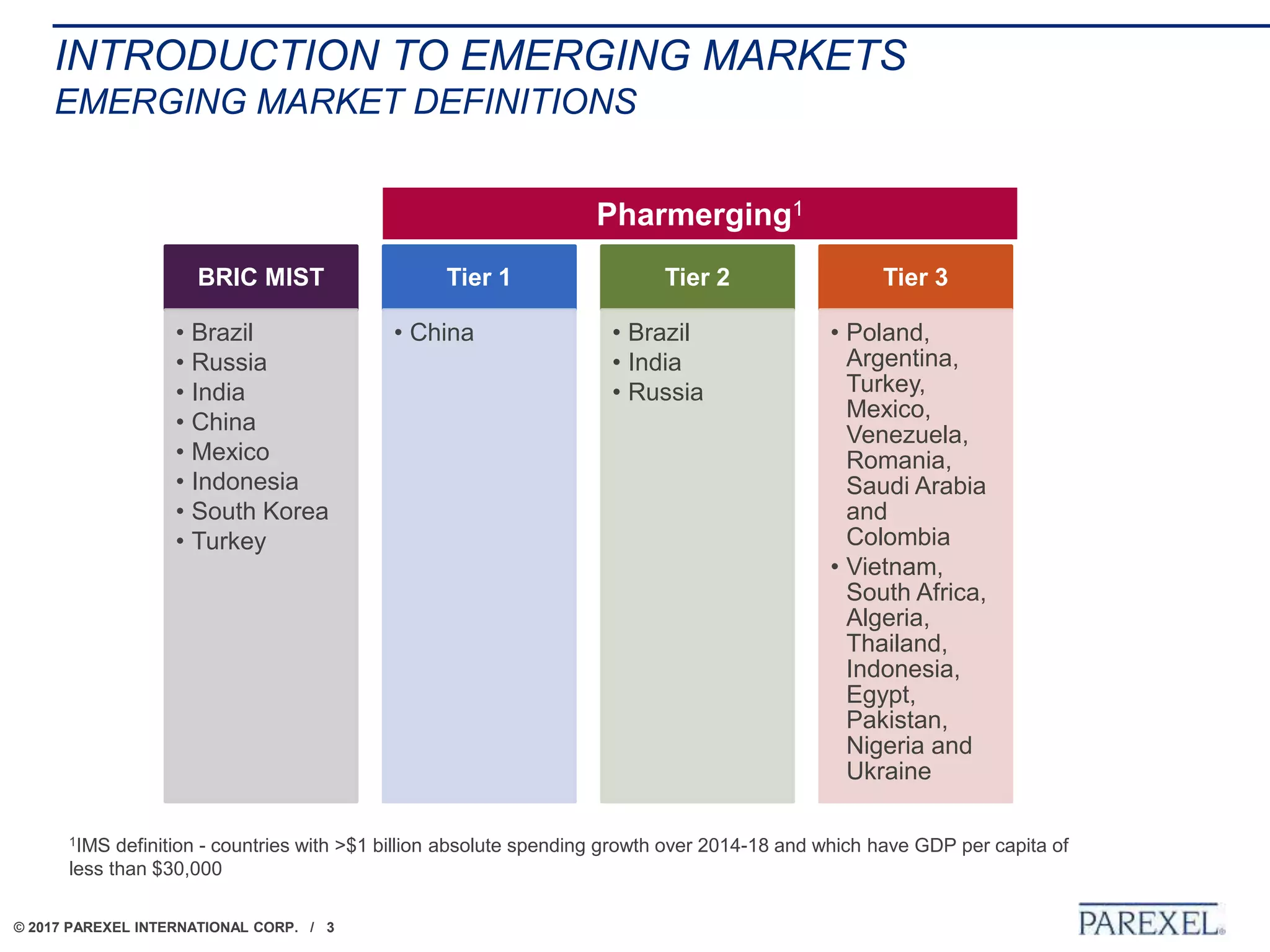

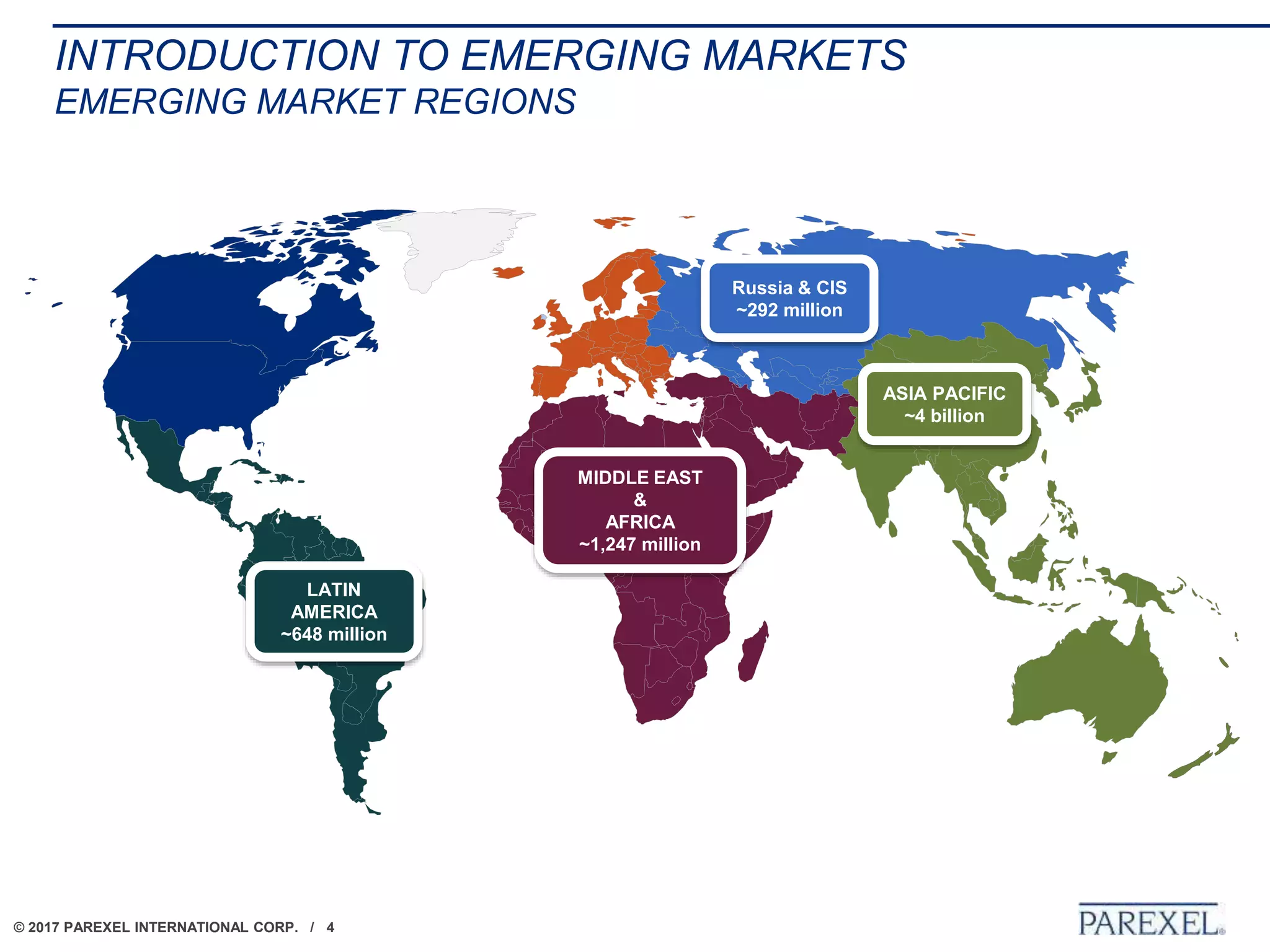

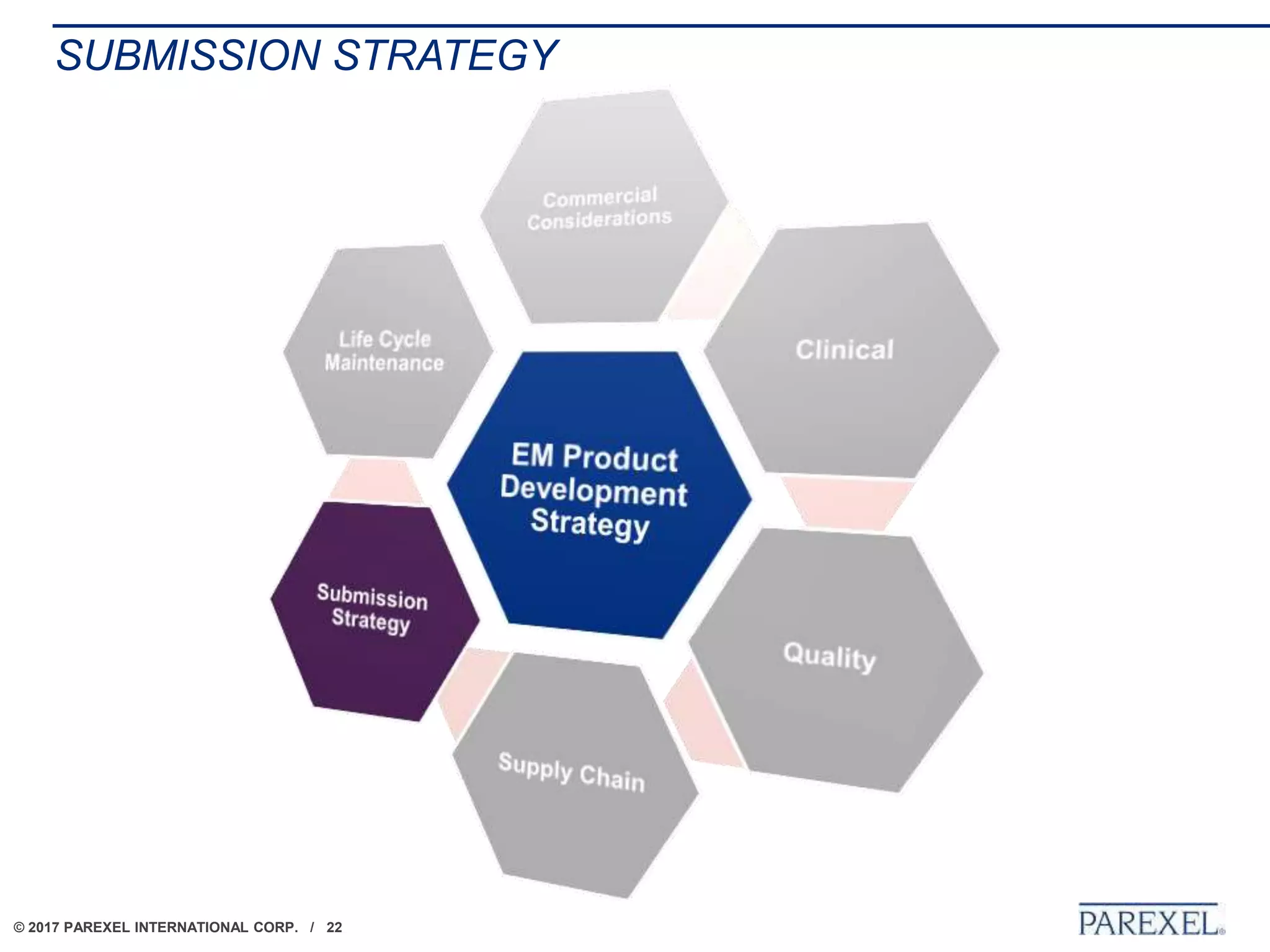

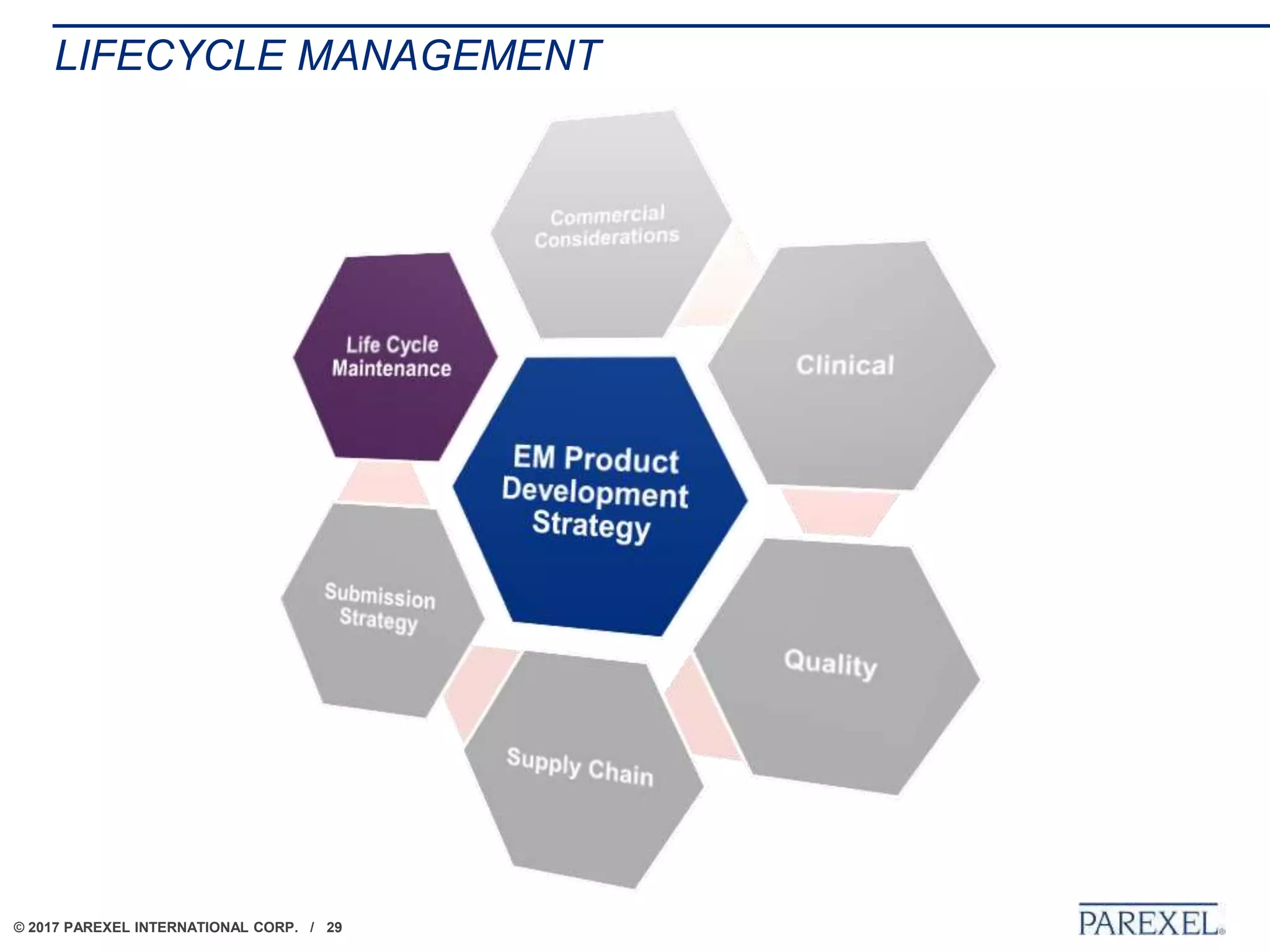

The document outlines regulatory strategies for biopharmaceutical companies entering emerging markets, detailing market definitions, clinical development considerations, and submission strategies. It emphasizes the importance of understanding local regulatory environments, satisfying clinical data requirements, and planning submission timelines to facilitate successful market entry. Additionally, it provides case studies demonstrating practical applications of these strategies in different countries.