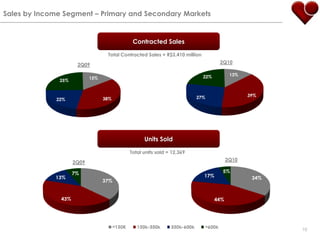

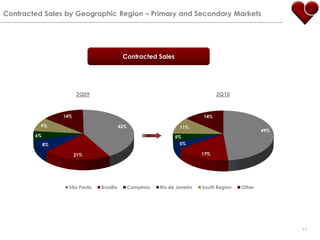

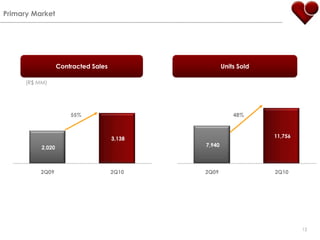

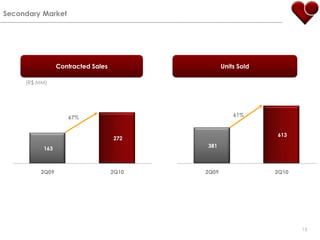

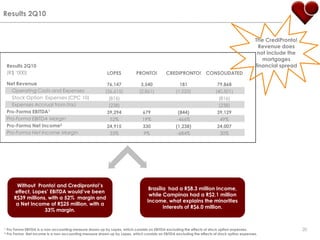

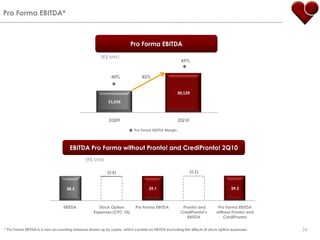

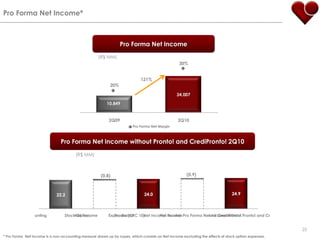

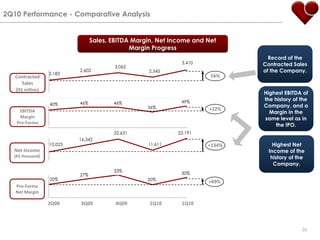

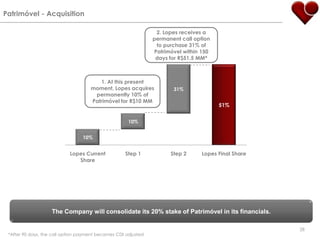

Lopes held a 2Q10 conference call to present operational and financial results. Key highlights included contracted sales reaching the highest levels, with a 56% increase in contracted sales from 2Q09. Pro-forma EBITDA increased 82% over 2Q09 to R$39.1 million, with a margin of 49%. Pro-forma net income increased 121% to R$24 million, with a margin of 30%. The company also announced acquiring stakes in secondary market companies VNC and Self, and establishing a foundation to acquire control of Patrimóvel.