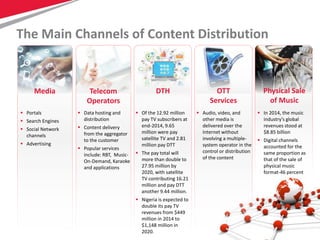

The document discusses the significant growth of the digital content market, projected to reach $549 billion by 2019, driven by the increasing internet user base and smartphone proliferation. It highlights challenges in content ownership, monetization, piracy, and proper localization as key issues in the industry. Additionally, it emphasizes the importance of personalized content and emerging business models, such as subscription and ad-based approaches, for adapting to consumer demands.