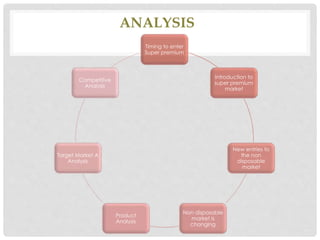

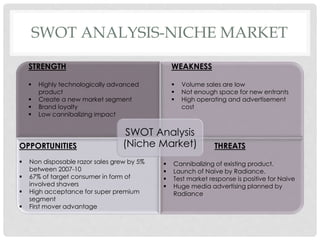

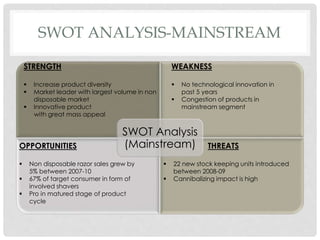

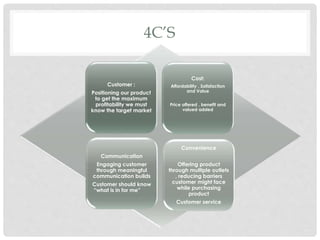

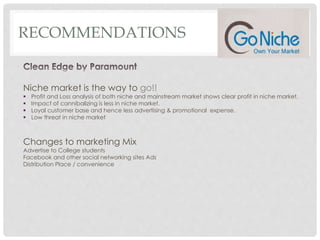

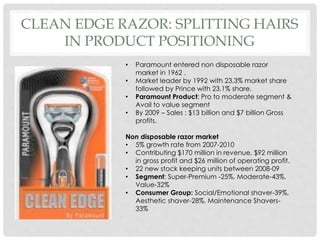

The document discusses positioning strategies for Paramount's new razor product, Clean Edge. It analyzes entering either the mainstream or niche market segments. The niche strategy is recommended, as it has less cannibalization risk than mainstream. A SWOT analysis shows niche has opportunities from growing demand but requires a higher budget. Recommendations include targeting college students on social media, and improving distribution convenience.

![Paramount

[21.4%]

Prince

[26.2%]

B&K

[21.1%]

Radiance

[2.6%]

Simpsons

[5.7%]

Other

[23%]

Brand :

Vitric : Moderate

Vitric advanced :

super premium

Vitric master :

Super premium

Brand :

Cogent : : super

premium

Cogent Plus :

Super premium

New competitor

Aggressive advertising

of $16.1M

Brand :

Naiv: Super premium

Similar to clean shave

Market Share 2010 E

New competitor

Increasing advertising

budget

Brand :

Tempest: Super

premium

Paramount

Brand :

Avail: Value

Pro : Moderate](https://image.slidesharecdn.com/cleanedgerazor-presentation-150815061515-lva1-app6891/85/Clean-edge-Razor-presentation-4-320.jpg)