Embed presentation

Downloaded 30 times

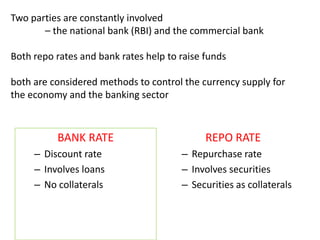

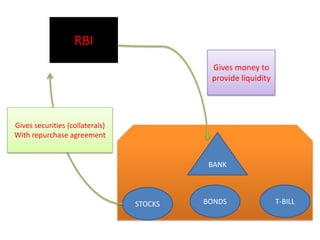

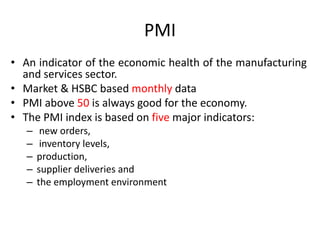

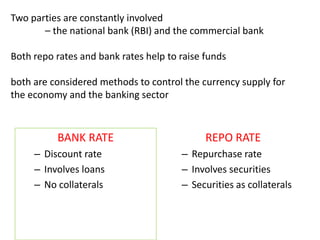

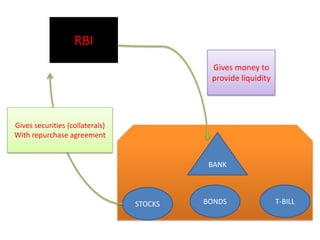

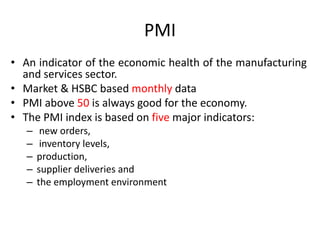

The document compares repo rates and bank rates, which are both methods used by the national bank and commercial banks to control currency supply and raise funds. Bank rates involve loans without collateral, while repo rates involve lending securities with other securities used as collateral. The document also discusses purchasing manager's index (PMI), which is an indicator of economic health for manufacturing and services, with a reading above 50 always considered good for the economy based on factors like new orders, inventory levels, production, supplier deliveries, and employment.