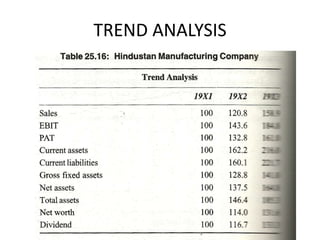

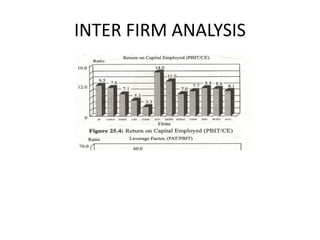

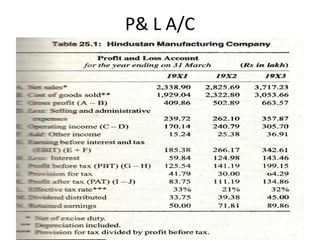

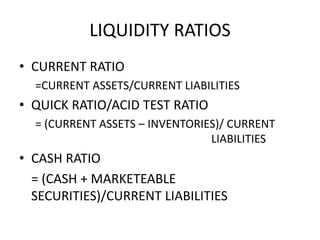

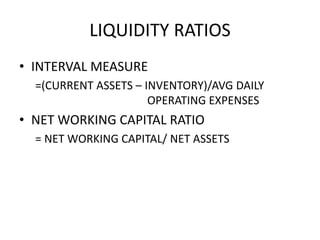

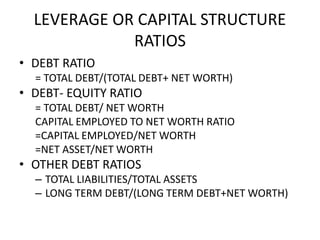

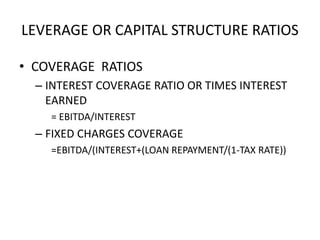

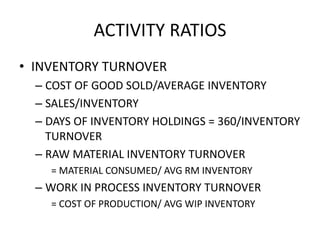

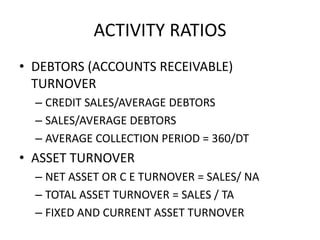

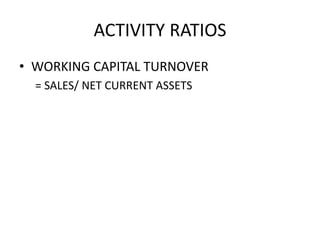

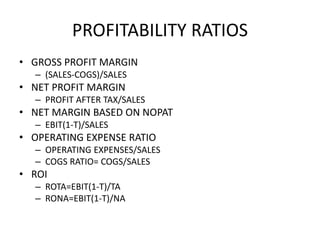

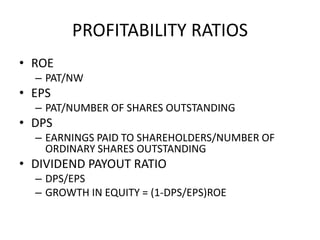

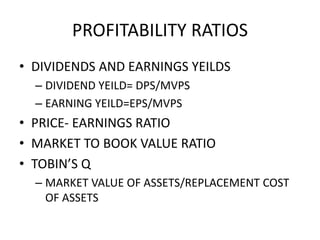

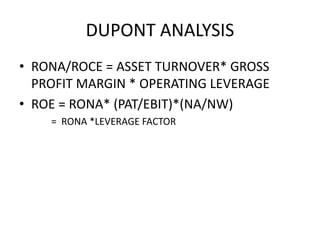

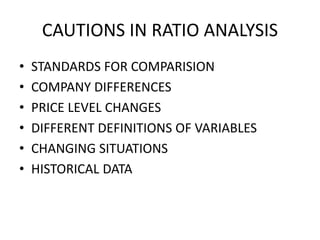

This document discusses financial ratio analysis and its uses. It outlines various types of ratios that are used, including liquidity, leverage, activity, and profitability ratios. It also describes methods for comparing ratios over time, between companies, and against industry standards. The ratios can be used for performance analysis, credit analysis, security analysis, competitive analysis, and trend analysis to evaluate a company's financial health and identify any potential issues. Cautions are discussed around ensuring appropriate standards of comparison and accounting for differences between companies.