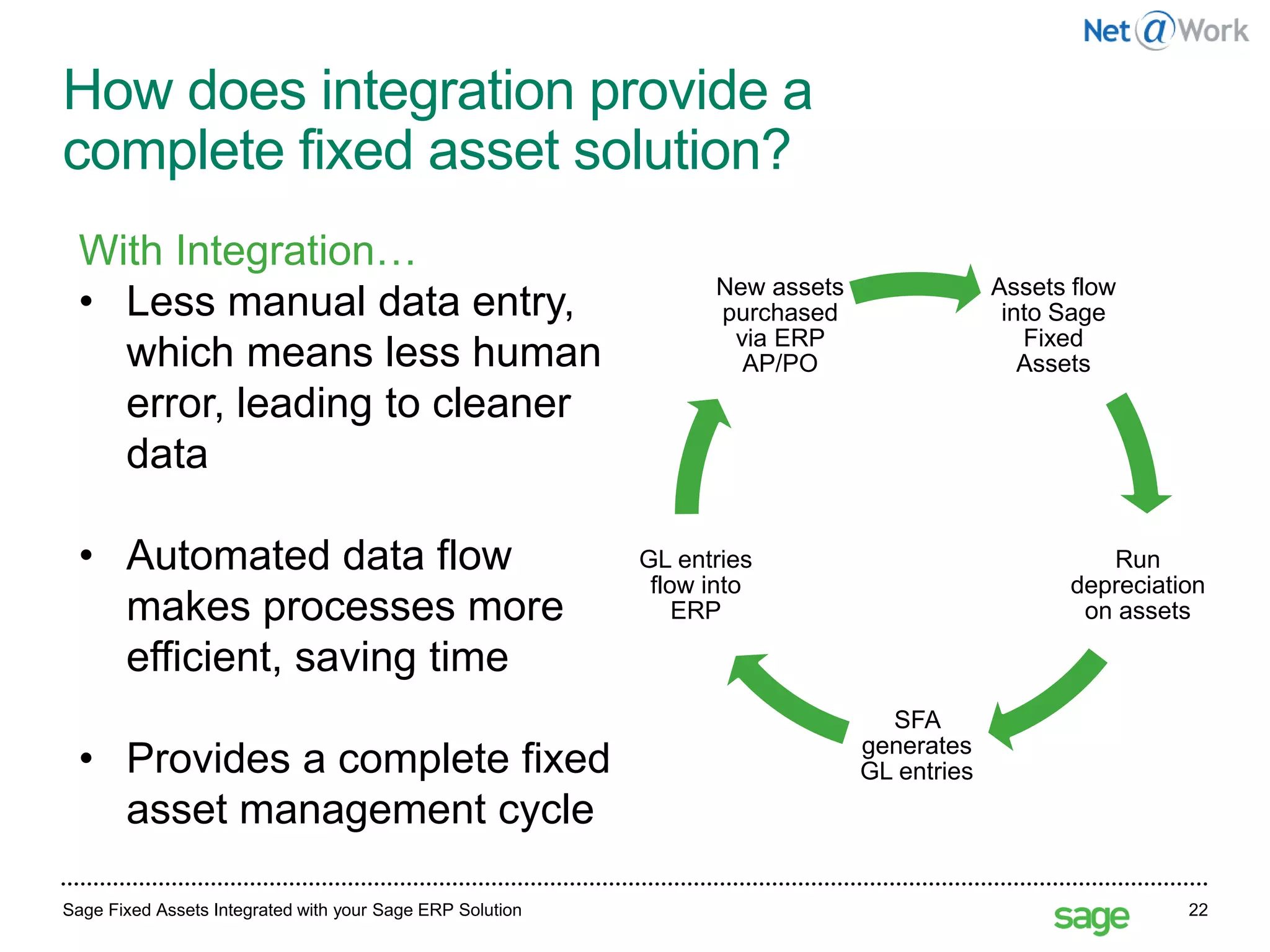

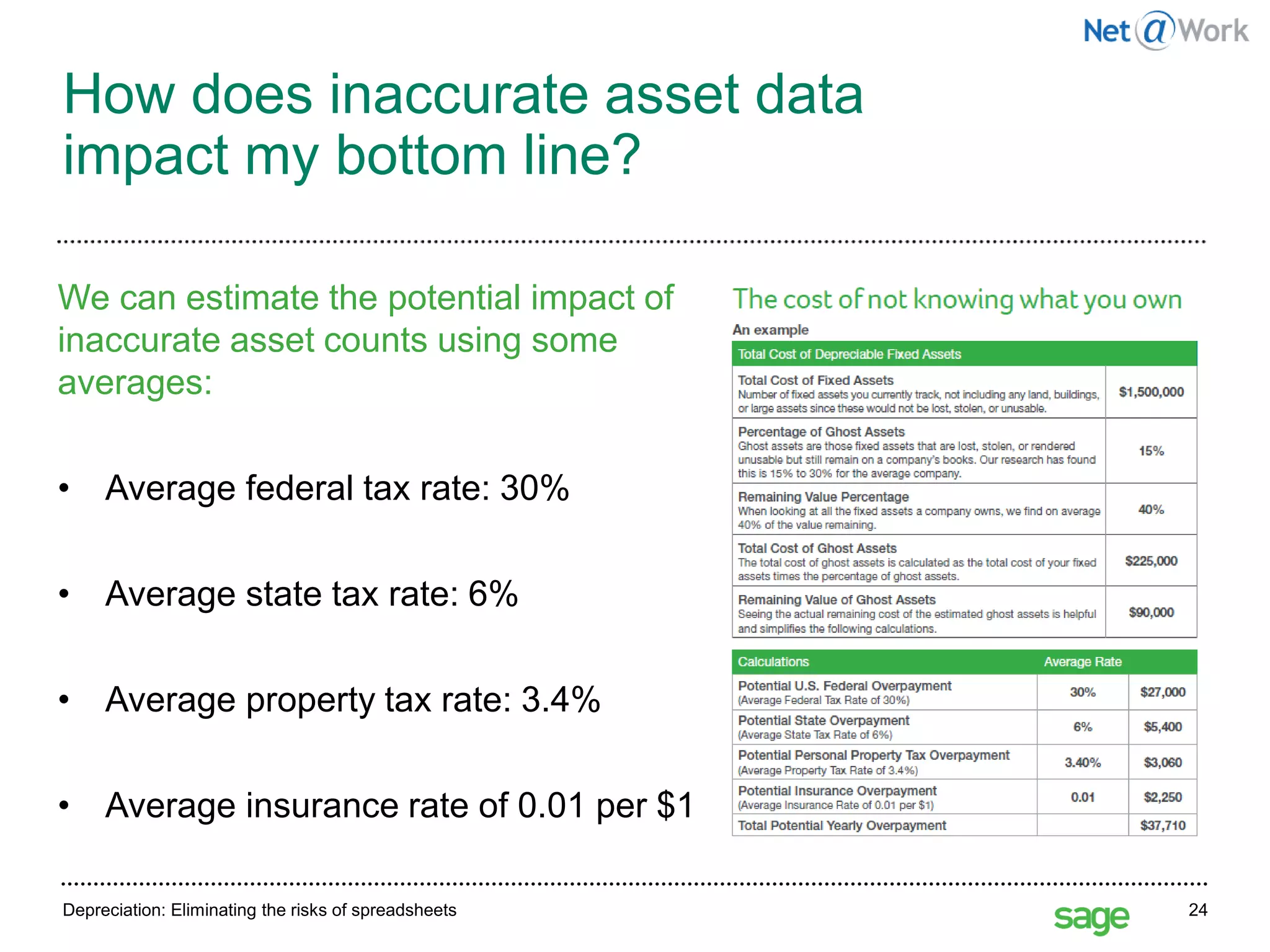

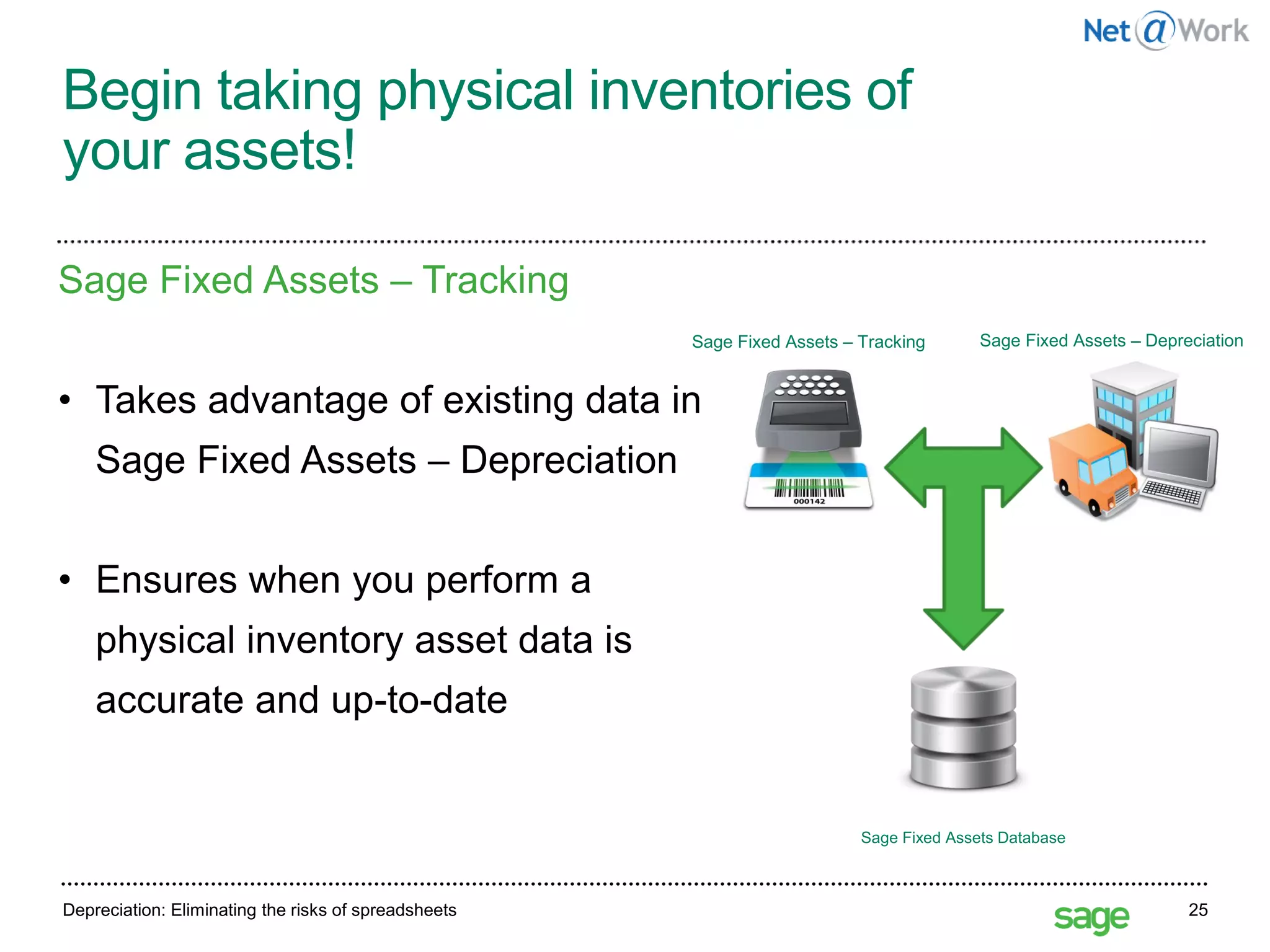

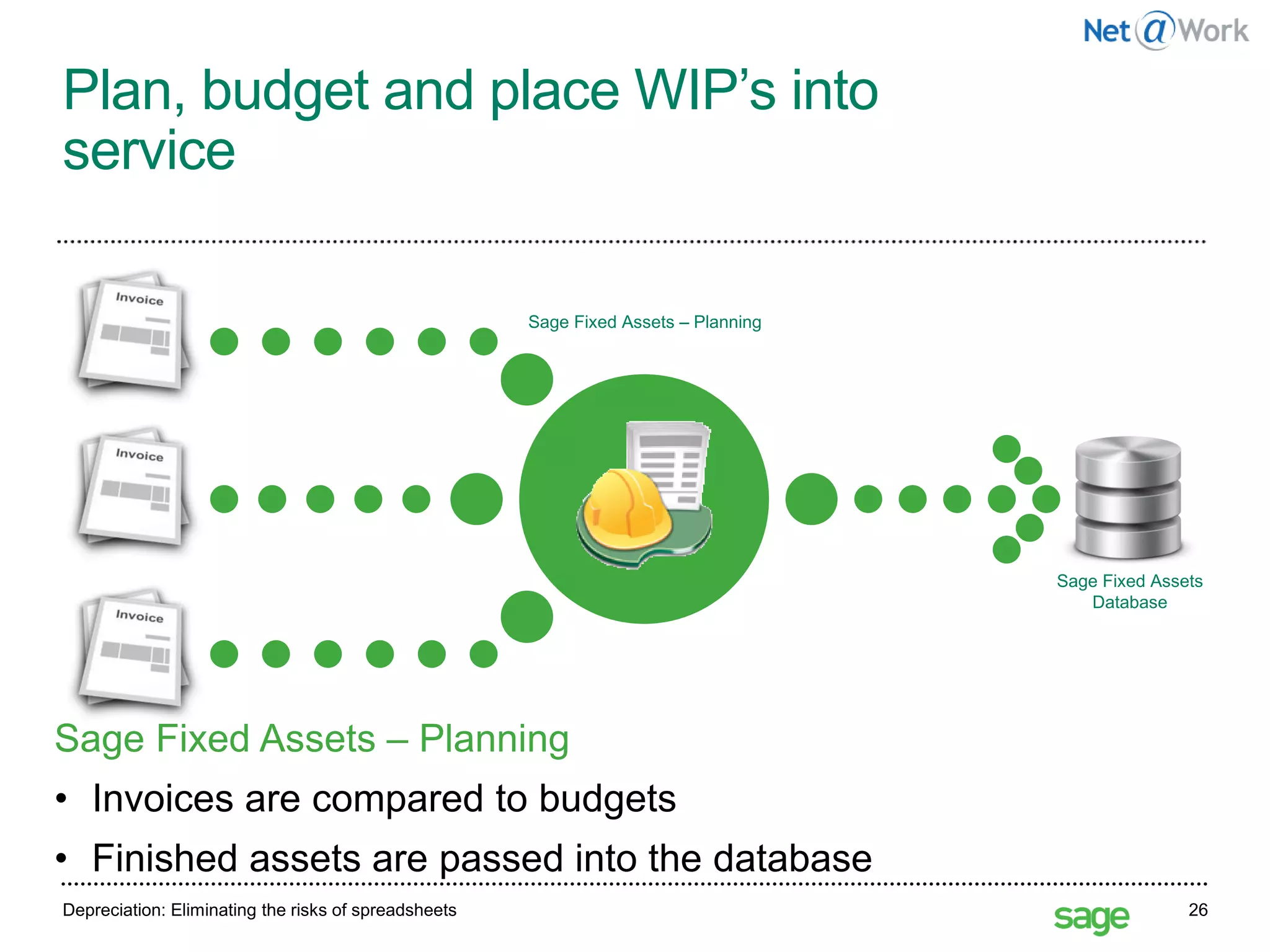

The document outlines a webinar hosted by Sean Munzert and Grant Griebel on the risks of using spreadsheets for managing fixed assets and the advantages of utilizing Sage Fixed Assets software. It details various dangers associated with spreadsheets, including inaccuracies and lack of security, and highlights how integrated solutions can enhance data integrity and efficiency in asset management. The presentation also includes information on a promotional discount for Sage Fixed Assets for current maintenance plan customers.