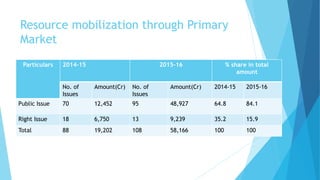

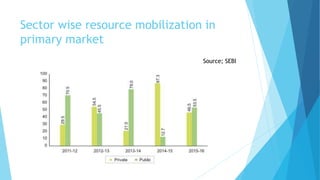

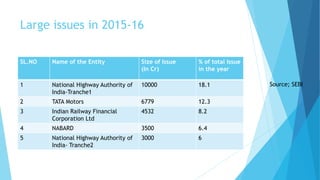

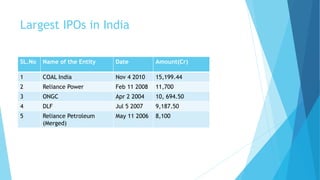

The primary market in India has seen significant growth over the past decades as a source for companies to raise capital. In 2015-16, 108 companies raised Rs. 58,166 crore through public and rights issues, compared to 88 companies raising Rs. 19,202 crore the previous year. Public sector organizations dominated primary market fundraising, with banks and financial institutions primarily responsible for the increasing amounts. National Highway Authority of India and TATA Motors were among the largest issuers. SEBI has taken steps to develop the primary market through initiatives like electronic IPOs and more favorable listing norms for startups and SMEs.