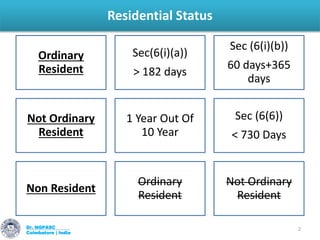

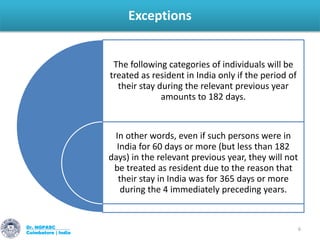

1. An individual is considered an ordinary resident if they are in India for more than 182 days in a year or are in India for 60 days or more in the year plus 365 days in the 4 years preceding the relevant year.

2. An individual is considered a non-resident if they are in India for less than 182 days in the year.

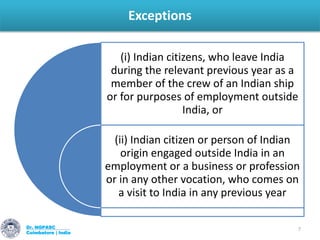

3. Certain individuals such as Indian citizens working on ships or employed abroad are only considered residents if they are in India for more than 182 days, even if they are in India for 60 days or more in the relevant year.