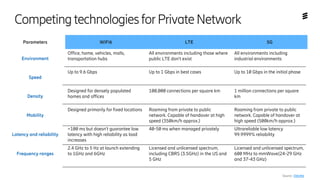

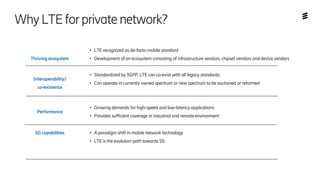

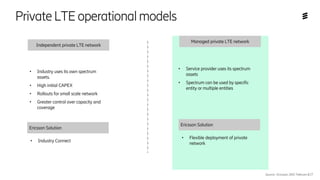

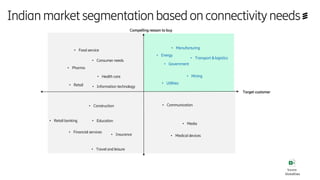

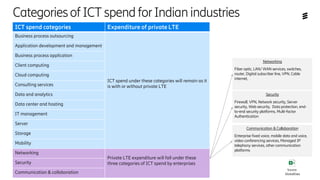

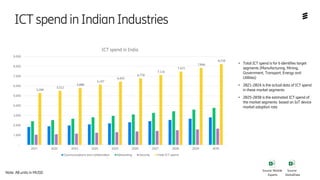

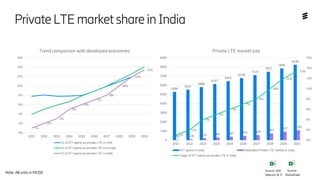

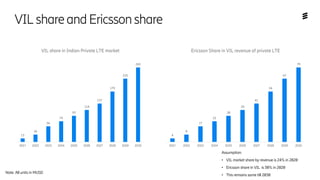

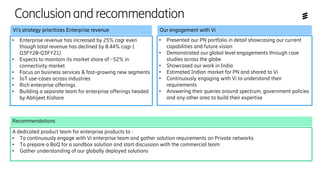

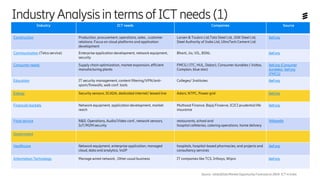

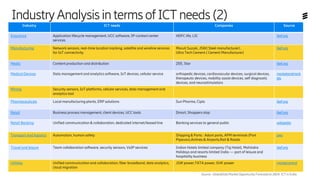

This document provides an overview of the private network market in India. It discusses trends driving demand for private networks including outdated infrastructure, bandwidth constraints of legacy systems, and the need for improved productivity and safety. It analyzes competing technologies for private networks like WiFi6, LTE and 5G. The document outlines the business case for using LTE for private networks and provides examples of private network operational models. It also segments the Indian market based on connectivity needs, categorizes ICT spending in Indian industries, and provides forecasts for the private LTE market size and share in India through 2030. Key recommendations include establishing a dedicated product team to engage with potential customers like VIL.