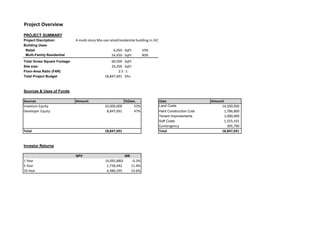

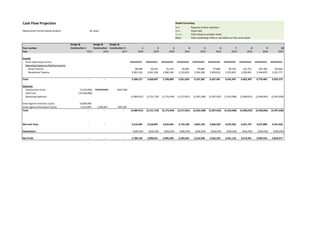

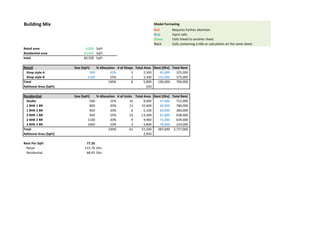

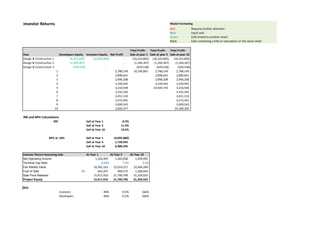

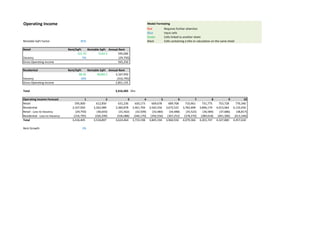

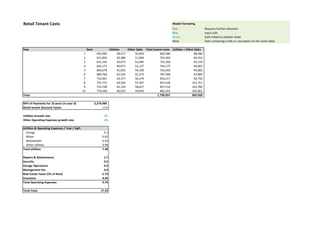

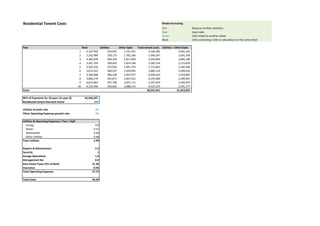

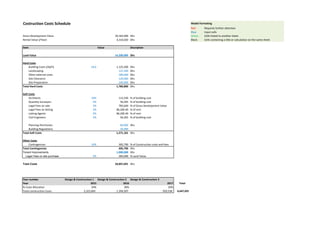

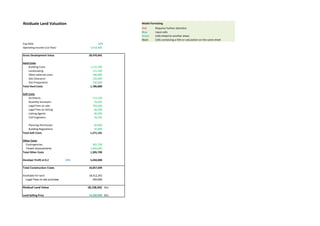

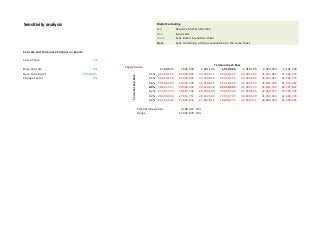

This document provides an overview and financial model for a proposed real estate development project in Dubai. The project involves constructing a mixed-use retail/residential building. Key assumptions in the analysis include net operating income projections and capitalization rates. Special attention should be given to these assumptions as they are important factors in determining the financial feasibility of the project over a 10-year holding period. The model outlines sources and uses of funds, cash flow projections, returns for investors, and other development costs and metrics.