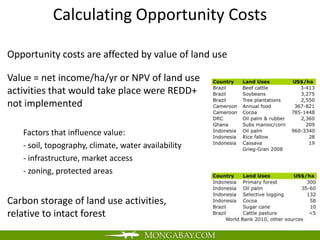

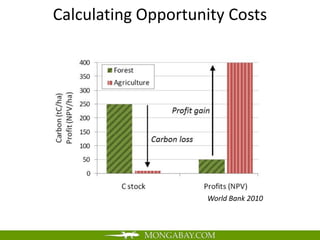

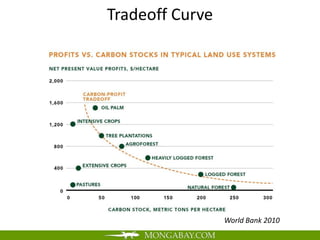

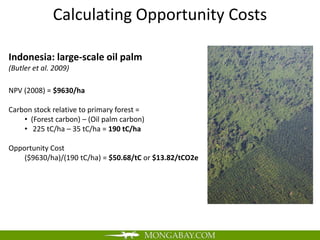

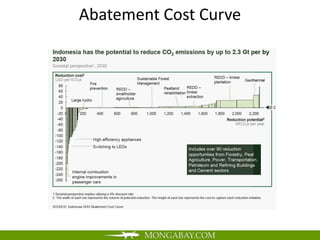

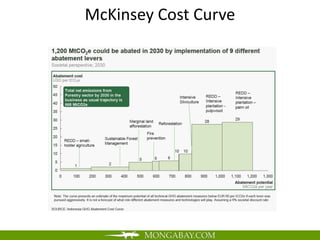

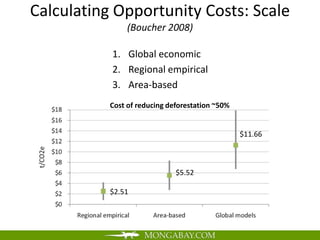

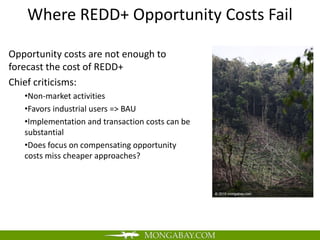

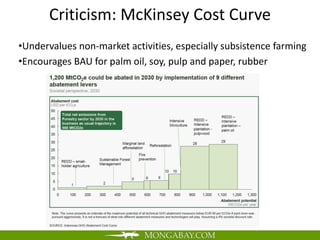

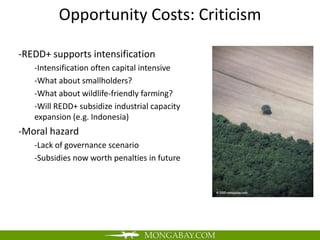

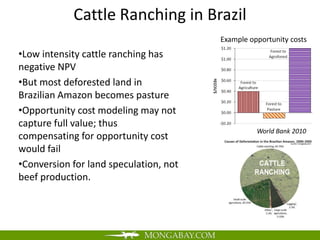

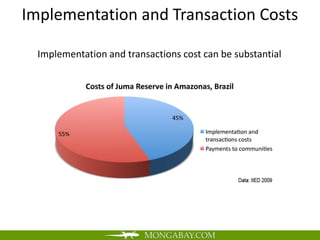

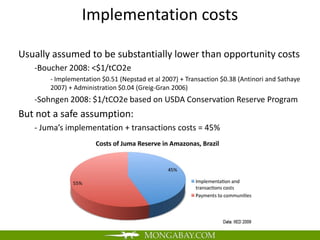

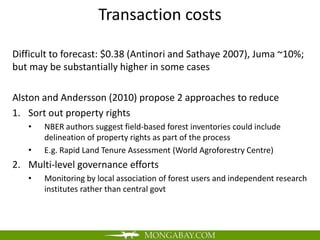

The document discusses the costs of Reducing Emissions from Deforestation and Forest Degradation (REDD+). It identifies four main types of costs: opportunity costs, implementation costs, transaction costs, and other hidden costs. Opportunity costs represent the value of alternative land uses forgone, such as agriculture. Implementation and transaction costs include the expenses of carrying out and monitoring REDD+ programs. Considering all costs is important for accurately assessing the financial requirements of REDD+ policies and programs.