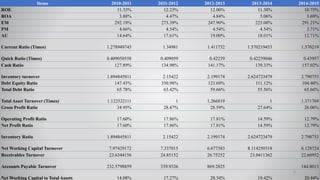

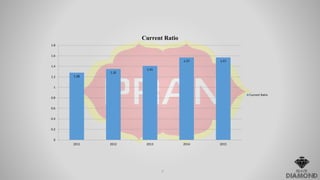

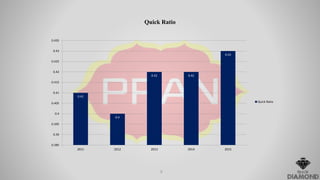

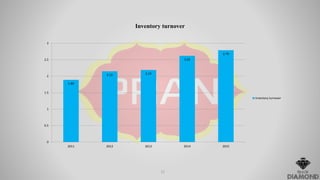

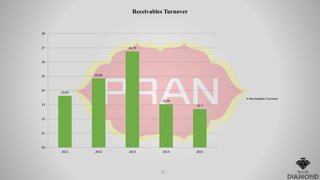

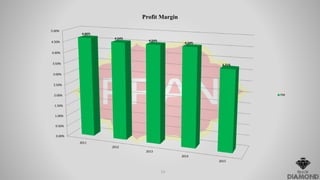

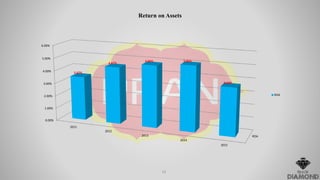

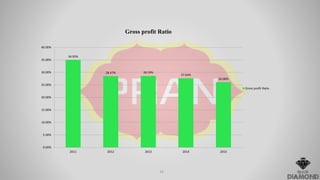

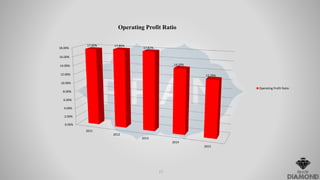

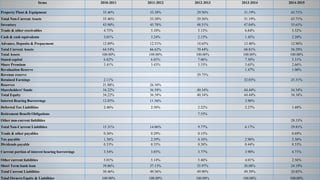

This document provides a presentation on ratio analysis of Pran Company by a group of 5 students. It includes an introduction to Pran Company, which produces over 400 food products in Bangladesh and exports to 134 countries. The presentation analyzes various financial ratios of Pran Company from 2010-2011 to 2014-2015, including return on equity, return on assets, inventory turnover, and current ratio. Graphs are presented comparing the ratios over the five-year period. The conclusion states that ratios must be analyzed compared to benchmarks to understand a company's position.