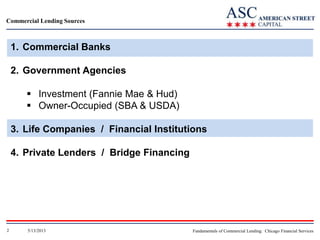

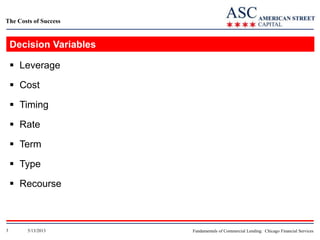

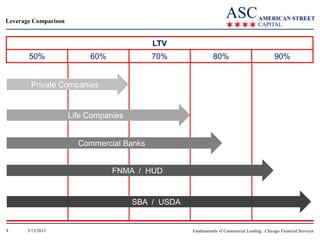

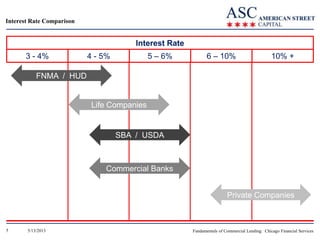

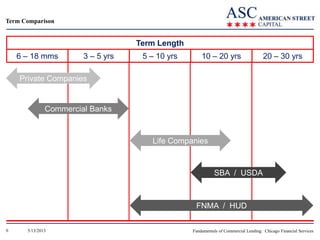

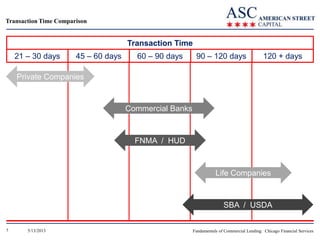

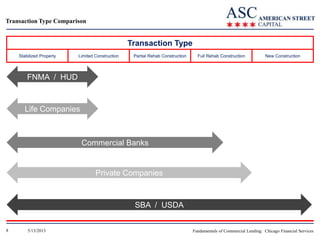

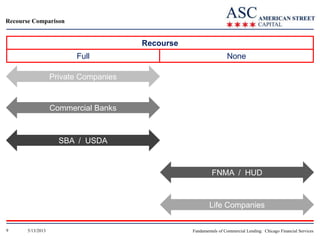

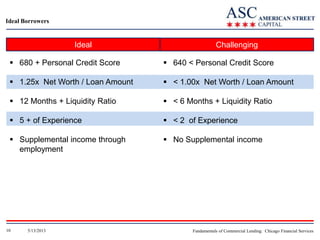

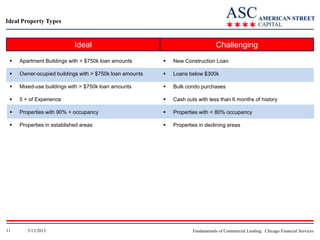

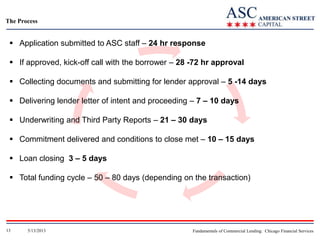

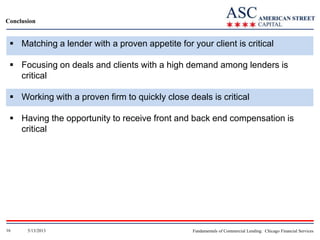

The document discusses the fundamentals of commercial lending. It provides an overview of various commercial lending sources such as commercial banks, government agencies, life companies, and private lenders. It then compares these sources across key decision variables such as leverage, interest rates, terms, transaction times, transaction types, and recourse. The document also outlines ideal borrower and property type characteristics and concludes with an overview of the commercial lending process.