1) Ricardian equivalence observes that a cut in current taxation financed by future tax increases has the same present value as tax cuts financed by government bonds. It argues this means tax cuts will not affect short-run or long-run consumption.

2) The document uses household savings functions to show that if a tax cut is financed by bonds, household savings will increase by the full amount of the new bonds, so consumption remains unchanged.

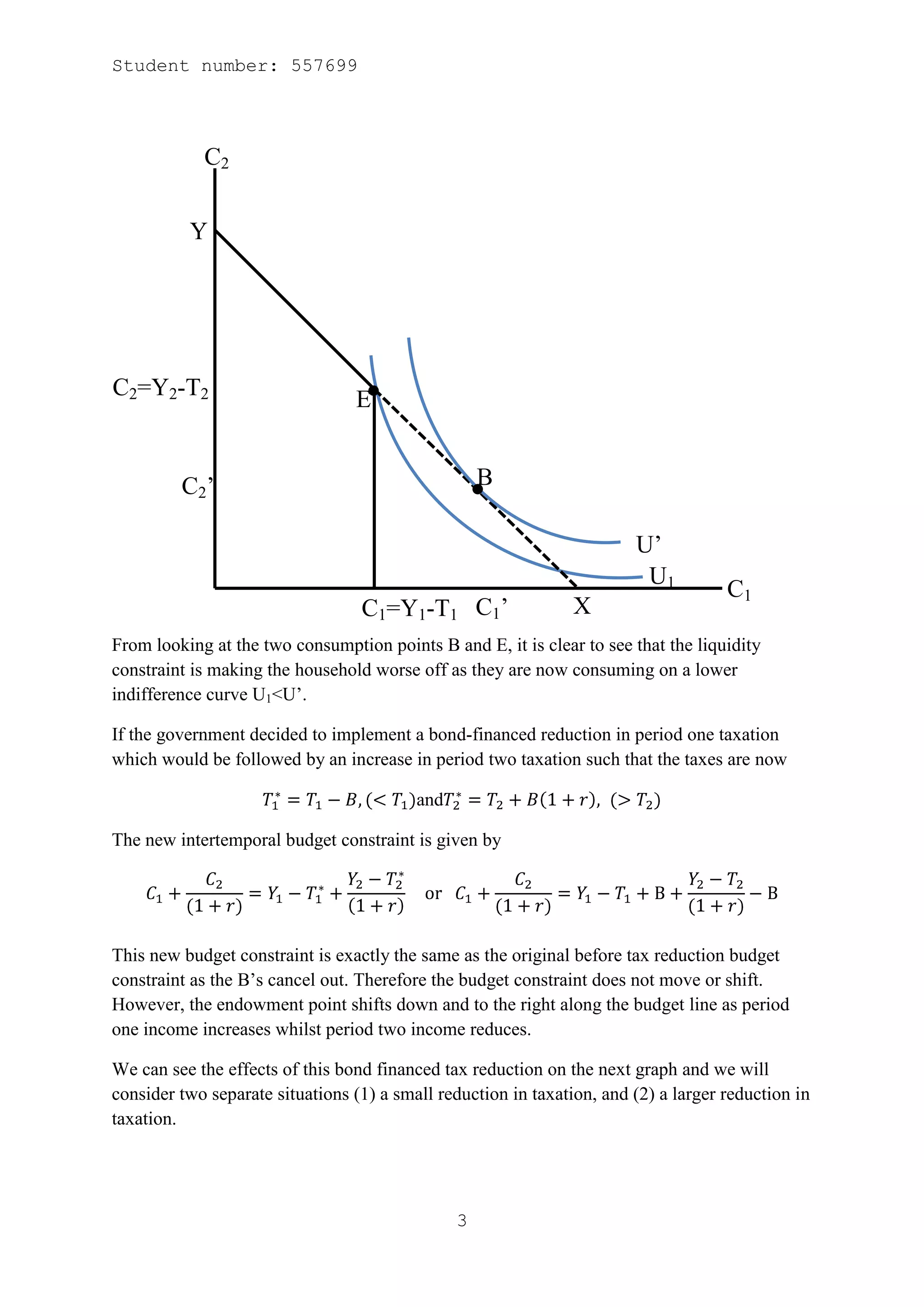

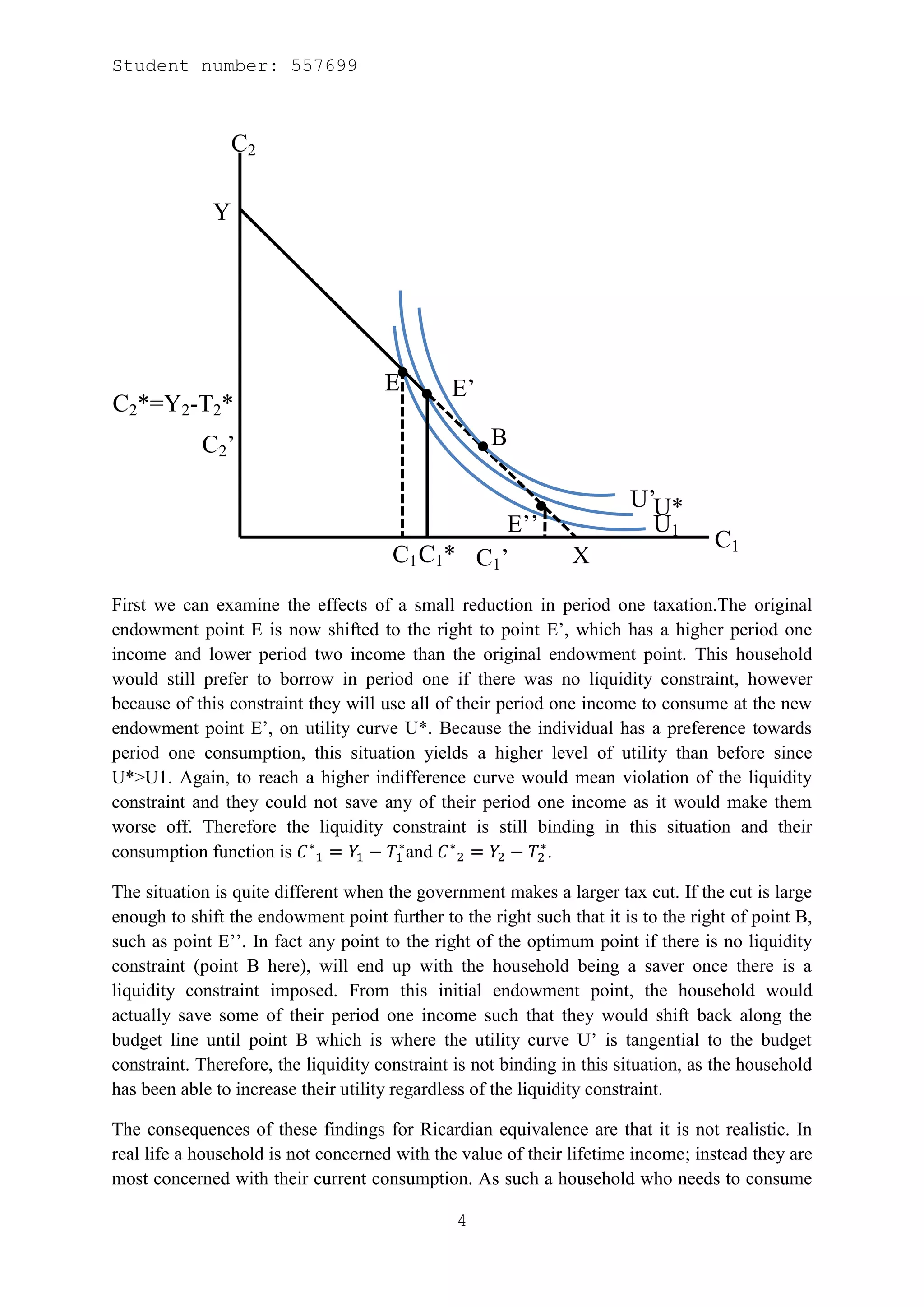

3) It discusses how liquidity constraints can impact household consumption decisions. A binding liquidity constraint means a household cannot borrow and must consume all current income, leaving them worse off than with no constraint.