Embed presentation

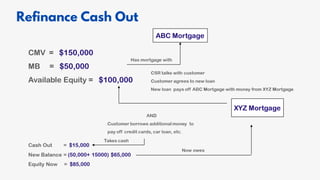

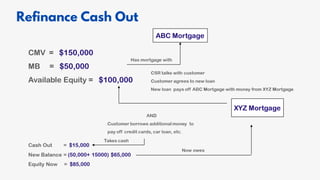

The document discusses refinancing and reasons for refinancing a loan. Refinancing means taking out a new loan to replace an existing loan, often at a lower interest rate. Reasons for refinancing include lowering interest rates to reduce monthly payments, switching to a fixed rate to gain certainty around payments, paying off the loan sooner by reducing the term, and consolidating multiple mortgages into one payment. Refinancing can also provide cash out against the equity in a property that can be used for home improvements, education expenses, or other major purchases.