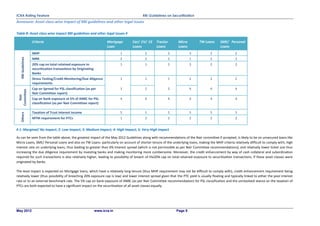

The RBI finalized new guidelines for securitization and direct assignment transactions that prohibit credit enhancement for direct assignments, severely impacting their volumes. The guidelines also introduce minimum holding period requirements for asset pools and clarify rules around profit recognition and excess interest release for originators. Investing banks will need to conduct stronger due diligence on acquired loan pools under the new regulations.