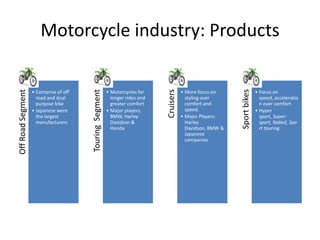

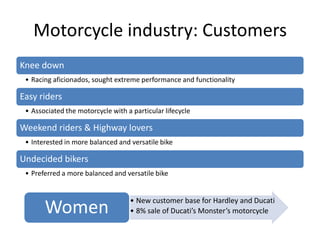

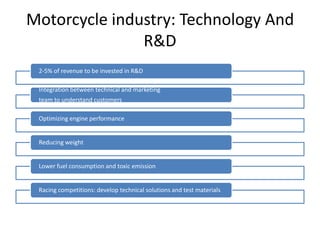

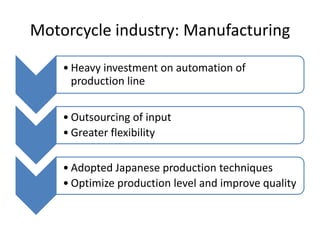

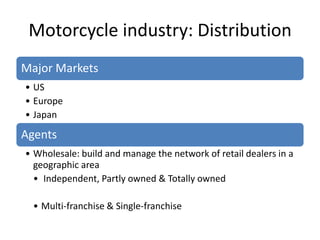

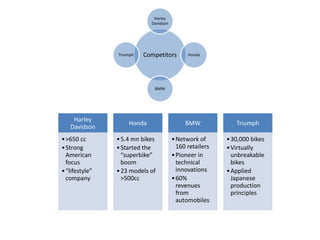

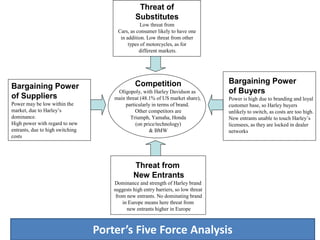

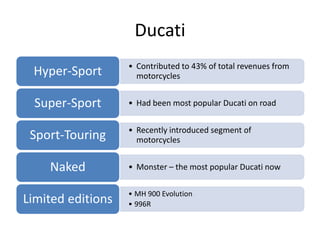

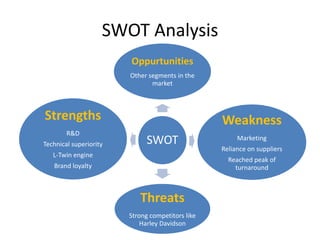

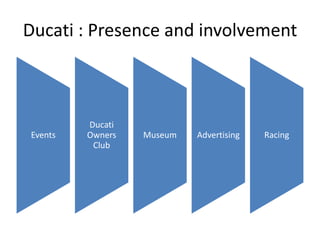

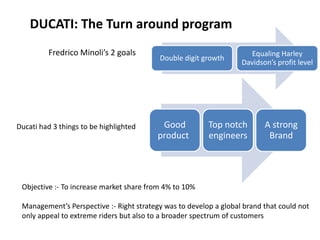

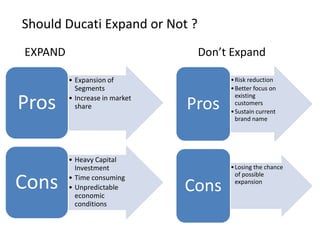

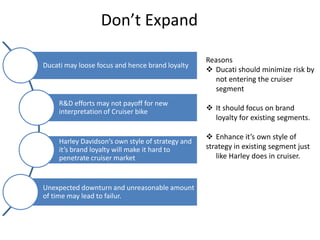

The document analyzes the motorcycle industry and Ducati's position within it, discussing key segments, customers, technology, manufacturing, distribution channels, and competitors like Harley Davidson. It describes Ducati's turnaround under new leadership, focusing on improving products, engineering, and branding to grow market share beyond ultra-high performance bikes. Finally, it considers whether Ducati should expand into new segments like cruisers or maintain focus on its core high-performance brand and customers.