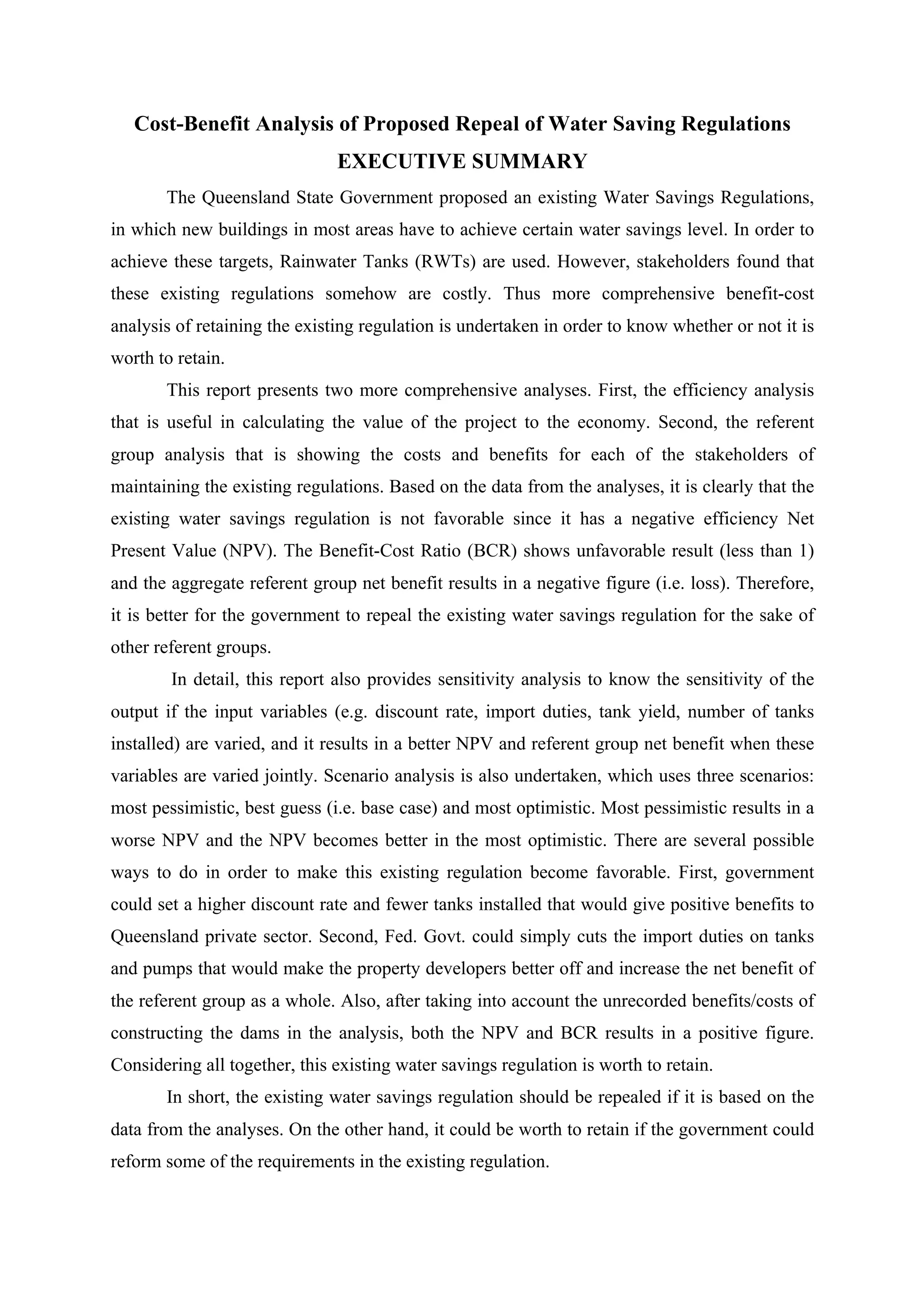

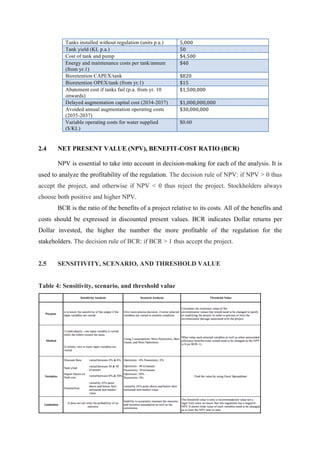

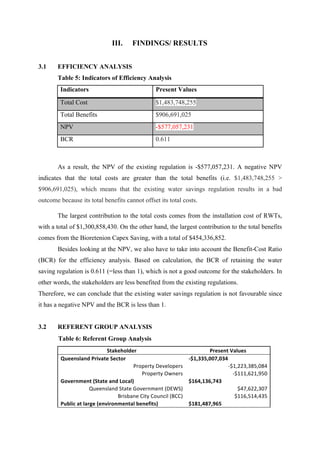

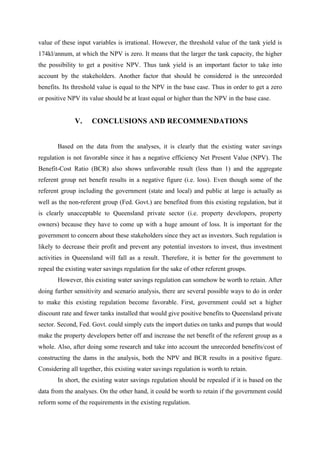

This report analyzes the cost-benefit of retaining existing water saving regulations in Queensland that require new buildings to install rainwater tanks. Two analyses are presented: 1) an efficiency analysis calculating the project's value to the economy, and 2) a referent group analysis of costs and benefits to stakeholders. The efficiency analysis shows a negative net present value and benefit-cost ratio less than 1, indicating costs outweigh benefits. The referent group analysis also has a negative aggregate benefit, with property developers impacted most by tank costs. Sensitivity analysis varies input variables, and scenario analysis considers three scenarios. The report recommends repealing the regulations based on the analyses, but retaining them could be worth it if requirements are reformed.