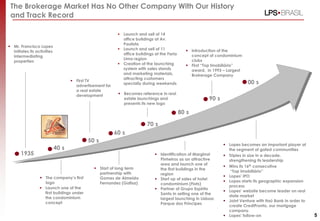

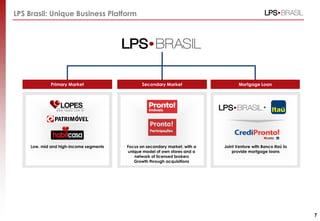

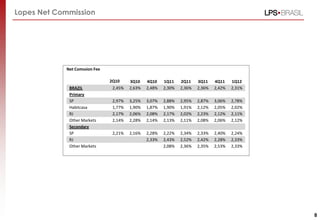

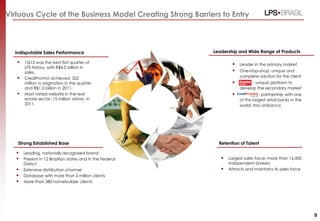

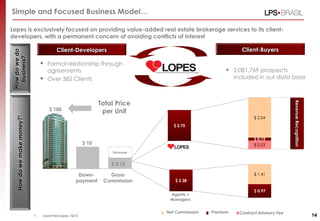

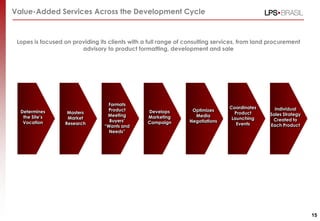

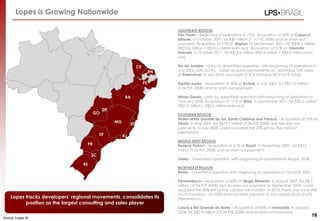

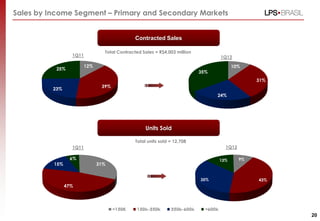

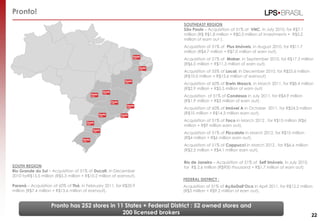

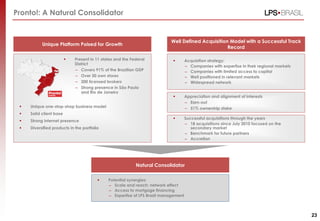

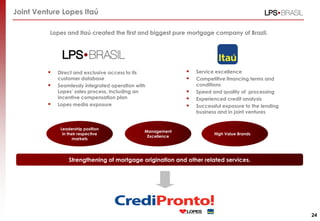

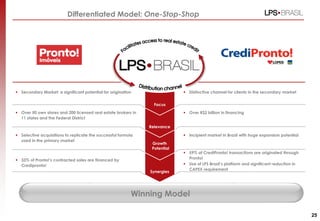

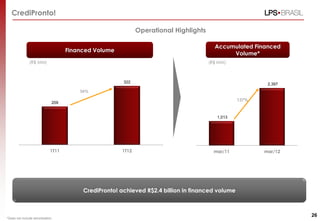

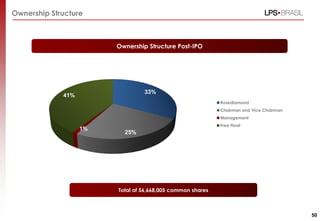

LPS Brasil is a leading real estate brokerage and consulting firm in Brazil with over 75 years of experience. It has achieved significant growth and awards for its assertive M&A strategy and leadership in the industry. LPS has an experienced management team, a simple and focused business model, unmatched scale and national reach, and a low risk business with a diversified client base, positioning it well for continued success.