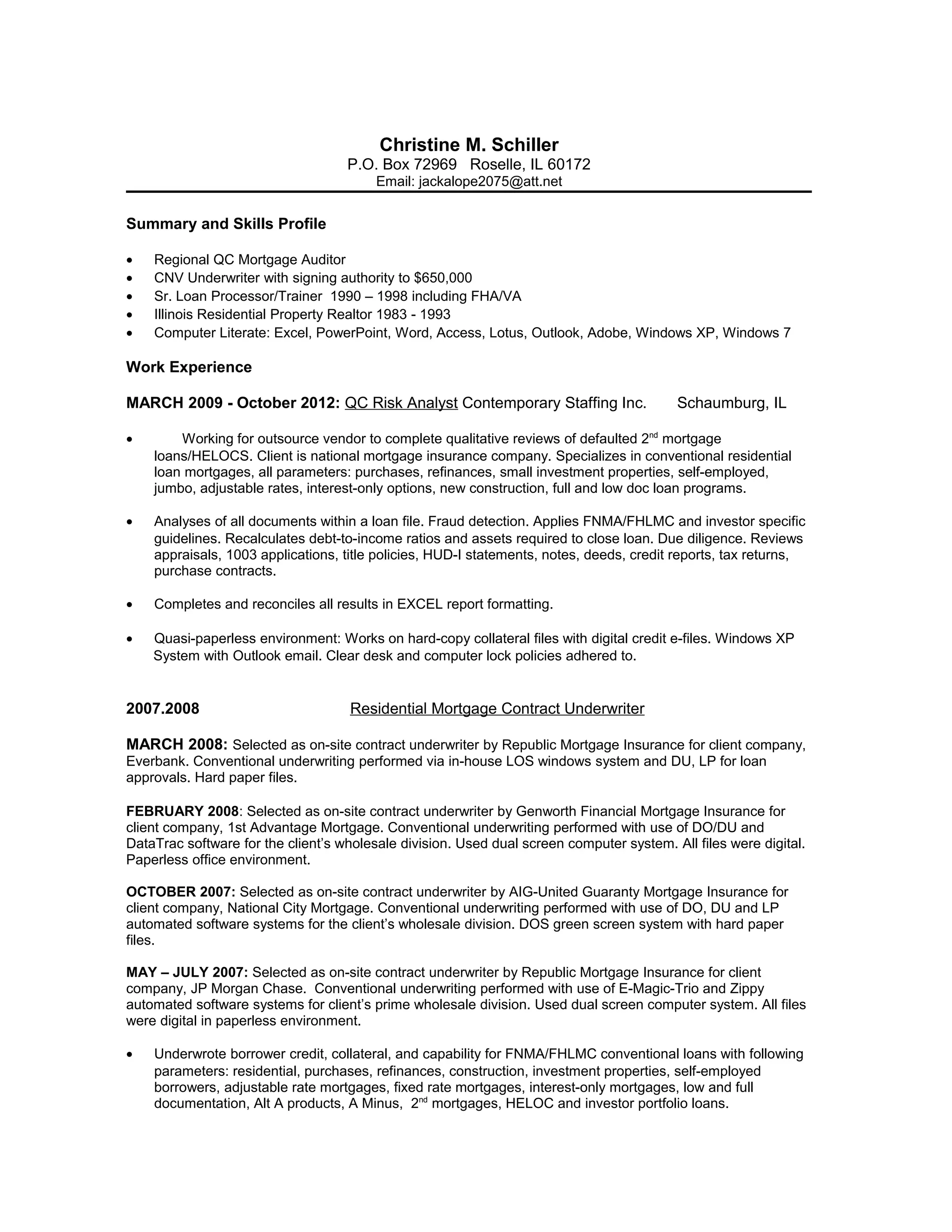

The document is a resume for Christine M. Schiller that summarizes her experience and skills. She has over 20 years of experience in the mortgage industry, including as a regional QC mortgage auditor, an underwriter, and a loan processor and trainer. Her resume lists her work history at various mortgage insurance and lending companies, and details her responsibilities and accomplishments in roles performing loan underwriting, quality control auditing, and fraud detection.