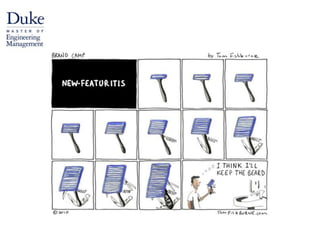

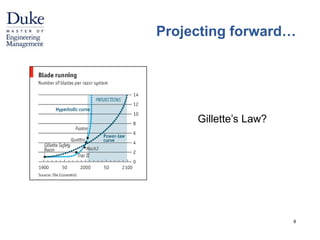

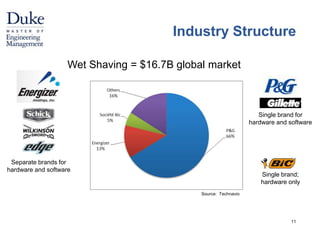

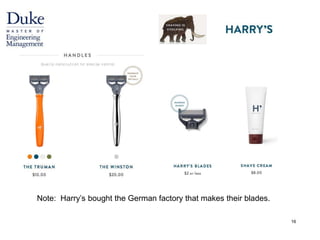

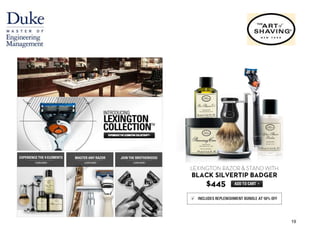

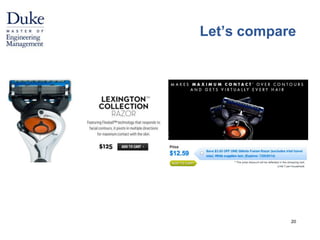

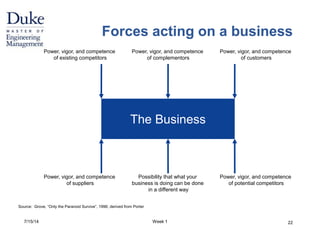

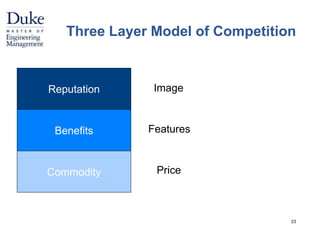

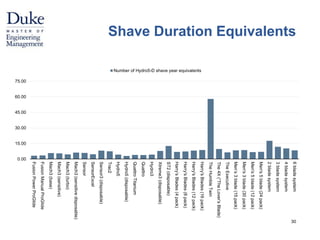

The document discusses a client who believes the wet shaving market is ripe for disruption. It then provides a brief history of shaving from prehistoric times to modern multi-blade razors. The rest of the document appears to be an agenda and discussion materials for a consulting project analyzing opportunities in the wet shaving market, including exploring new product offerings and business models that could provide a better shaving experience or lower costs to consumers compared to existing major brands like Gillette and Schick.