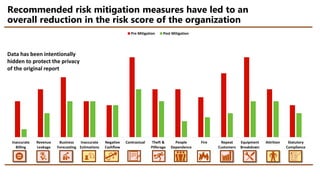

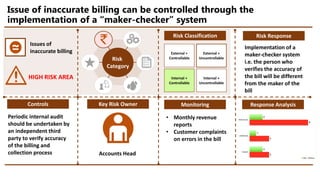

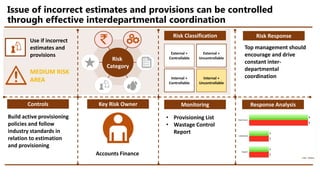

The risk management report identifies seven high-risk and six medium-risk areas across various business functions, with the majority of risks concentrated in operations and accounts. Key areas of concern include inaccuracies in billing and revenue leakage, which can be mitigated through the implementation of structured controls such as a maker-checker system and a zero tolerance policy. Recommendations also emphasize the importance of interdepartmental coordination for improving estimates and provisions, leading to an overall reduction in the organization's risk score.