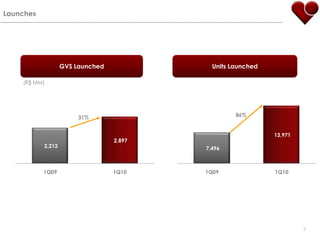

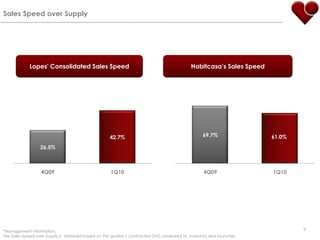

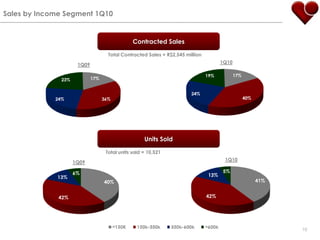

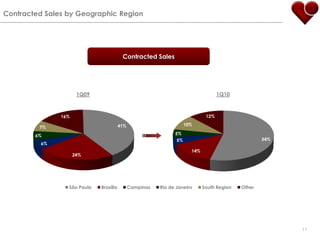

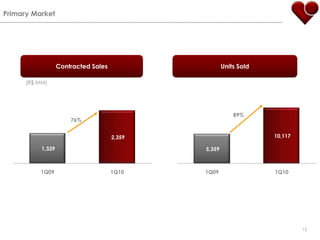

1. Lopes' contracted sales totaled R$2.5 billion in 1Q10, an 80% increase over 1Q09, with 10,521 units sold, an 89% rise. The sales speed over supply was 43% consolidated and 61% for Habitcasa.

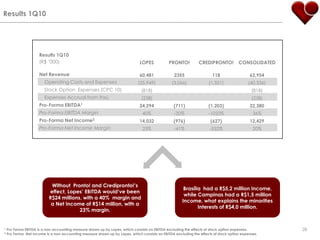

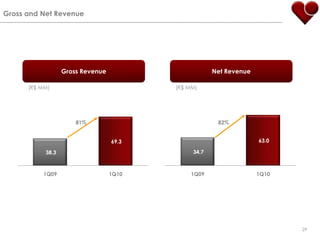

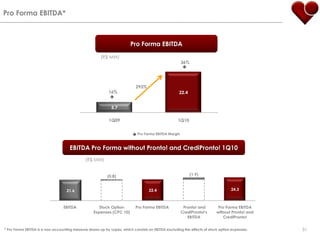

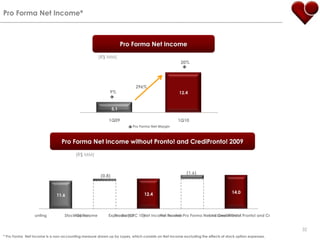

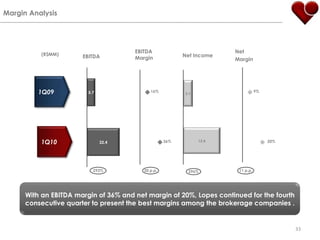

2. Net revenue was R$63 million, an 82% increase, with pro-forma EBITDA of R$22.4 million, up 293%, and a pro-forma net income of R$12.4 million, up 296%.

3. Several new units were opened during the quarter in São Paulo, Rio de Janeiro, Curitiba, and other cities to strengthen the company's