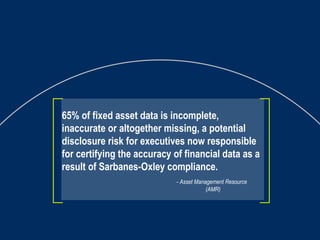

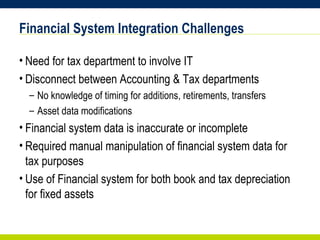

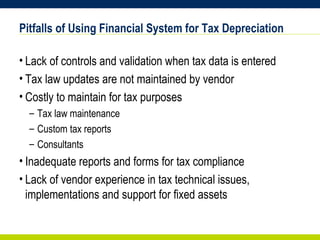

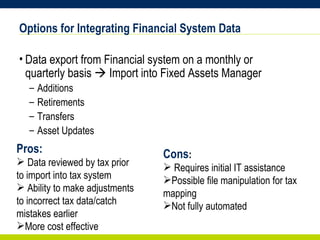

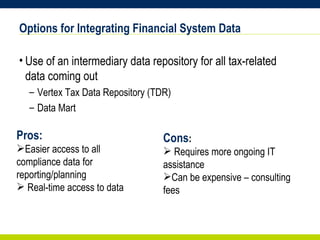

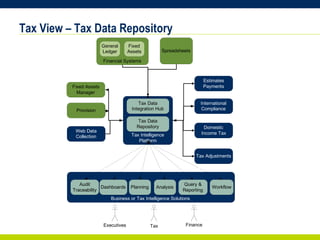

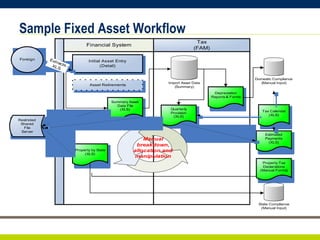

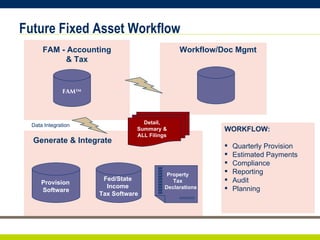

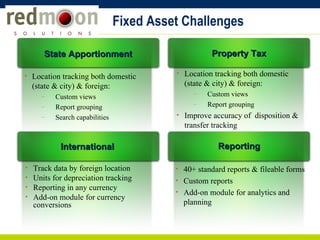

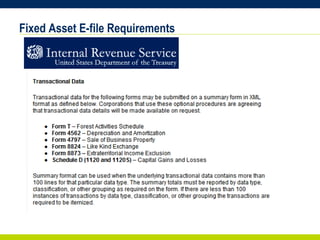

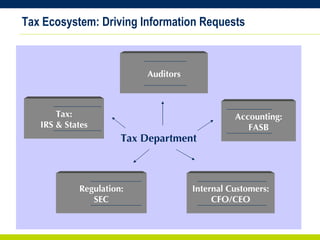

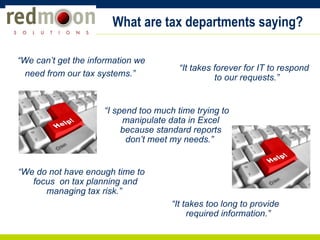

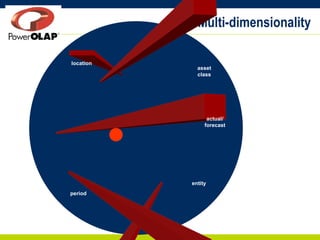

The document discusses how to automate fixed asset lifecycles including tracking assets, calculating depreciation for accounting and tax purposes, and ensuring compliance. It describes integrating fixed asset software with financial systems and tax filing software to streamline the process. Options for integration include importing financial system data, using an intermediary data repository, or fully automating the data flow. The software allows users to track both domestic and international assets for tax planning and reporting.