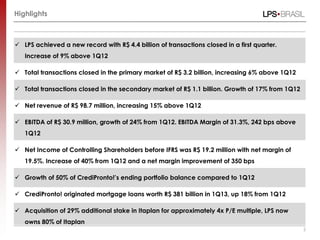

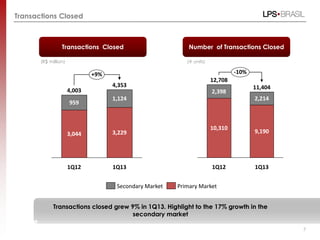

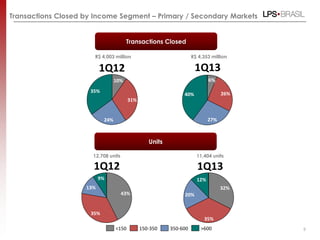

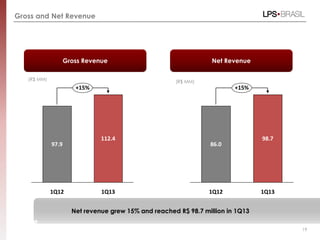

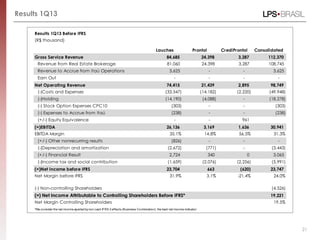

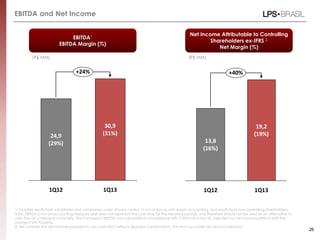

1. LPS achieved record transactions of R$4.4 billion in 1Q13, up 9% from 1Q12, with net revenue growing 15% to R$98.7 million and EBITDA increasing 24% to R$30.9 million.

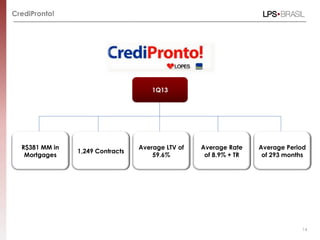

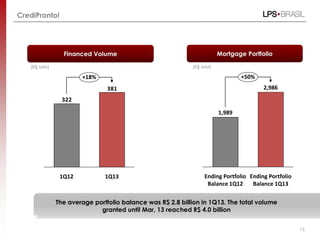

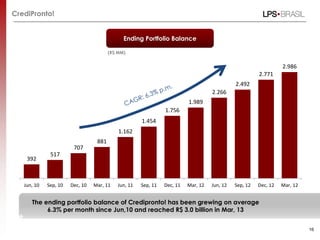

2. CrediPronto's mortgage portfolio balance grew 50% compared to 1Q12, reaching R$2.986 billion.

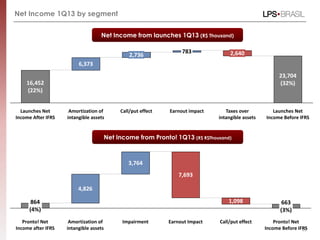

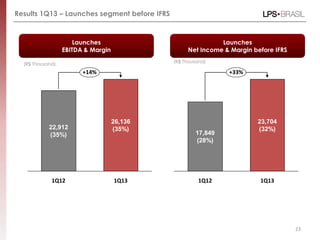

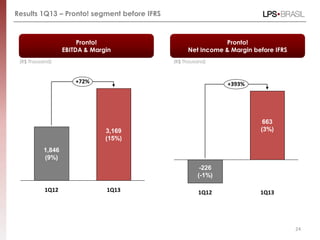

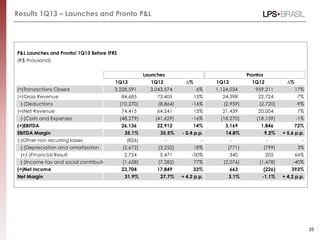

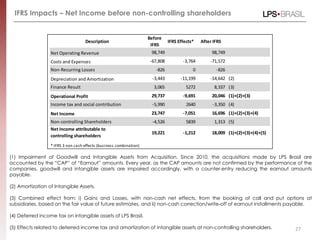

3. Launches segment net income before IFRS was R$23.7 million, up 33% from 1Q12, while Pronto segment net income was R$0.663 million, an increase of 393% from 1Q12.